10th Jan 2025 Intraday Trades & Concept

Fridays in the stock market are sometimes described as dull days where not much happens. That’s what many “experts” say. But if you look at recent Fridays, you might notice that we often get trending markets, which means the price can move in one direction for a while and give good trading opportunities.

The Market Opens

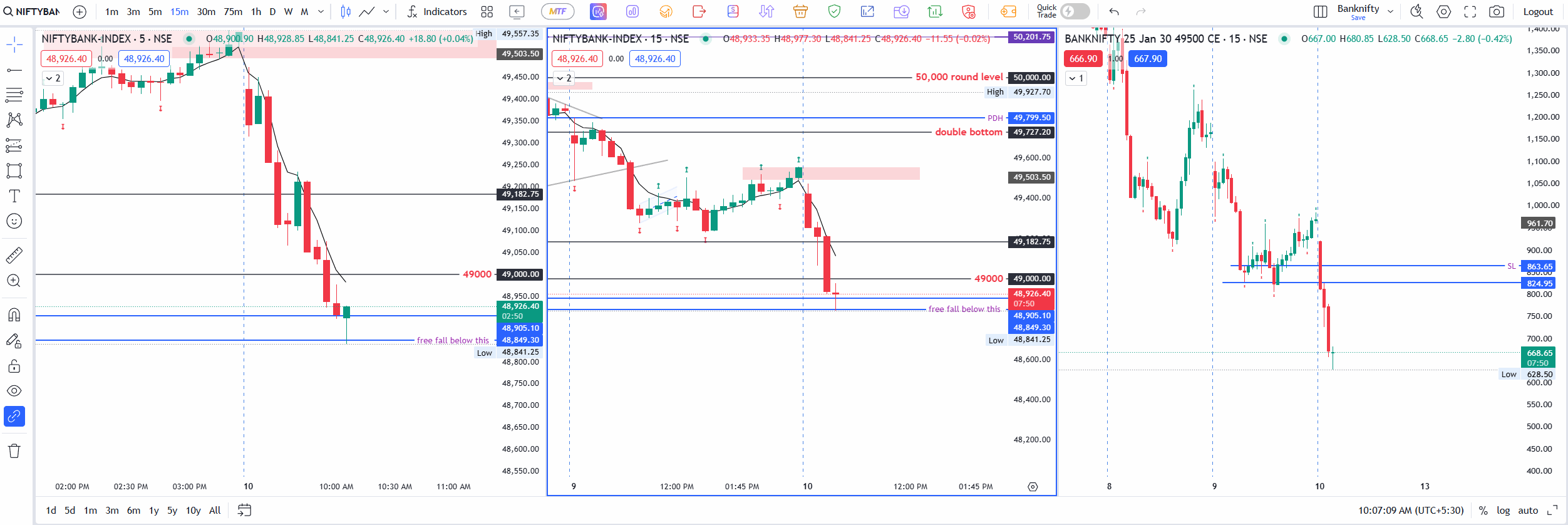

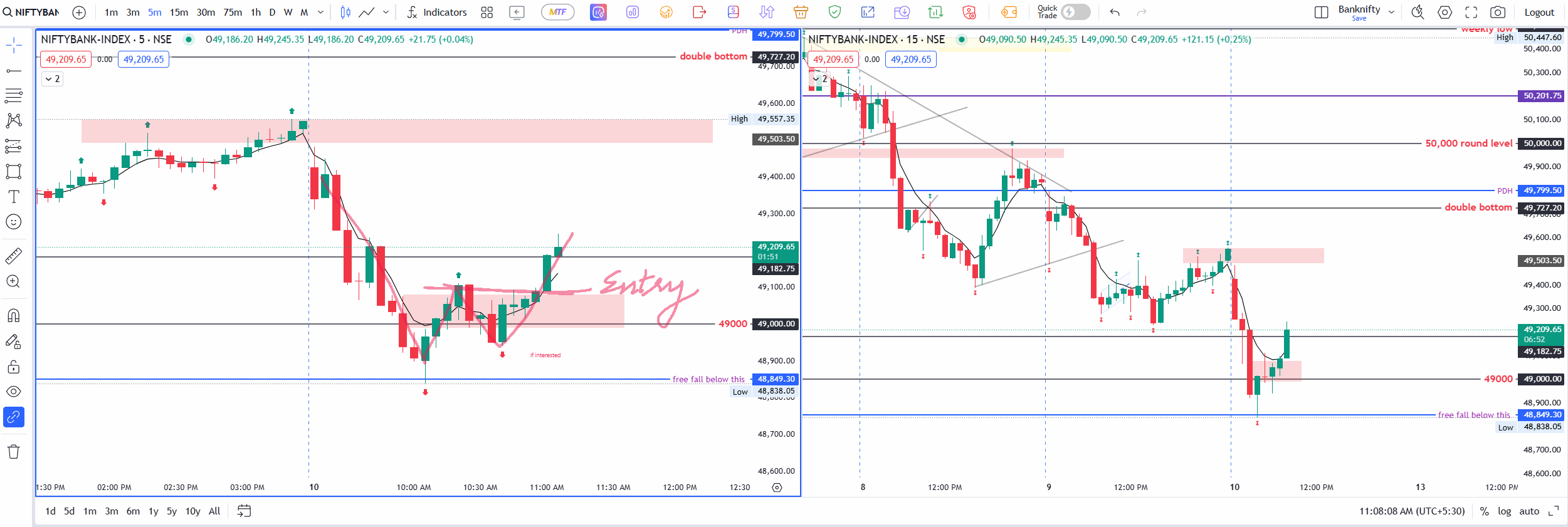

Banknifty

Banknifty opened -77 points gap-down.

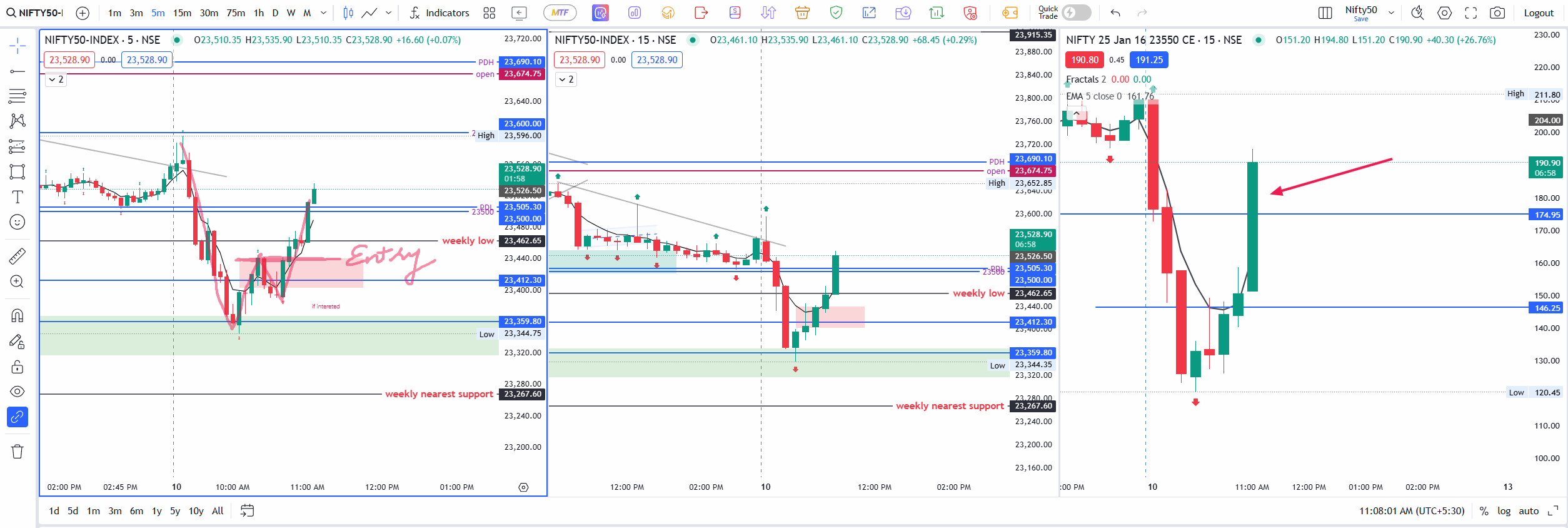

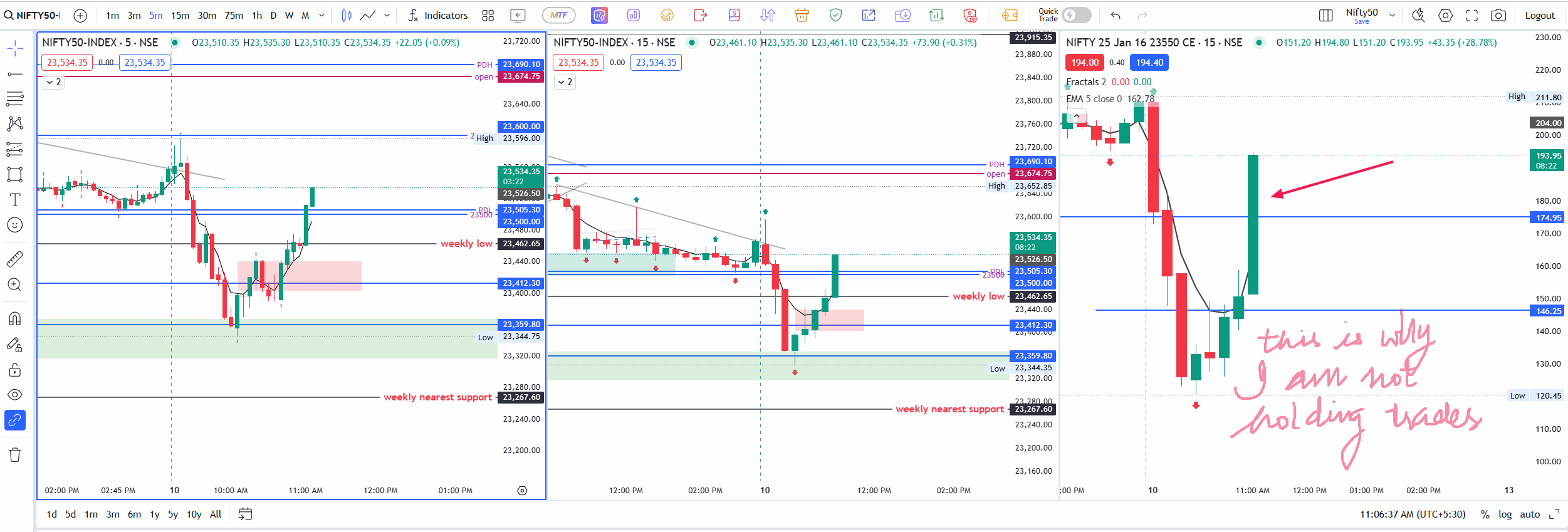

Nifty

Nifty opened +25.40 points gap-up today.

This opening was pretty much flat overall, but it also showed that Banknifty and Nifty were not moving in sync—one started in negative territory, and the other in positive. This situation made it a bit tricky to plan trades in the morning.

My Early Thoughts and Simple Game Plan

Honestly, I didn’t have big plans for trading today. Maybe it’s because of the usual belief that Fridays can be slow. But deep down, I also remembered recent Fridays often brought nice, strong moves. So, I kept an eye on the charts, in case something interesting happened.

Before the market opened, I noticed that Banknifty was near 49,000, which is a round number that lots of traders watch. Round numbers can be important because buyers or sellers sometimes appear there in large numbers. I also saw that Nifty had a zone around 23,318 to 23,365 that I marked as support, meaning if the price fell there, it might bounce up again.

My First Trades in Nifty

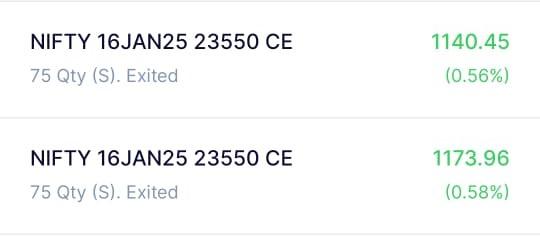

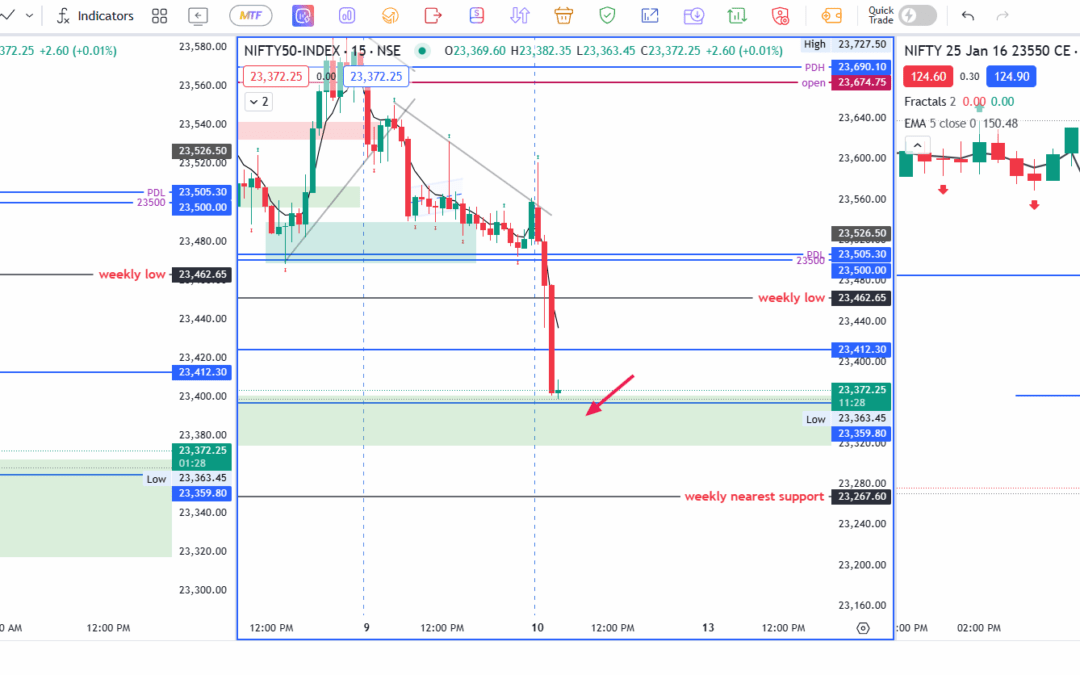

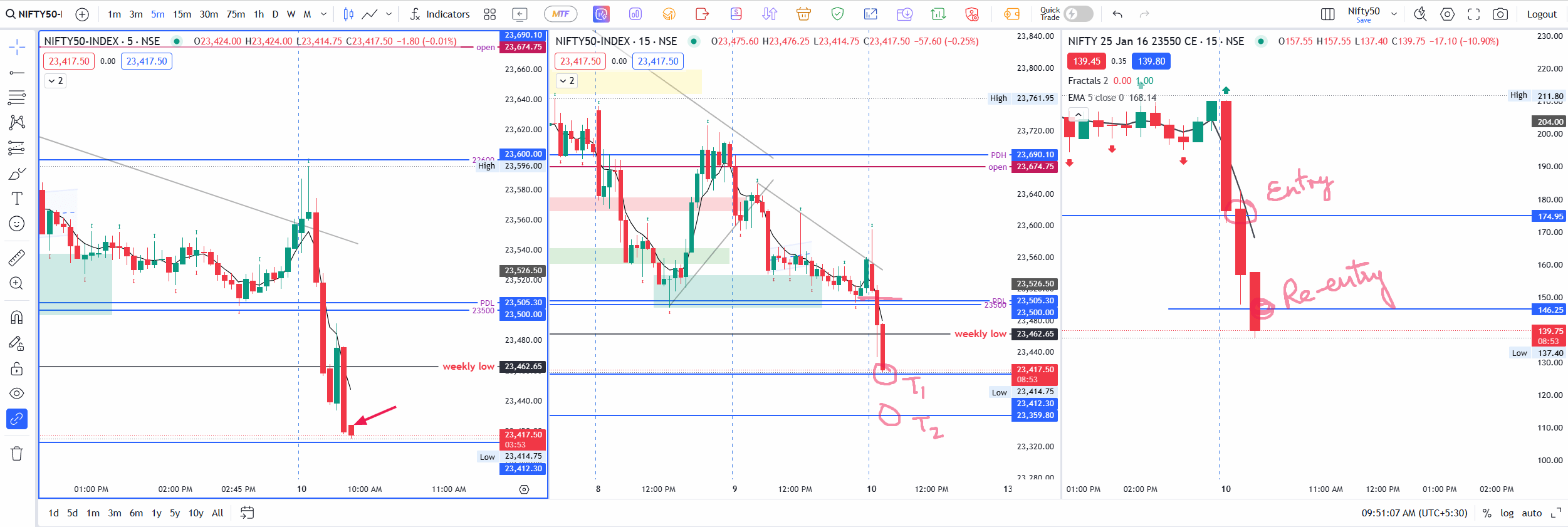

Not long after the market opened, I decided to sell 23,550 CE (Call Option) at ₹174.95, following a 15-minute setup I usually use. This was a bearish strategy: if the market stayed below a certain price, I would keep the premium I collected. I closed that position at ₹158.35, which gave me a profit of about ₹1,173.90.

Because the market seemed to keep moving in a way that matched my view, I re-entered the same strike 23,550 CE sell at ₹146.25 and then exited at ₹130.15. That trade gave me another profit of around ₹1,140.45. So, by this point, I was happy with my gains in Nifty. I felt my plan was going well, even though I expected the day to be slow.

Missing the Banknifty Trade

While I was focusing on Nifty, I did not take any trades in Banknifty at all. Sometimes it’s hard to manage two trades in different indices at the same time—especially when I’m also trying to note down my thoughts for a blog post. I had a feeling that if HDFC Bank also showed a strong red candle, then Banknifty might fall further. But HDFC wasn’t really joining in the way ICICI Bank was. Early in the day, ICICI Bank contributed around 94 points of downward push to Banknifty, while HDFC only contributed about 2.8 points. If HDFC had dropped more, Banknifty might have fallen faster, giving me more confidence to trade it.

But it didn’t happen during my trading hours so I stayed out of Banknifty trades.

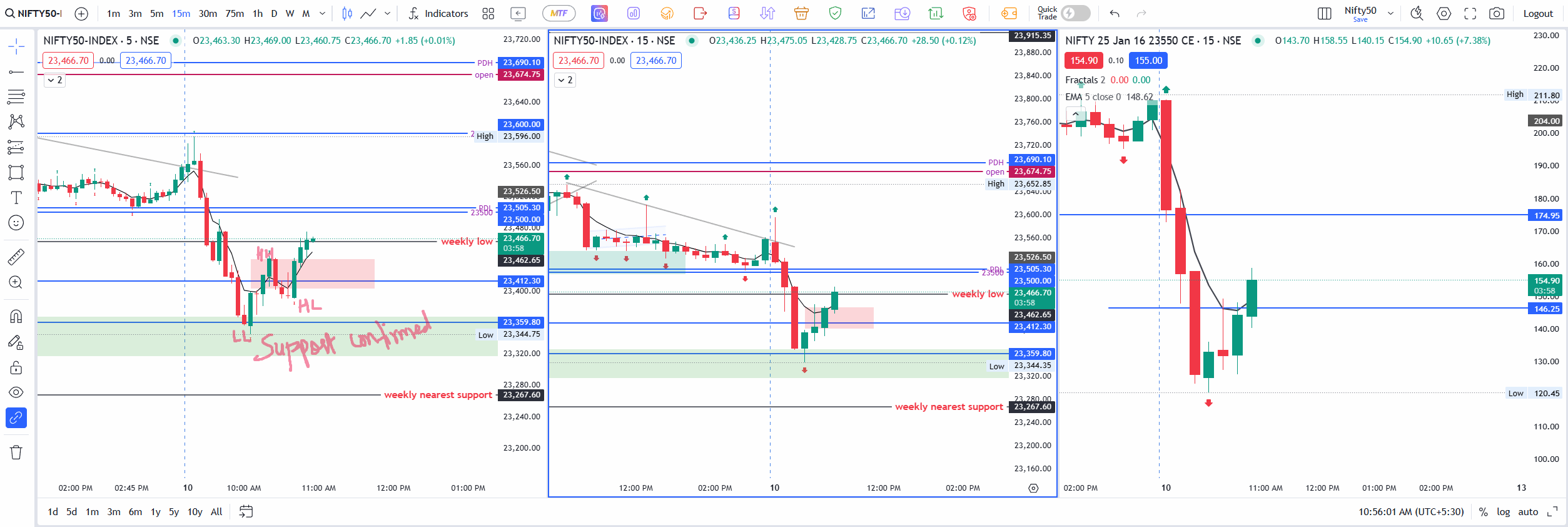

Support Zones and Time Frames

In Nifty, that support zone I marked—23,318 to 23,365—did indeed act like a floor for prices. The market bounced up from that area, which sometimes surprises new traders who expect the price to just keep dropping. Support zones can be powerful.

For Banknifty, I use a 75-minute chart as part of my analysis. I had a line at 48,849 that I believed would be important. If the price closed below that line, I expected a “free fall,” meaning the market could drop quickly. But, instead, the price took support right there and reversed upward. When you see a zone or a line that stops the price from going lower, it often means there are enough buyers around that level.

By 10:30 AM, I decided to take a break from trading. Fridays can be tricky, and I was already satisfied with the two trades I took in Nifty. I thought about checking again around 12 PM to see if there was something interesting happening in the market orI might call it a day.

Observing the Half-Day Trend

Nifty Reversal Trade “W Pattern” at Support

During the first part of the session, prices in both indices moved in a trending fashion and then recovered more than 50% from their lows. I figured I wouldn’t enter any new trades unless something really clear showed up on the charts.

Banknifty Reversal Trade “W Pattern” at Support

I had an eye on the support levels I marked on the chart but didn’t take a trade. For those who like reversal trades, there was a hint of a possible “W pattern” forming from a support area. But I personally chose not to trade that pattern.

Regrets and Future Outlook

Sometimes I regret not holding trades longer, especially when I see the price eventually moving in my favor. But I also know that risk control matters a lot in trading. Missing out on some extra profit can be better than watching a small loss turn into a big one.

I used to hold trades for longer periods before some rules by SEBI changed how much intraday leverage we could get. Now, I mostly look for smaller moves and quick profits. This is why a sudden green candle in Nifty at 9:40 AM made me exit early. I was afraid the price might jump, so I closed out my position, even though, in hindsight, maybe I could have held it a bit longer for a bigger gain.

I have a personal notion that Banknifty could fall to 46,000 one day and then bounce back, while Nifty might move near 21,282. These levels come from the lows on an election day back in June 24. It doesn’t mean this will happen soon, but it’s something I keep in mind when looking at the bigger picture.

The Day’s Finale

By the end of the session, Nifty dropped -121 points approx, it fell more but recovered from the support marked. Banknifty on the other hand did not recover that much and closed -676 points making a strong bearish candle. Overall scenario for Banknifty looks bearish now, and like I said above the line market at 48849 will act as a deciding point for me. Below this line I will be super bearish in Banknifty.