31st Jan 2025 Intraday Trades & Concept

Market Opens

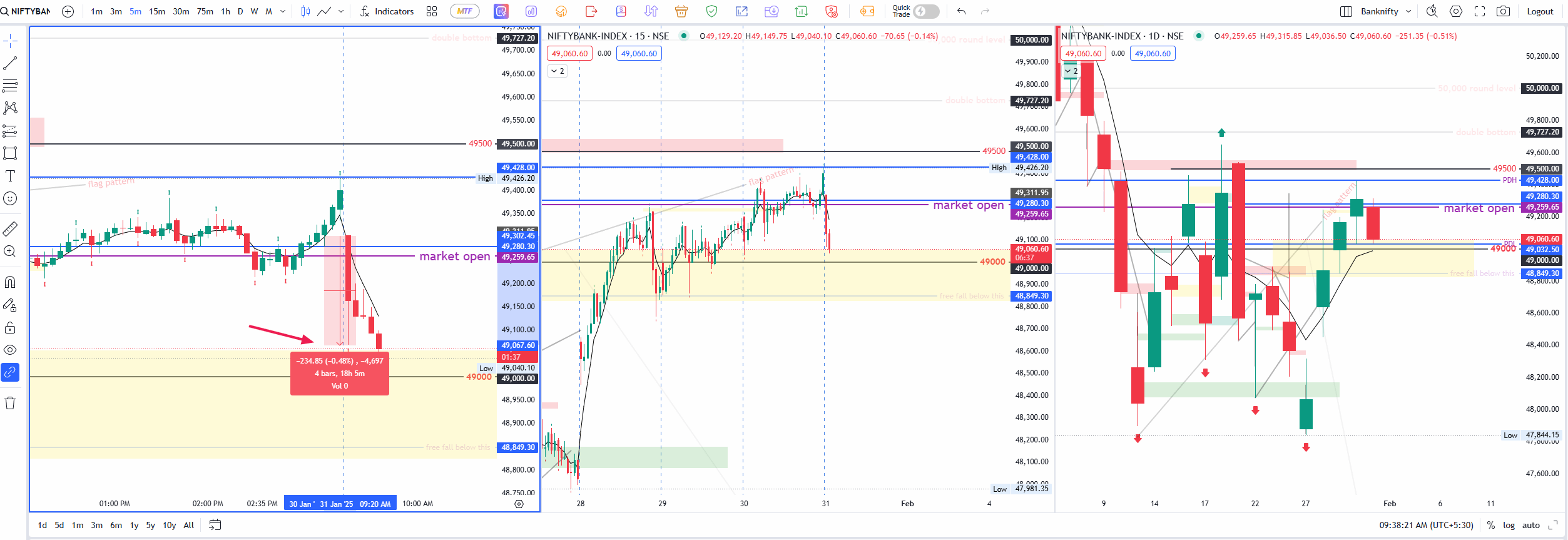

On the surface, today looked like a day of mixed signals right from the opening bell. Nifty opened with a +47.25 points gap-up, while Banknifty started the day in negative territory at –52.30 points, settling around 49,259.65.

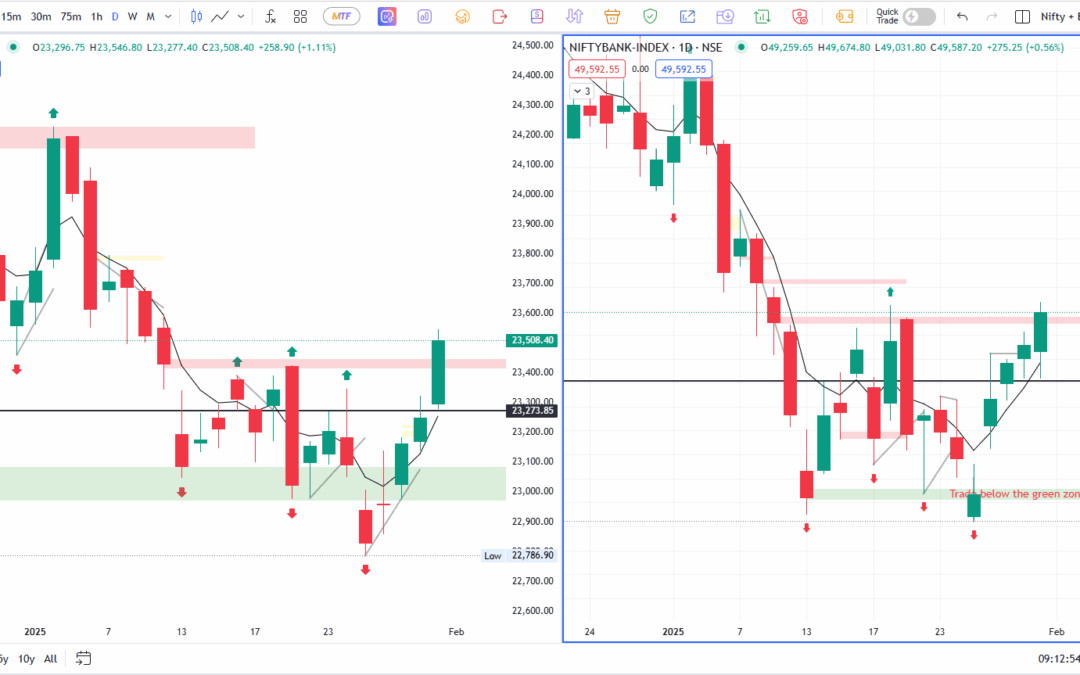

Banknifty’s Four-Day Green Streak

Banknifty has posted four consecutive green candles on its daily chart. Typically, this suggests healthy buying interest, but it also raises the question of whether a red candle might be due—either as a natural pullback or a sign of short-term profit-taking. My thought is may have a red candle today.

The index has a clear 500-point range in play, anchored by a round-number support at 49,000 and resistance near 49,500. My early assessment was that price might get “stuck” between these two levels for much of the session, seeing the Banknifty stocks movement.

Adding to the puzzle, the very first 5-minute candle in Banknifty covered a notable 233 points. With an average daily range of around 400–500 points, it’s possible that a good chunk of the day’s movement gets used up early, leaving less room for dramatic swings.

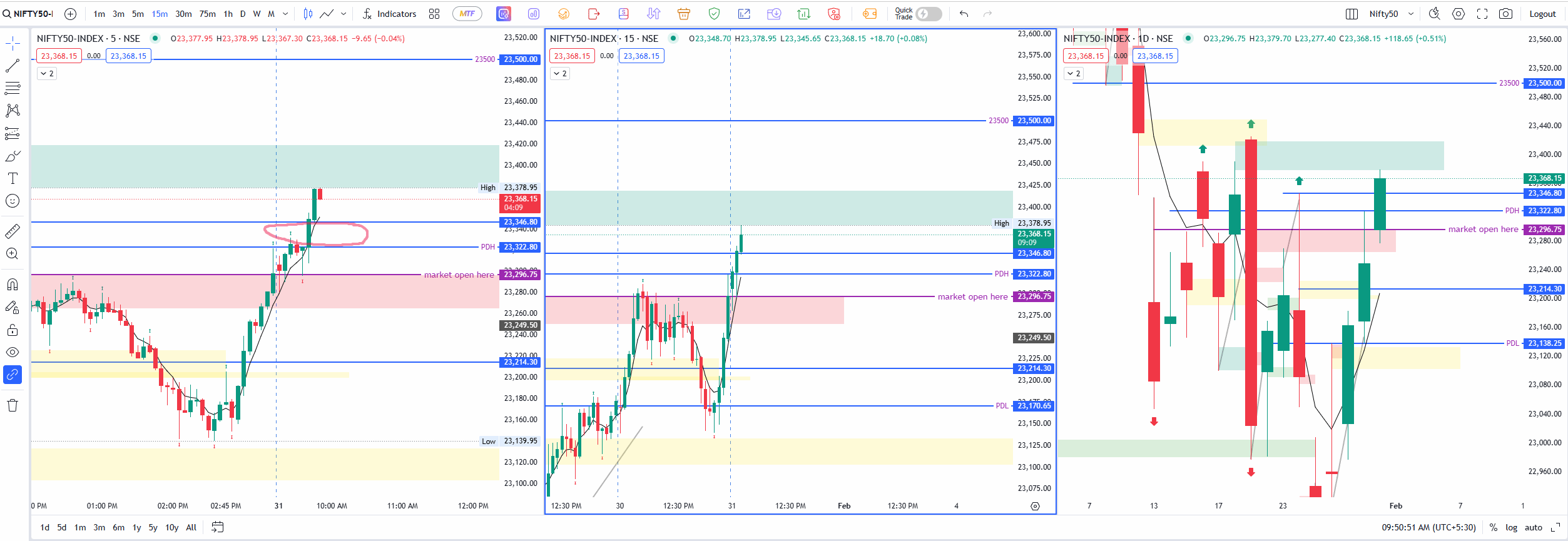

Nifty’s Early Strength

Nifty exhibited a more upbeat opening, bolstered by a gap-up start. Despite spotting a 5-minute price action setup, I opted not to enter any trade early in the session. My hesitation stemmed from a level I’d marked between 23,322.80 and 23,346, a zone where I wasn’t entirely certain how price would behave. While I sat on the sidelines, the index charged upward with conviction; at one point, 43 out of 50 Nifty stocks were in positive territory, confirming that at least some portion of the market was in a bullish mood.

Eventually, Nifty reached to the zone I’d identified, appearing to take support there. With each bounce, it formed higher highs on the chart. Meanwhile, Banknifty found its own support near 49,000 and started moving upward.

Holding Off on Trades

Even as Nifty demonstrated vigor, I decided not to initiate any positions. Fridays often come with their own quirks, and I’ve observed a pattern across several of my previous blog posts: the market frequently shows one-sided movement early on, then stages a significant retracement later, or vice versa. My current expectation—a “probability” insight based on these past observations—was that Nifty would likely hold onto its gains and close in the green.

Banknifty posed a slightly different scenario. On one hand, its four consecutive green daily candles could indicate that a red day is overdue. On the other, if the index aligns with Nifty’s positive momentum, it might defy that expectation and deliver a fifth green candle instead. The market’s seeming resilience in the morning, plus the fact that Banknifty found support near 49,000, nudged me toward thinking it might also finish in positive territory—despite the day’s slightly negative start.

Reflecting on Friday Tendencies

Fridays can sometimes be a tale of two halves. The market has been known to rally without much pullback in the first hour, only to reverse sharply mid-session. Other times, it drifts lower initially, then recovers enough to close near or above the day’s open. Lately, it seems that if a trend establishes itself early, there’s a fair chance it sticks around, especially when many leading stocks are participating.

While Banknifty’s recent streak suggested a possible reversal, the broader evidence of bullishness in Nifty (and many of its constituent stocks) implied that a sustained sell-off might not materialize. Such mixed signals are a clear reminder that no single indicator—be it a candle streak, support/resistance zone, or prior Friday pattern—can dictate what the market will do next. This inherent uncertainty highlights why disciplined traders often wait for clear pullbacks or confirmation signals before committing to new positions.

Final Thoughts

In the end, the opening divergence between Bankifly Nifty and Banknifty set the tone for a day of cautious optimism. Nifty’s upward momentum clashed with Banknifty’s early gap-down, but both indices appeared to stabilize around key support levels. With Banknifty’s four green candles in a row, it was natural to anticipate a red day, yet the intraday action suggested enough strength to counter that outlook—especially once Banknifty rebounded from 49,000 and Nifty continued inching higher.

I opted to stay on the sidelines, observing whether the familiar Friday pattern of “one move, then a retrace” would unfold or if we’d witness a steady climb into the close. Regardless of the outcome, days like these underline the importance of respecting well-defined levels, monitoring momentum in leading stocks, and sticking to a clear plan. After all, consistency often trumps chasing impulsive trades, especially in a market that can shift from bullish to cautious—or vice versa—within a single session.