27th Jan 2025 Intraday Trades & Concept

Market Opens

Days when the market opens with a sharp gap-down can either be a goldmine of opportunities or a minefield of stop-outs.

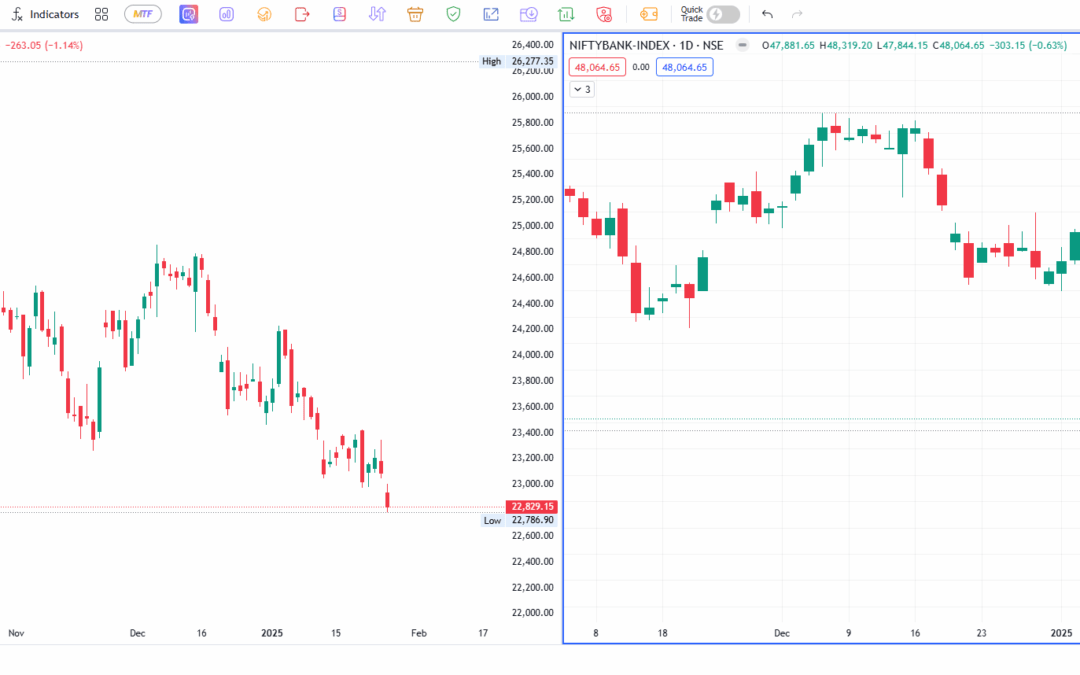

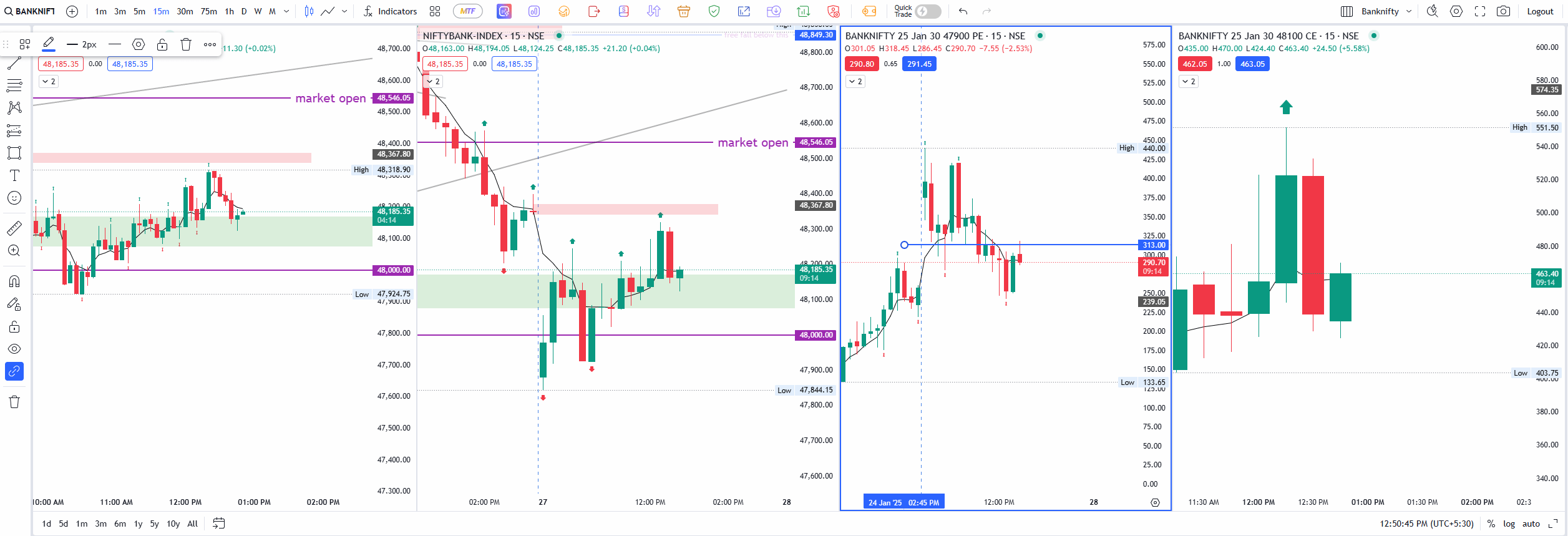

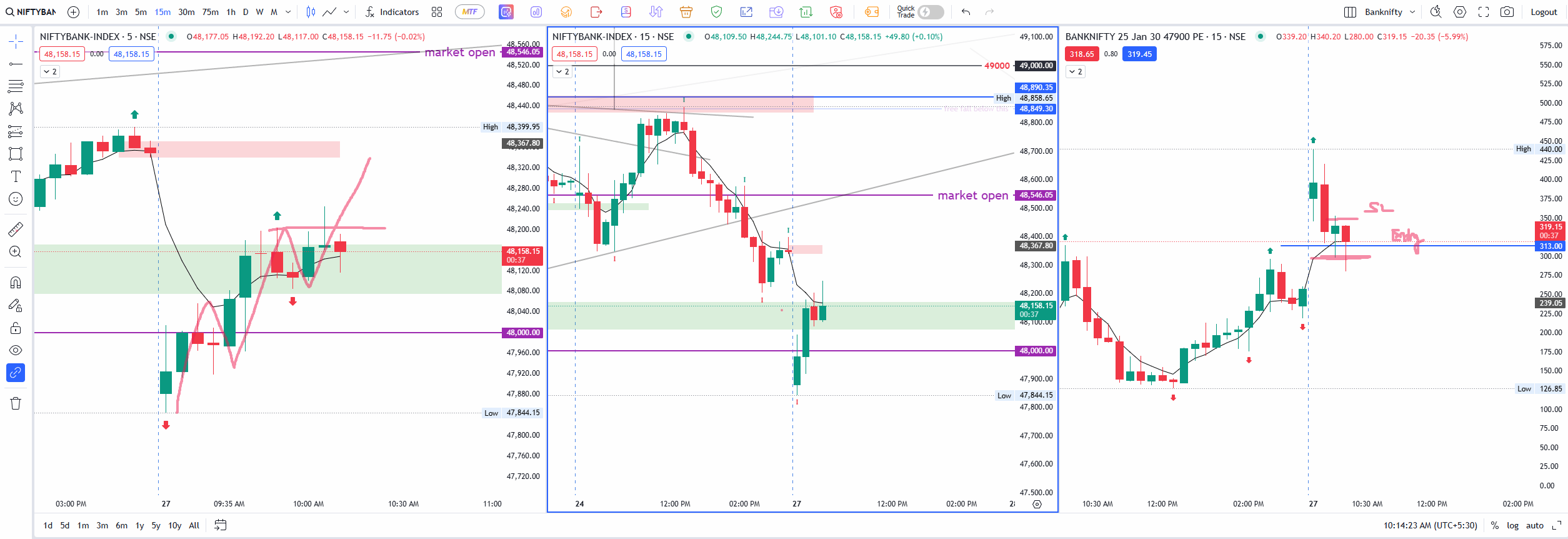

Banknifty

Banknifty opened with a –486.15 points gap-down

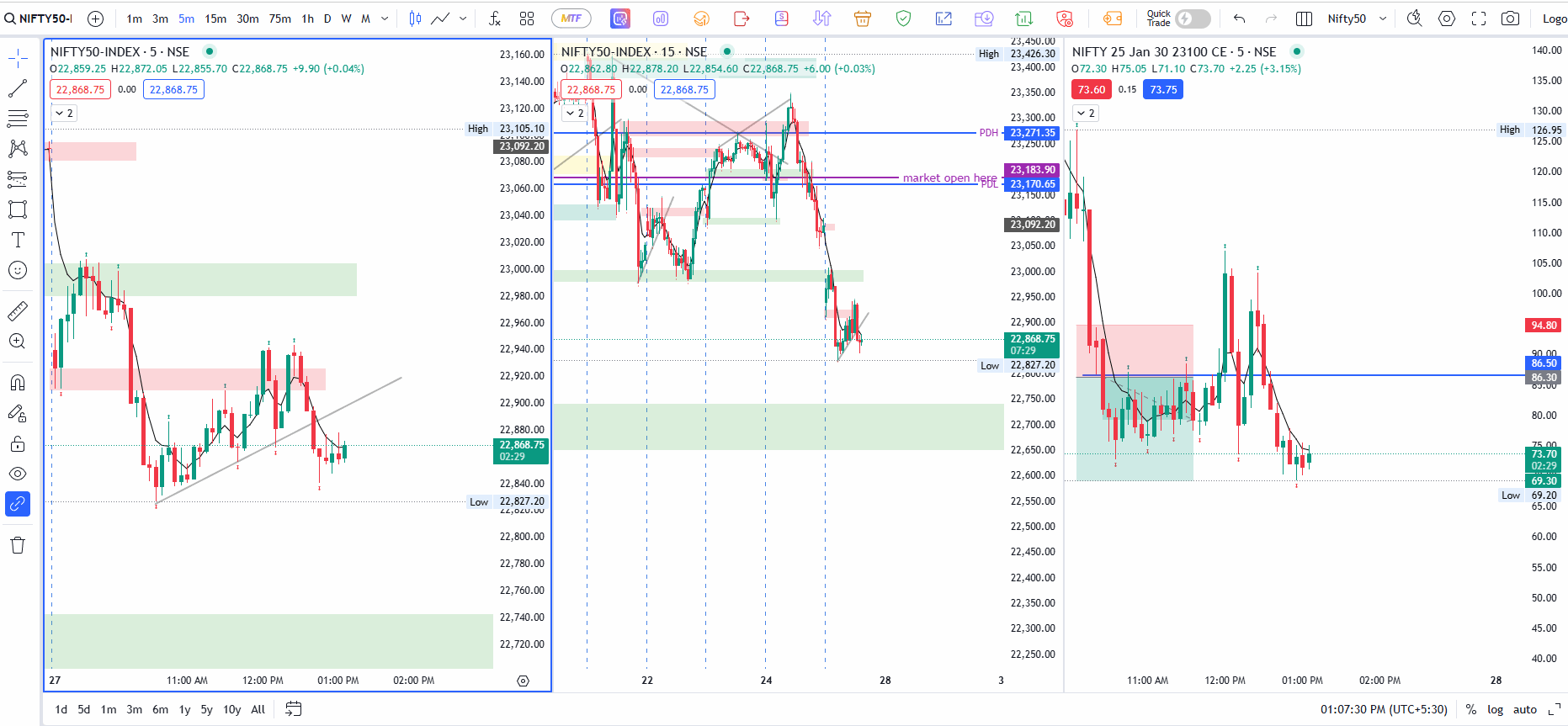

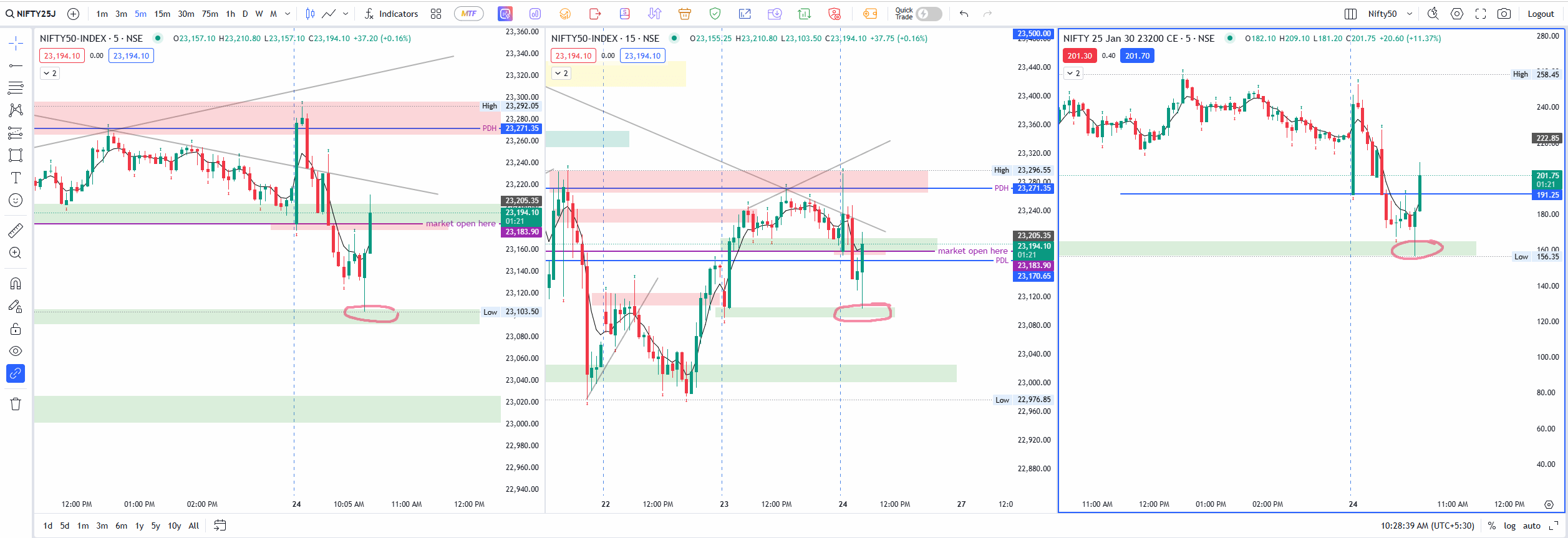

Nifty

Nifty followed with a –152.05 points fall at the open.

This was a notable shift after several sessions of large gap-ups and gap-downs, but it wasn’t the first time we’ve seen such an extreme move in recent weeks.

Below is an in-depth look at my trades, the mistakes I made, and the lessons I’m taking away from a day defined by fast moves, fake breakouts, and indices moving out of sync.

An Early Gap-Down and Mixed Signals

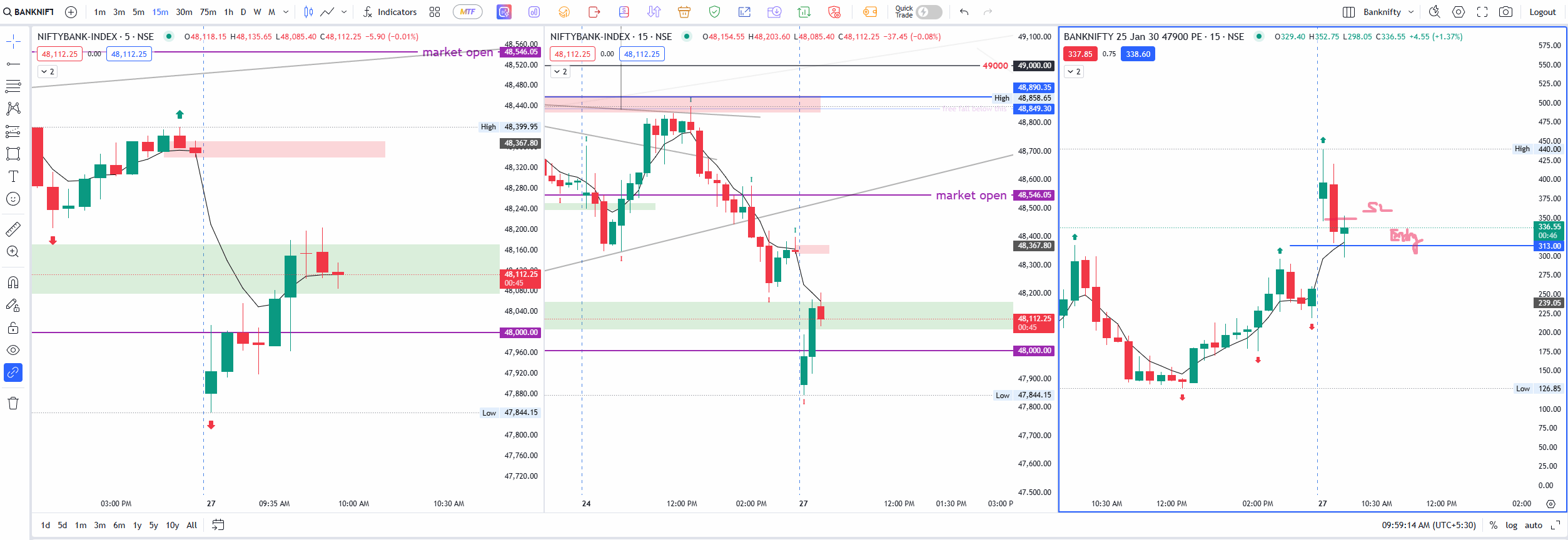

Banknifty: Fast Moves, Missed Reversals

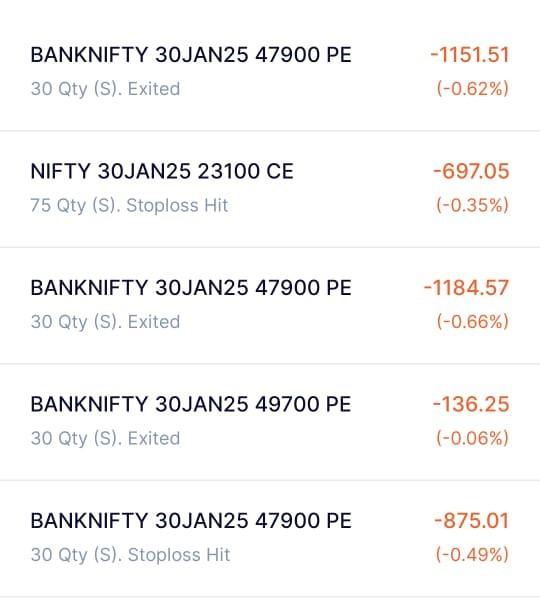

I started with a 15-minute setup in Banknifty, coupled with the 5 EMA on a 15-minute chart for a bulling trade, targeting a gap-fill in the spot chart. My first attempt involved selling 47,900 PE at ₹313 with a 25+ point SL (Stop Loss). Unfortunately, my SL got triggered at ₹340, taking me out of the position quickly.

Undeterred, I planned to re-enter 47,900 PE, but in my haste, I accidentally added 49,700 PE. I caught the mistake right away and exited that erroneous trade for a minimal loss. Once I corrected the strike price and sold 47,900 PE at ₹293.45, my SL was hit again at ₹330.80. By then, Banknifty’s price fell so rapidly I missed any chance to pivot to a CE sell for a reversal.

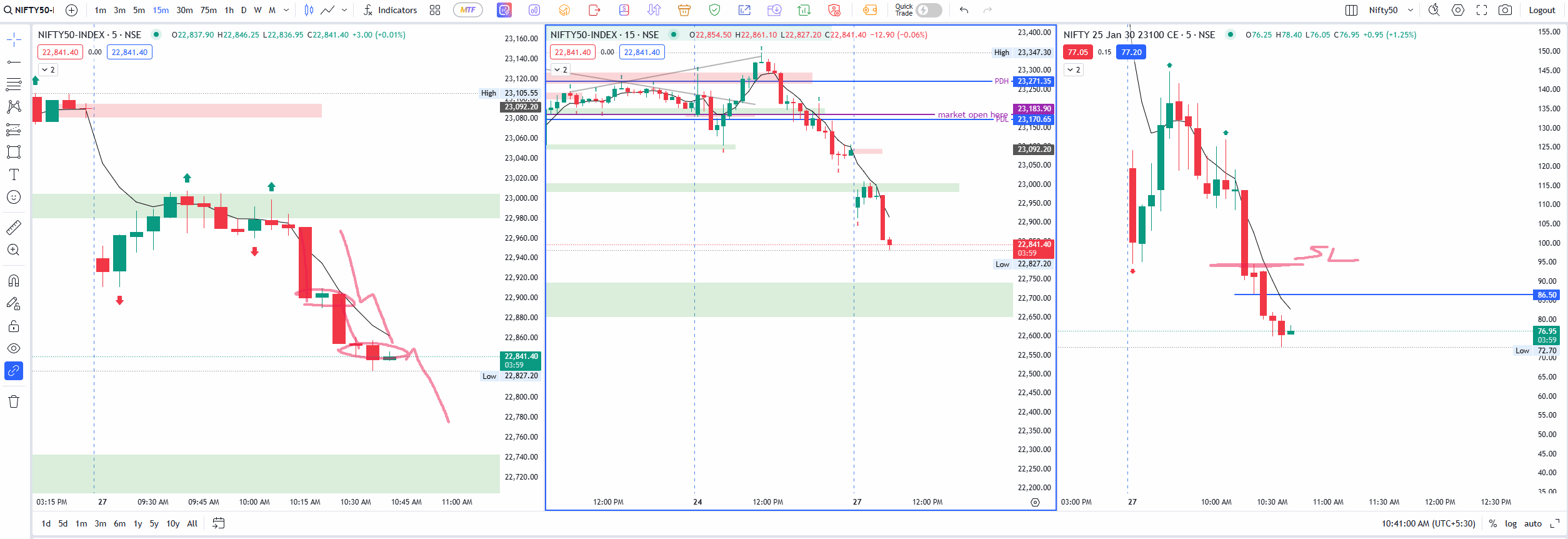

Nifty: Break of Day Low and a Half-Fulfilled Target

While juggling Banknifty, I also watched Nifty break its day low in a single 15-minute candle. On a 5-minute chart, I sold CE 23,100 strike price at ₹86.50, setting a Stop Loss at ₹95.00. The trade gave showed me a 1:1.59 reward, close to my 1:2 target, but not quite there. Eventually, my stop was hit, underscoring how tricky it can be to manage trades on two different indices when they’re not moving in sync.

Chasing Entries, Hitting Stop Losses

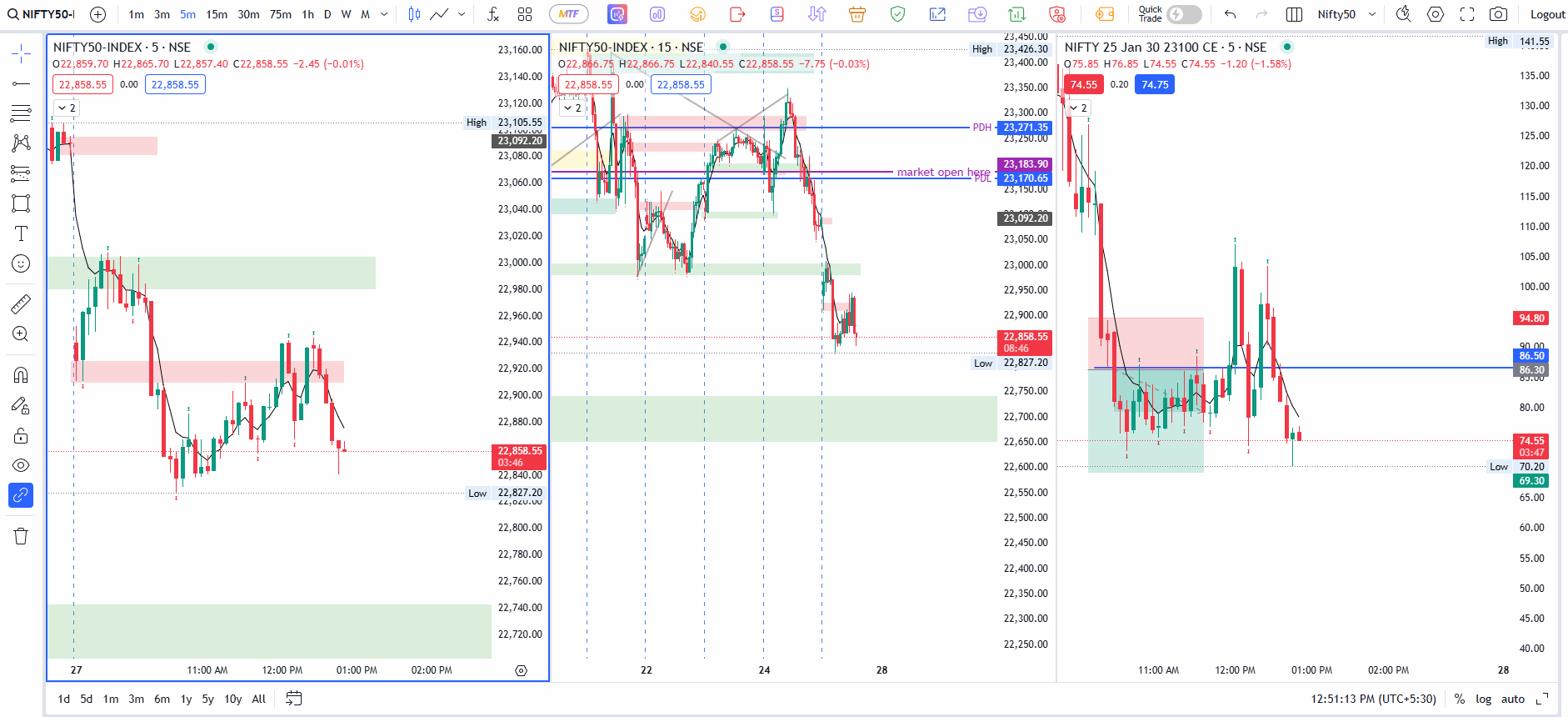

Another Attempt at 47,900 PE

Undeterred, I re-entered 47,900 PE in Banknifty at ₹265.95, still eyeing a gap-fill target on the spot chart. The options chart did manage to fill the gap, but the spot chart did not, so I held on longer. One strong bullish candle formed, the price retraced, and—again—my SL was hit. By this point, I’d faced four stop-outs plus one accidental strike entry. It was time to step back.

Fake Moves and Market Choppiness

Nifty’s Fake Bullish Candle

At one point, Nifty showed a strong green candle, breaking near the day’s open. I assumed it might push higher, but it swiftly retraced. A second attempt to move up also failed, and Nifty continued to slide. Had I tried to jump back in for a bullish trade, I would have been whipsawed again. This underlines the importance of waiting for clearer confirmation before committing capital—especially on days where the price repeatedly tests and fails key levels.

Index Discrepancies

One of the most frustrating parts of the day was watching Banknifty and Nifty move out of sync. It often happens that one index will trend downward while the other moves sideways or even attempts a small bounce. Eventually, by the time they both align, the initial momentum is already gone. On a day like today, you have to be causious while taking trades.

The Day’s Finale

By the close:

- Nifty 50 ended by a fall of approx 267 points today.

- Banknifty close in green with 295 points approx still closing below last trading day.

By the time I decided to stop trading, I’d taken four losing trades plus one accidental entry. It was a humbling reminder that not every gap-down day follows the neat pattern of a bounce or a breakdown. Yes, a massive gap often signals volatility, but it can also lead to erratic behavior where each index dances to its own tune.

In the end, no strategy can guarantee smooth sailing—especially when the market itself hasn’t decided on a clear direction. The best we can do is follow our rules, set strict stop losses, and remain flexible. Tomorrow is a new day, and the market isn’t going anywhere. Having capital left to trade another session is far more valuable than forcing a big win on a day when conditions just aren’t lining up.

Key Takeaways from a Challenging Day

- Double-Check Strike Prices: Mistakenly adding 49,700 PE instead of 47,900 PE was a minor error this time, but it underscores the need to verify trades before hitting “confirm.”

- Gaps Don’t Guarantee Fills: While gap-fills are common, there’s no rule saying it must happen the same day. Sometimes, price only partially fills a gap—or never does at all.

- Watch for Index Divergence: When Banknifty makes higher highs and Nifty keeps dropping, trades become riskier. A single candle can reverse your entire setup.

- Stop Losses Are Non-Negotiable: I took multiple hits today, but it could have been worse if I’d tried to remove or loosen my SL. Preserving capital is more important than chasing every move.

- Be Realistic About Daily Range: Knowing average moves for Nifty (150–200 points) and Banknifty (400–500 points) can help set expectations and avoid over-trading once a large portion of that range is covered.