8th Jan 2025 Intraday Trades & Concept

Trading the Indian stock market indices—Nifty 50 and Banknifty—often resembles a grand puzzle. Every day, you’re trying to figure out which piece of price action fits where and how best to align your trades with market momentum. Today’s session was no different. In fact, it stood out for its relatively flat opening, sudden reversals, and the psychological challenge of entering and exiting trades at just the right moment. Below is a comprehensive look at how the day unfolded, the trades I took, and the lessons I’m taking away from the experience.

The Market Opens

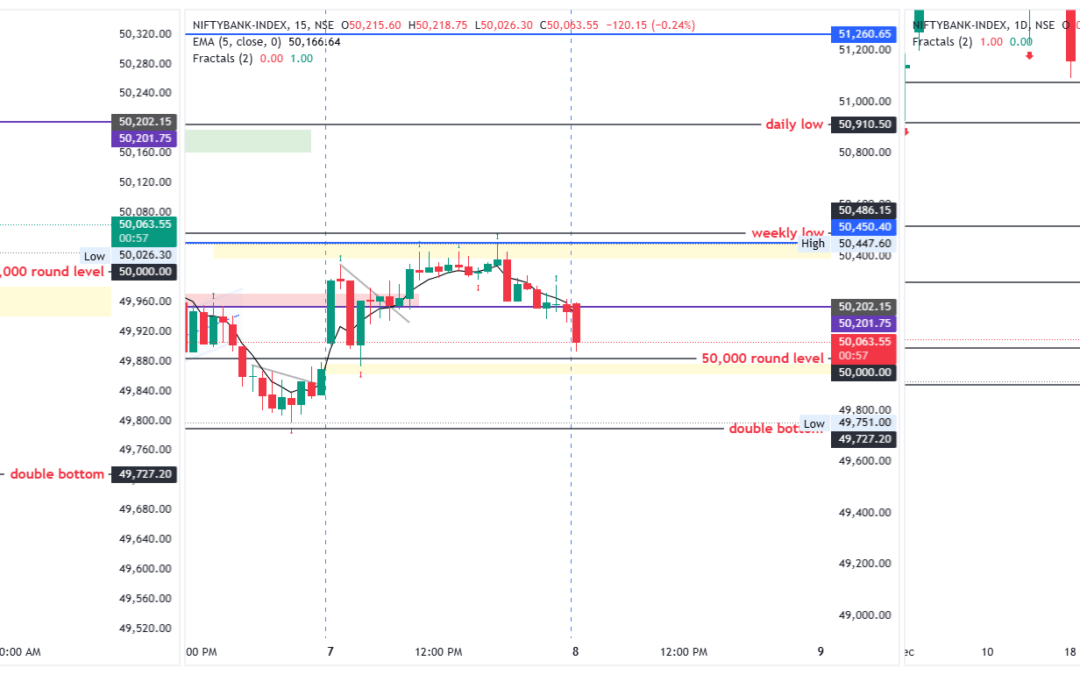

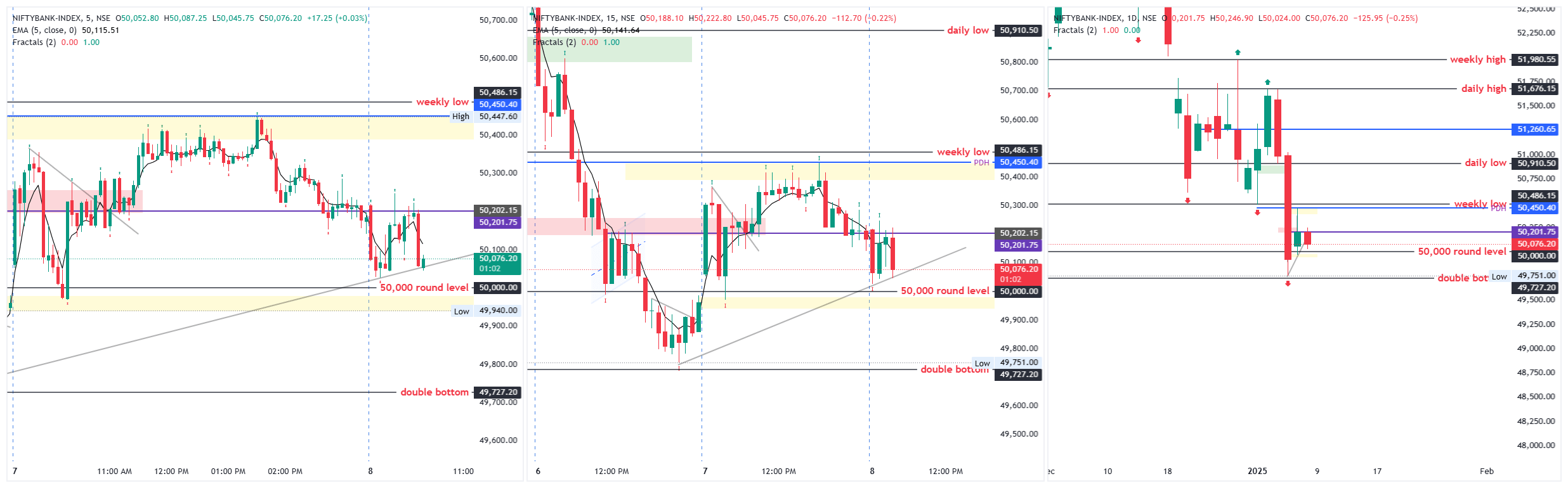

Banknifty

The day started with a minor negative opening of about –0.40 points, which is essentially flat.

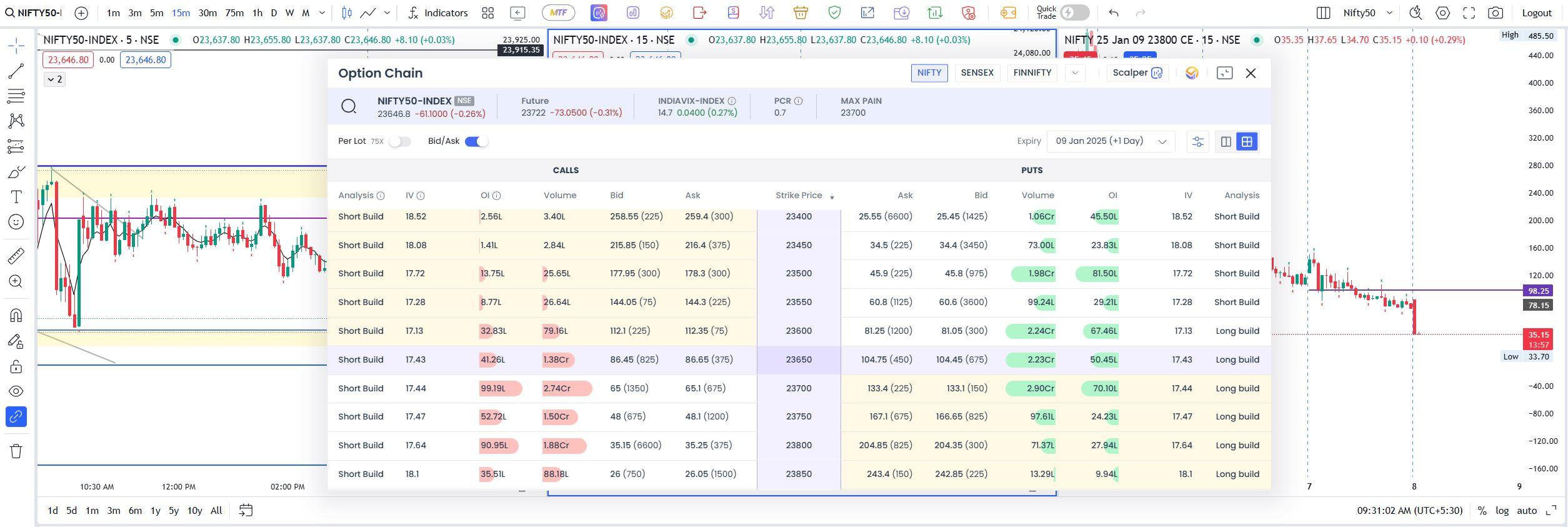

Nifty

It opened with a +38.75 points gap-up, a modestly positive start that hinted at potential bullish momentum.Despite these small deviations at the open, both indices formed what can be described as an “inside candle”—a pattern where the day’s trading range sits inside the previous day’s high and low, often signaling indecision. The stage was set for a day of potential breakouts or breakdowns.

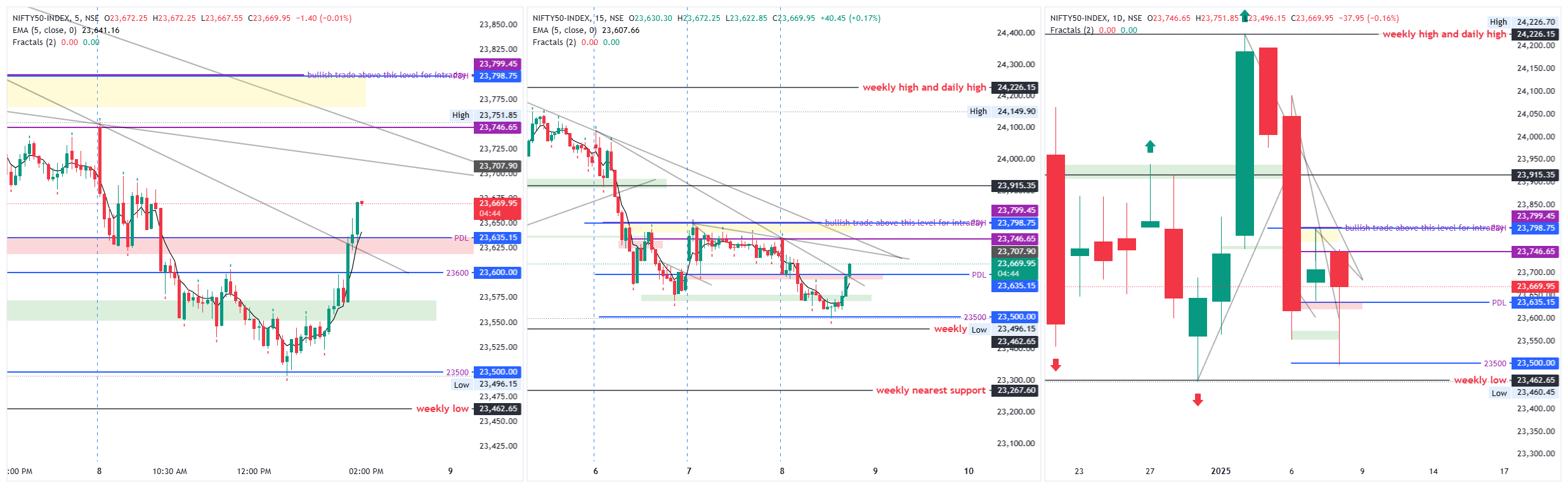

Zones Marked and Potential Breakouts

I identified critical zones for each index based on previous swings and price action:

- Nifty Zone: 23,617 to 23,799

- Banknifty Zone: 49,946 to 50,446

My game plan was straightforward:

- Wait for a gap-up beyond these zones to see if the market could sustain a bullish move.

- Consider a short or bearish position if there was a breakdown below these marked levels.

In theory, these zones provide a roadmap for price behavior. If the market trades decisively above or below these areas, it often indicates the next directional move.

Option Premium Imbalance

One noteworthy observation early in the session was that At-the-Money (ATM) Put options for Nifty were priced higher than their Call counterparts. This skew sometimes suggests the market might lean bullish because when Puts are more expensive, sellers prefer to sell the Puts. If market trend upward these Puts decay faster considering time and money factor.

The Market Cycle Reminder

Markets typically rotate through phases:

- Trending (either up or down)

- Volatile (large swings in both directions)

- Accumulation (tight range or sideways movement)

Then the cycle repeats with another trending phase. Identifying these phases can help in timing entries. Today, the indices seemed to oscillate between a volatile range and a potential downward break—though timing that break was the real challenge.

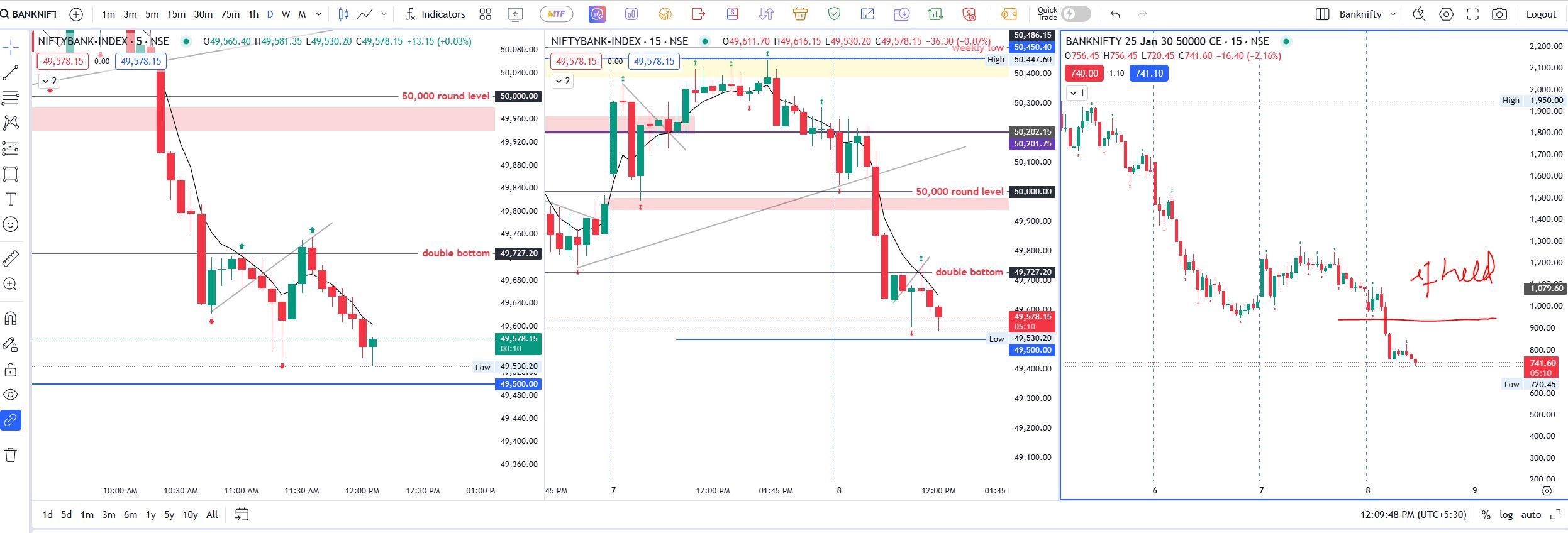

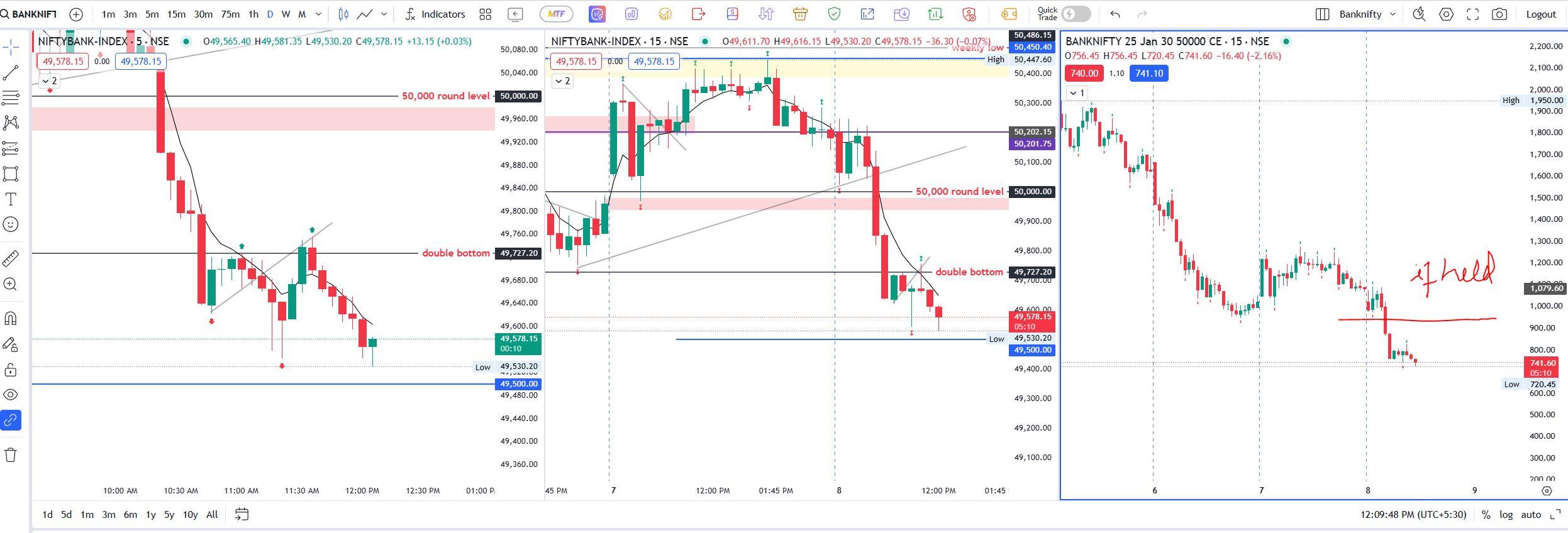

My Banknifty Strangle

Given Banknifty’s narrow range around 50,000, I initiated a strangle strategy:

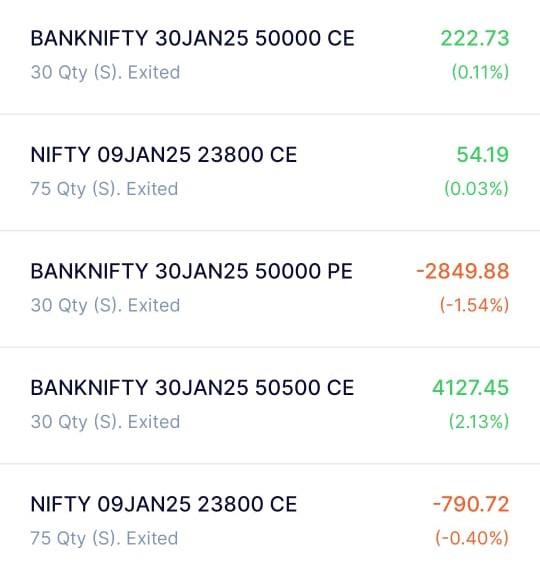

- Sold 50,000 PE at ₹662.60

- Sold 50,500 CE at ₹783.90

A strangle involves selling both a Call and a Put at different strike prices, expecting the underlying to stay within a particular range. However, once a strong move emerges, one leg of this position typically suffers losses while the other gains. In a highly directional market, a strangle can become risky if not managed carefully.

For Nifty, the range seemed too tight for a similar approach, so I opted to watch the action rather than initiate a strangle or straddle.

Bearish Breakdown

Eventually, the market showed its hand. A strong bearish candle appeared in both indices, suggesting a potential breakdown below key support. This signaled a direction that might invalidate the strangle strategy—or at least one side of it.

- I exited my 50,000 PE at ₹754.75, booking a net loss of –₹2,849.88.

- I continued to hold the 50,500 CE sell position and even added a 50,000 CE sell at ₹891.30.

At this point, the market had made a decisive move down, and the plan was to capitalize on continued bearishness through selling Calls. Normally, I prefer to take trades earlier, but by the time the move solidified, it was already around 10:30 AM—later than my usual entry window.

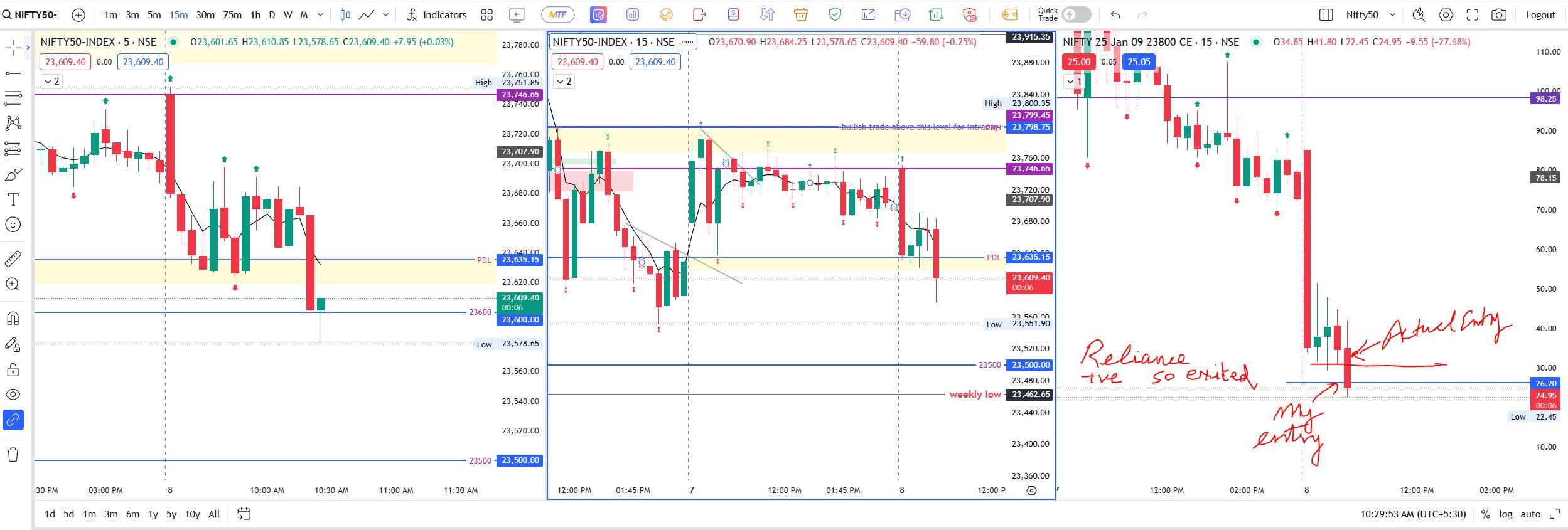

Late Entry in Nifty

I also tried to participate in Nifty’s downside momentum:

- Entered Nifty 23,800 CE Sell at ₹26.20.

- However, this entry was delayed because of a system glitch—my order didn’t go through immediately.

Suddenly Reliance and a few other heavyweight stocks in the Nifty 50 started pushing higher. This collective bullishness lifted the index briefly, prompting me to exit positions in both indices to protect my profits and limit further damage.

The Deceptive Bullish Move

Interestingly, while Nifty showed a small bullish spurt, Banknifty did not follow suit in any substantial way. This divergence between the two indices is not uncommon but can catch traders off-guard if they’re expecting both to move in sync. My early exit turned out to be premature because, after the short-lived up-move, prices reverted downward, eventually hitting the very targets I had initially marked.

Why the Exit Felt Necessary

A few factors contributed to my choice to exit early:

- Breakdown Confirmation: The price should break down a zone “properly”—i.e., with a decisive candle and volume. After four consecutive red candles, I was wary the 15-minute setup could fail and it did.

- Swing Low Not Broken: Banknifty never breached the previous day’s swing low convincingly at that point.

- False Bullish Trigger: The short bounce in Nifty and some large-cap stocks like Reliance spooked me into closing my trades prematurely.

In hindsight, the up-move was likely a stop hunt—market makers and bigger players pushing the market briefly upward to shake out weaker hands. The actual downside target was eventually reached, but I was no longer in position to capitalize on that move.

The Day’s Finale

By the end of the session, the market had indeed continued its downward trajectory, aligning with the initial bearish breakdown. Nifty recovered approx. 190 points and finally closed at – 60.80 pts making a “hammer candle” in red.

Banknifty recovered 426 pts and finally closed at -372.95 pts took a support at 49388.20.

Key Takeaways and Lessons

- Inside Candle Warnings: A tight range within the previous day’s high and low often signals indecision. It pays to be extra patient for a confirmed breakout or breakdown.

- Watch Divergences: Just because Nifty moves in one direction doesn’t guarantee Banknifty will follow, and vice versa.

- Option Premium Skews: When ATM Puts are priced higher than Calls, keep an eye out for the potential that the market may drift upward rather than tank.

- Strangle Management: If you’re going to sell options on both sides, be prepared for quick adjustments. One leg is almost guaranteed to face pressure in a big move.

- Beware Late Entries: Entering a trade later in the morning can be riskier if your system or confidence isn’t aligned. It may be better to wait for another setup.

- Don’t Get Spooked: The market will often create minor reversals just to shake out retail traders before resuming its primary trend.

In the end, today’s session underscored the importance of patience, clear confirmations, and not letting small reversals force you out of well-planned trades. Every trading day is a lesson in humility and adaptability, reminding me that the market doesn’t just reward the best analysis, but also the best execution and emotional control. Tomorrow brings a fresh set of opportunities—and I’ll be there, zones marked, strategy ready, determined to manage my entries and exits with a bit more finesse.