9th Jan 2025 Intraday Trades & Concept

Today felt a little odd from the very start. The market opened with Banknifty down by 122.50 points and Nifty down by 14.20 points. On top of that, it was Nifty’s weekly expiry, which can often add extra excitement to the trading day. I also noticed something funny: whenever I see the number 420—whether it’s a clock reading 4:20 or a phone number ending in 420—I get this weird feeling that something might go wrong. I had a small worry this might affect my trades today, so I was on high alert from the moment the market opened.

Early Observations and the 420 Feeling

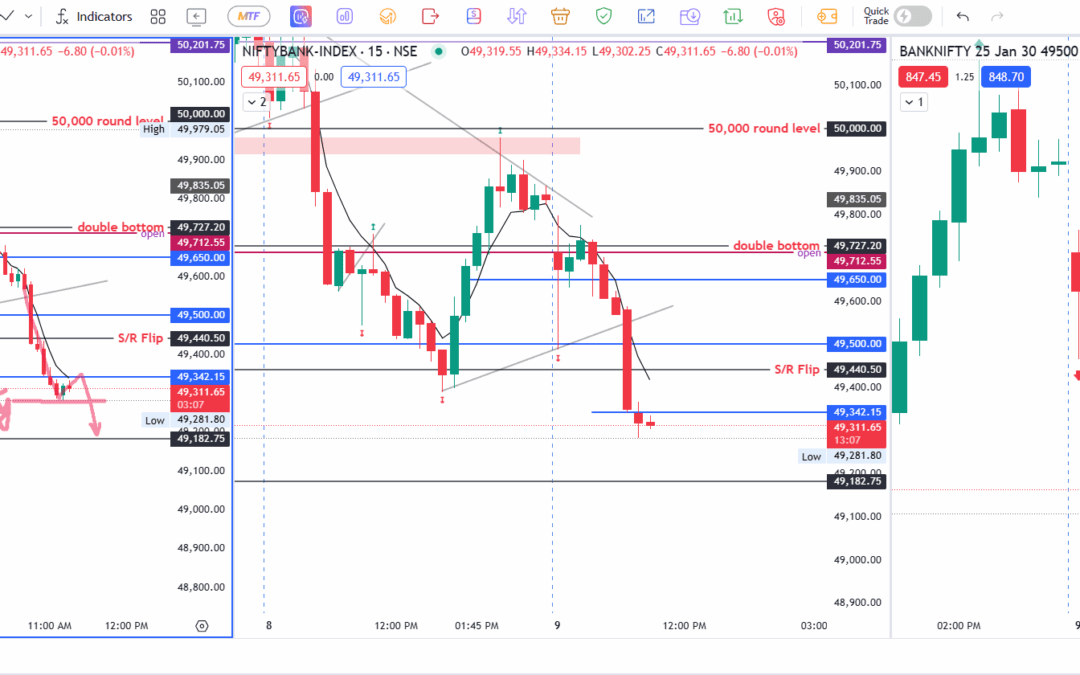

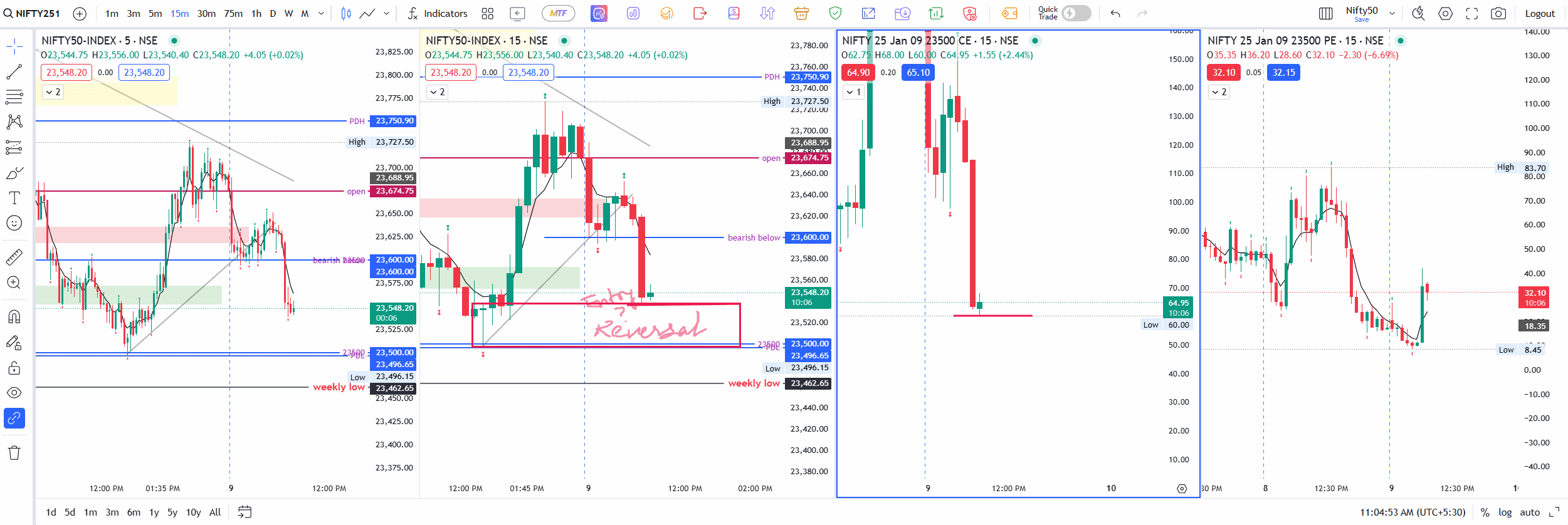

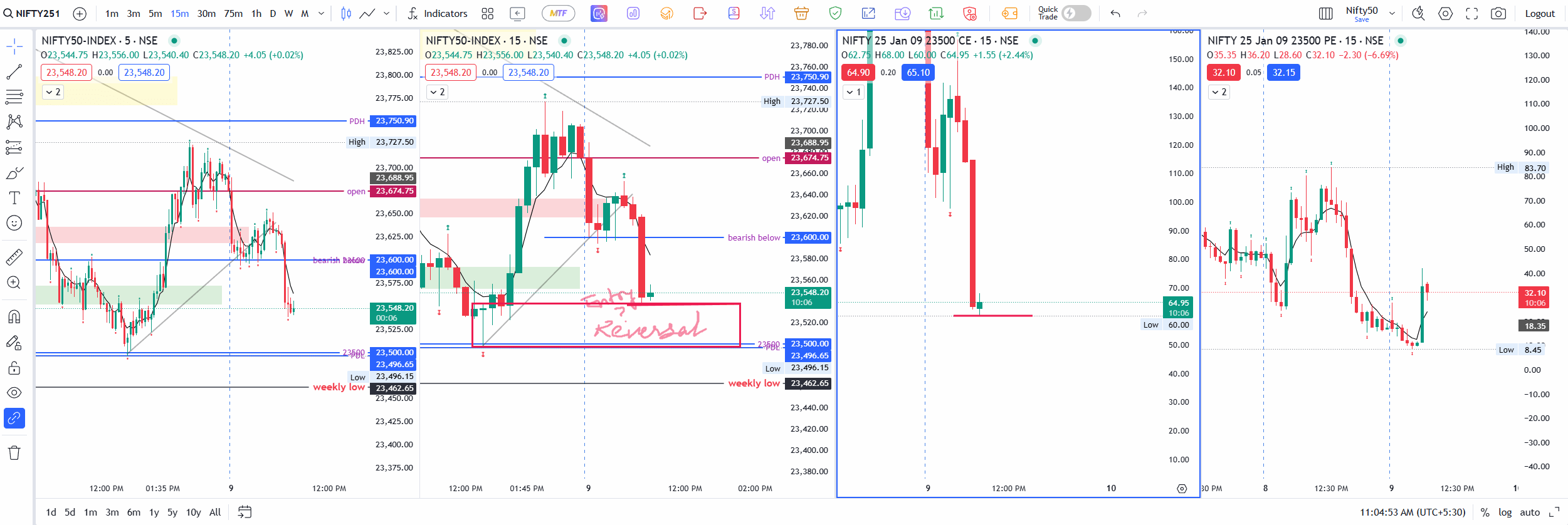

Since Banknifty had a gap-down opening and Nifty also opened slightly in the red, I was curious to see if my “420 superstition” would play out. The first thing I checked was how Nifty moved around 23,600, because I decided that if Nifty fell below 23,600, I would turn bearish and look for Call Option (CE) selling trades. This meant I was expecting prices to drop, so selling Call Options could be profitable if the market stayed below that level.

A few minutes into the session, Nifty did indeed drop below 23,600. I entered a position by selling 23,700 CE at ₹15.75 and exited at ₹7.65. However, I realized my actual plan had been to take the same position earlier at ₹18.70, but I ended up entering at a lower price. This difference might not seem big, but it can affect overall profits. Still, I was glad I stuck to my bearish plan and got out with a gain.

Mixed Signals from Nifty and Banknifty

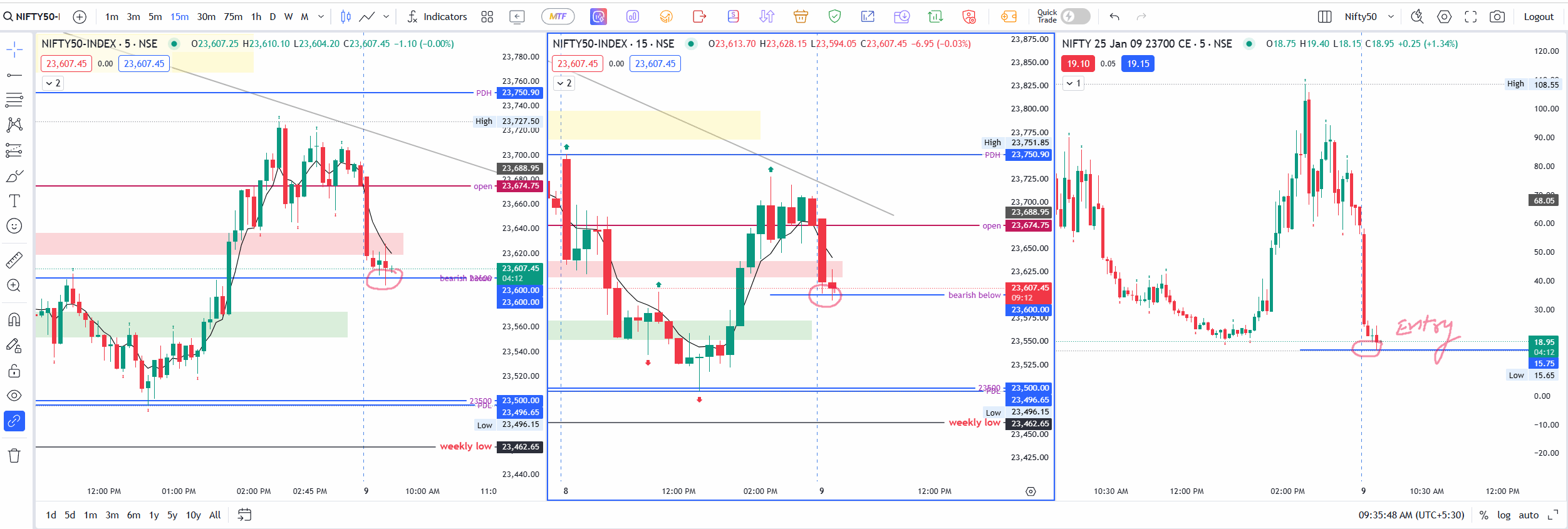

While I was focusing on Nifty, I also kept an eye on Banknifty. It started moving up and stayed inside the first 5-minute candle’s range. Meanwhile, Nifty was still trading below its day’s low. Usually, when both indices move together in the same direction, trades seem to go more smoothly. But today, they were not in sync. This made me feel a bit uneasy because mismatched moves can cause trades to fail if we’re not careful.

On top of that, HDFC and SBIN had been forming red candles (meaning they were going down) for the past four days. I thought they might show a green candle today (an upward move), but since I wasn’t sure, I just kept watching them. Then another problem appeared: a power cut happened. I immediately remembered my odd suspicion about “420.” Maybe it was just my imagination, but the power cut stopped me from taking trades in both indices at around 10:45 AM, right when the market was giving a breakdown.

Banknifty Trades and Quick Losses

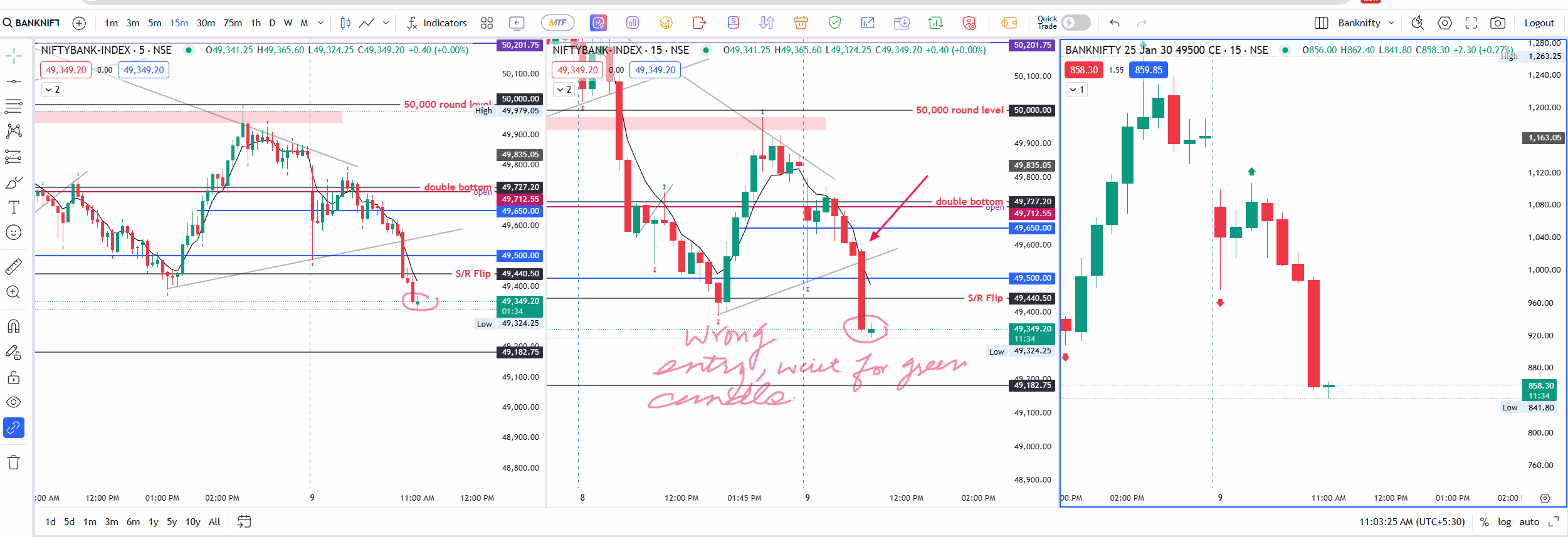

Despite the hiccup, I managed to place a trade in Banknifty. I sold 49,500 CE at ₹852 and ended up exiting at ₹856.15, taking a small net loss of around –₹216.29. Even though this loss wasn’t huge, it still felt disappointing because I had hoped for a good move.

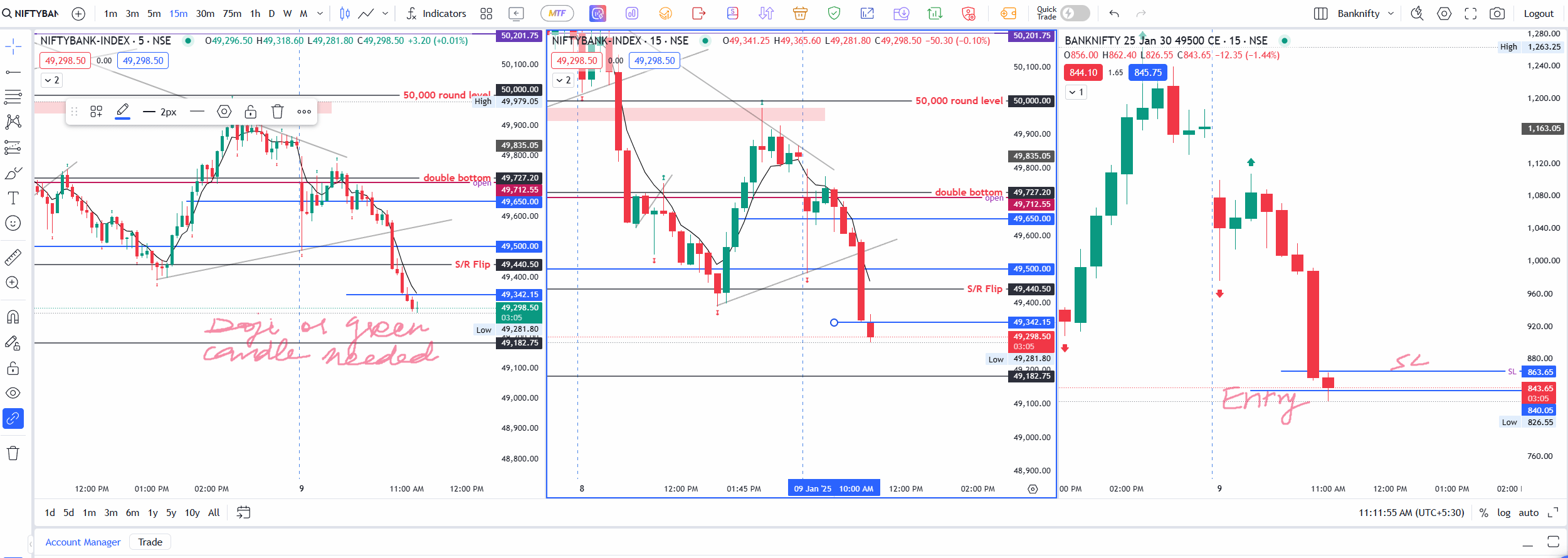

After that, I tried again. I re-entered a sell position at 49,500 CE for ₹840 and exited at ₹864. Once again, this didn’t go in my favor. The continuous red candles on the 15-minute chart suggested I should wait for at least one green candle before jumping in, but I broke that rule. Looking back, I can see how important it is to follow my plan and not let impatience take over.

Exiting the Nifty Trade Early

I also exited my Nifty trade because the market approached a fresh zone where the price had moved up yesterday. Zones are areas of support or resistance that can cause the market to bounce or reverse. Since that area was still active, I thought the price might bounce up again today. So, I decided to exit and wait.

Upon reviewing the charts, I noticed a possible pullback zone between 23,500 and 23,539 in Nifty. The reason is that a “Dragonfly” bullish candle formed yesterday on the 15-minute chart. This kind of candle can sometimes signal a bounce or upward movement. Therefore, I wanted to be cautious.

Watching Premiums and Planning Next Steps

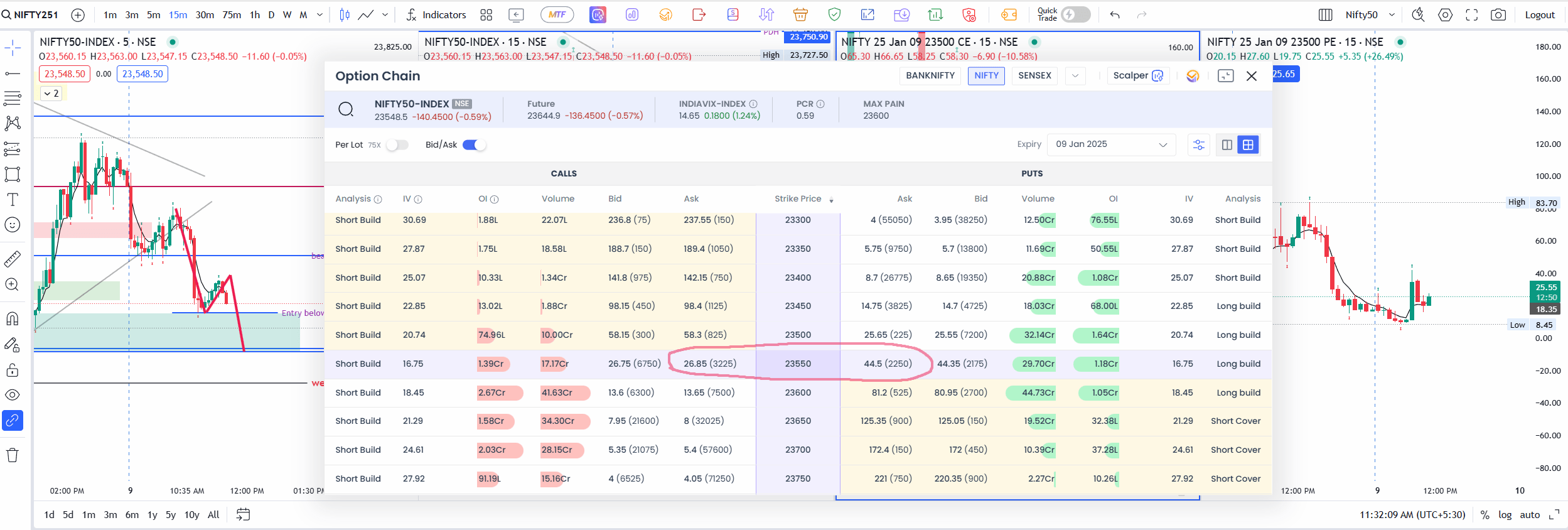

I noticed that the Put Option premiums (PE) at-the-money for Nifty 50 were priced higher than the Call Option premiums (CE). Sometimes, this can mean the market might move up for a short while, because if too many people are buying or selling Puts, it can lead to a situation where the market does the opposite of what most traders expect.

Meanwhile, Nifty seemed to hold the zone I had marked, so I didn’t rush into any new trades. I wanted to see clearer price action signals on the 15-minute timeframe.

The Day’s Finale

As the day ended, I couldn’t help but laugh a bit about my “420 hunch.” True, things did go wrong here and there—power cuts, missed entries, and trades against my rules. But all of these moments serve as lessons for the future. If I can remember to follow my own trading guidelines, watch the key zones, and wait for real confirmations, I’ll have a better chance of making consistent profits.

That’s all for today’s story. Tomorrow is a new day, and I’ll be ready with a fresh mind and a careful plan—hoping that no more 420 superstitions sneak up on me!

Nifty closed with a strong bearish candle -157 pts approx. but didn’t close below yesterday low.

Banknifty, closed -213 pts approx. It did trade below yesterday low but recoverd approx. 266 pts finally closing at 49501 just above round levele 49500.

Lessons from Today’s Trades

I made several mistakes by going against some of my own rules, especially with the Banknifty trades. When my plan says “wait for a green candle” before entering, it’s important to follow that rule to avoid jumping into a trade too early. Today, I broke that rule and paid the price with some losses.

Here are some key reminders I’m taking away:

- Stick to the Plan: When I say I will wait for a specific candle or a specific price level, I should do just that.

- Indices Moving Together: I often get better results when Nifty and Banknifty move in the same direction. If they don’t sync, I need to be extra careful.

- Respect Pullback Zones: If I see a zone where price reversed before, it could happen again.

- Handle Distractions: Power cuts or other issues shouldn’t make me hurry. It’s better to miss a trade than to take a rushed one.