14th Jan 2025 Intraday Trades & Concept

The Market Opens

After several consecutive sessions of downward movement, the market finally opened with a positive start today.

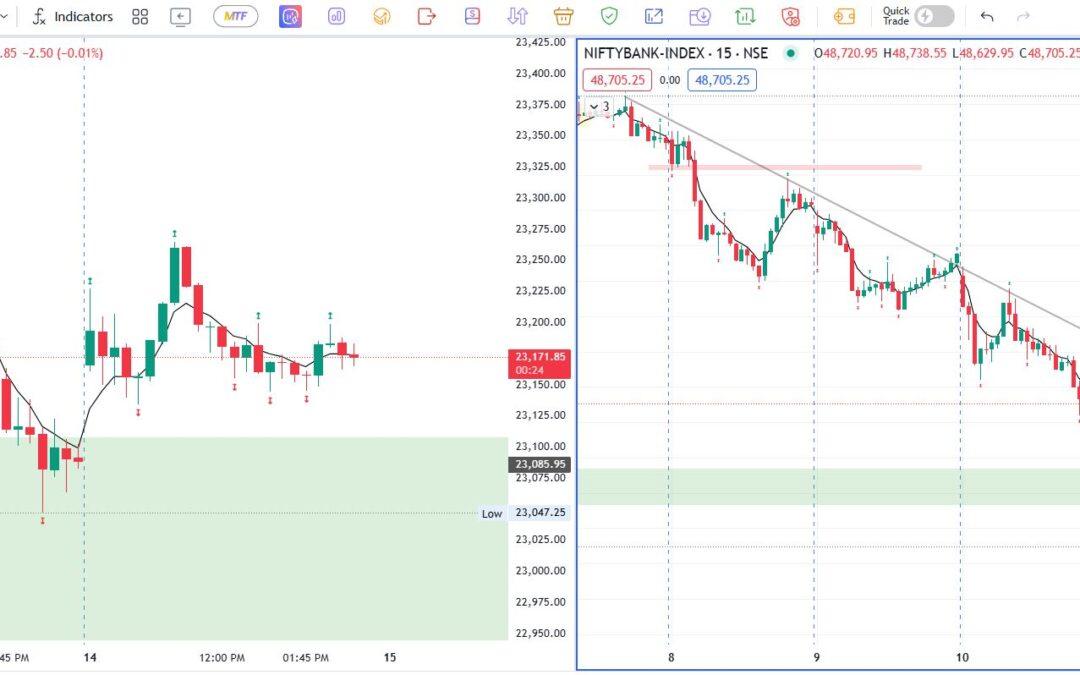

Banknifty

Banknifty opened+225.65 points gap-up today.

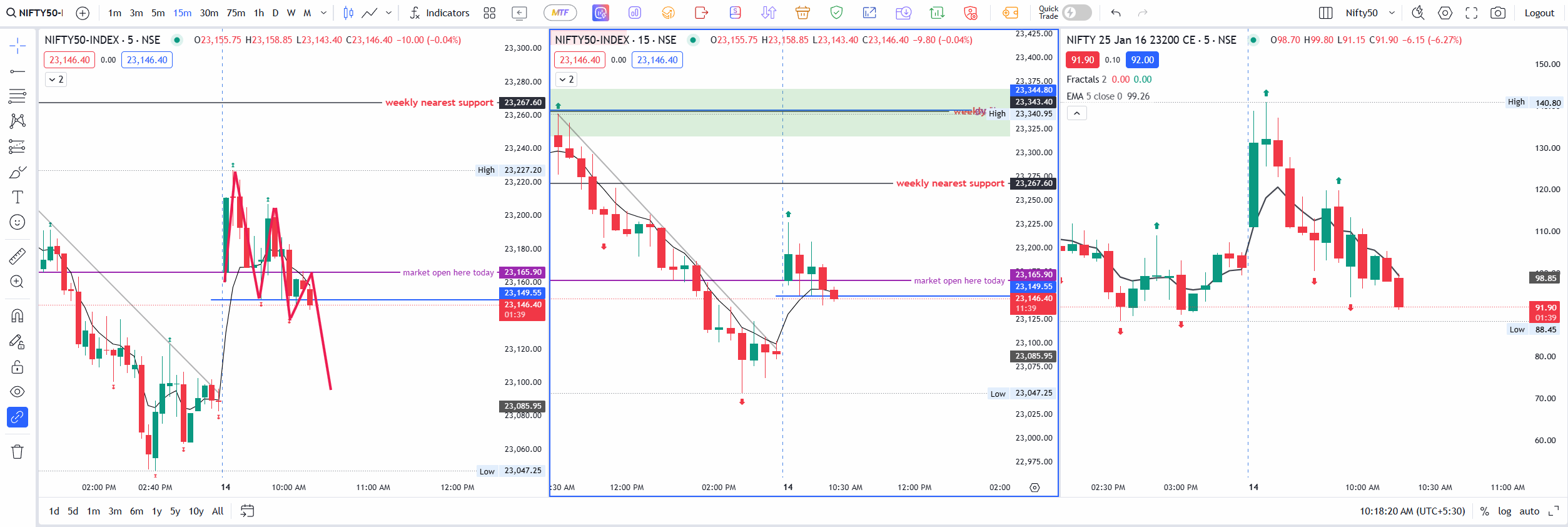

Nifty

Nifty opened +79.95 points gap up.

This gap-up might come as a surprise because yesterday’s large gap-down led to a continued fall, ending with a strong bearish candle in both indices. With the recent sell-off in mind, I was expecting for either of these candles:

- a green candle

- a green doji

- an inside candle

Missing the First 15–20 Minutes

Unfortunately, I couldn’t sit at my trading desk during the crucial first 15 to 20 minutes after the market opened. By the time I checked, Banknifty had already climbed to a resistance zone I marked yesterday. This zone is where the price had created a gap on the previous days, so I expected some respect there—meaning the price might stall or pull back when it touches that level.

Meanwhile, Nifty wasn’t moving in sync with Banknifty. After printing one bullish candle on the 5-minute chart, Nifty started retracing and quickly traded below the day’s low. This kind of divergence can make trading tricky, because it’s easier to be confident in your trades when both indices move in the same direction.

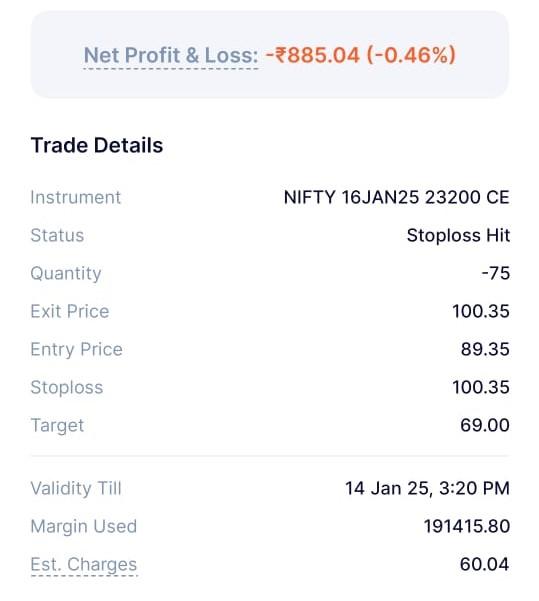

The 23,200 CE Sell Idea

Given that Nifty appeared weaker than Banknifty, I thought about taking a Call Option (CE) sell at the 23200 strike—but only if the 15-minute candle closed below 23149.55 with a strong bearish candle. If that happened, I’d have more confidence that the market was ready to continue downward.

Eventually, I saw enough signs to jump in. I sold the 23200 CE at ₹89.35 with a target near 23000. At the same time, Banknifty broke below a line I’d marked earlier in my charts, so I felt this confirmed that both indices were (somewhat) in sync—although Banknifty still wasn’t fully below its day’s low.

Stop Loss Hit

While I waited for this move to play out, my Stop Loss (SL) on the 23,200 CE sell was triggered. The market reversed from its initial drop, which can happen after a few days of continuous selling—traders might step in to buy at lower prices, or existing short positions might cover to lock profits. Either way, I was stopped out of the trade.

Many Nifty stocks turned positive, indicating some buyers were finally stepping in. After several red days, it’s not unusual to see a small “relief rally” where profit booking by bears—or new buying from bulls—pushes prices higher for a while.

Notable Stock Moves

Around 10:40 AM, I noticed HCLTECH was down by 9.3%, a sharp drop even on a day when the main indices looked ready for a small bounce. On the other hand, Adanient was up by 6.57%, and in fact, all the Adani stocks ended up closing positive. This split in the market, where some stocks continue to slide while others surge, often occurs when investors switch focus from one sector to another.

Premiums for Put Options (PE) have been relatively high due to the intense selling in recent days. When the market finally shows any sign of strength (like today’s gap-up), these expensive Put premiums can deflate quickly if the price holds up—leading to a nice gain for people selling Puts. But it also cautions that we shouldn’t expect the market to keep plunging every single day. “We can’t be bearish every day,” as I like to remind myself; market behavior tends to rotate between selling pressure and bouts of buying or short covering.

Wrapping Up Early

By 10:43 AM, I decided to call it a day. My planned trades didn’t work out as I hoped—especially with the 23,200 CE sell hitting its Stop Loss—but that’s part of trading. I saw some positivity creep back into many Nifty stocks, which aligns with the idea of a relief rally after multiple days of selling. Since the market has already shown me that it’s not going to provide the clear, straight-down move I was anticipating, I prefer to step aside.

Sometimes, the best move in trading is to do nothing when conditions aren’t aligning well with your plan. With the market pulling back from the bearish scenario, and certain stocks showing significant recovery, holding onto a short position could lead to further losses. So, I chose to end my trading session early and wait for another day when the price action is clearer and more in line with my strategies.

That’s all for now—no more trades. Let’s see if the market continues to stabilize or if this is just a brief pause before resuming its downward trend. Until then, I’ll be keeping an eye on those support and resistance zones, waiting for a better opportunity on the horizon.

The Day’s Finale

By the end of the session, Nifty closed at +90 points approx to 23716.

Banknifty on the other hand rallied approx +688 points to 48729 today.

Nifty made an inside candle as per the expectation but Banknifty closed above the high of previous day.