24th Jan 2025 Intraday Trades & Concept

Market Opens

The market can sometimes offer more than meets the eye, even on days that appear to open flat. Today was one of those days:

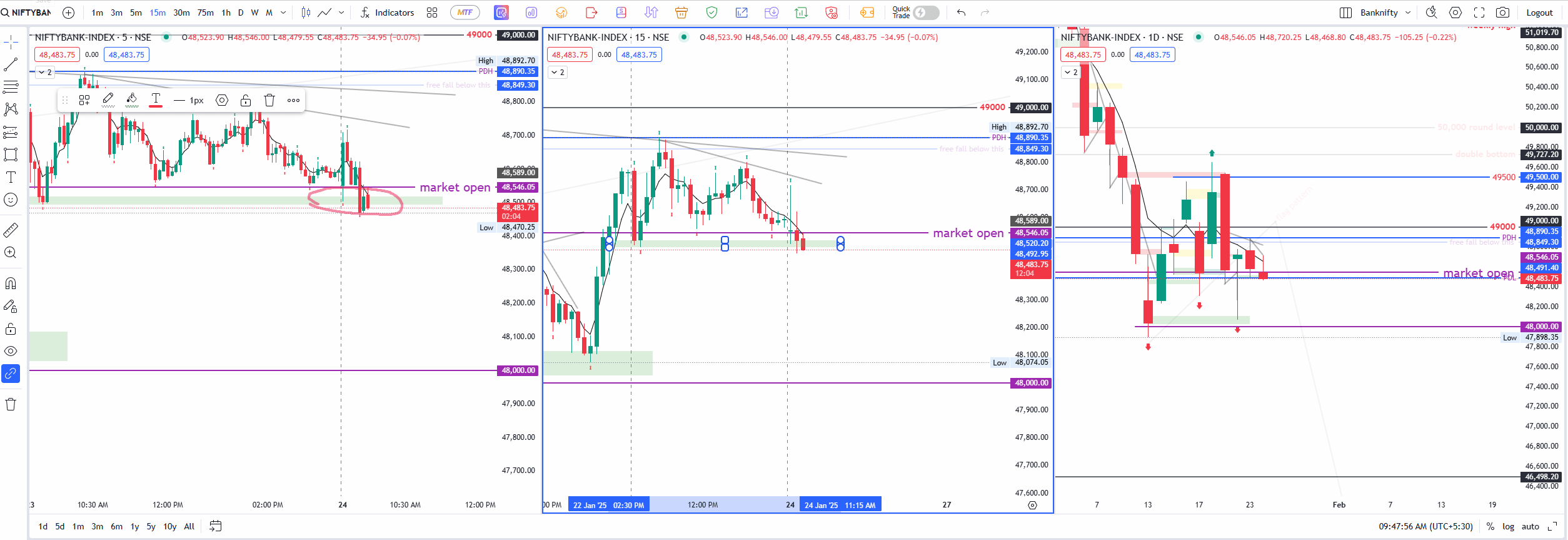

Banknifty

Banknifty opened just –42.95 points lower than its previous close.

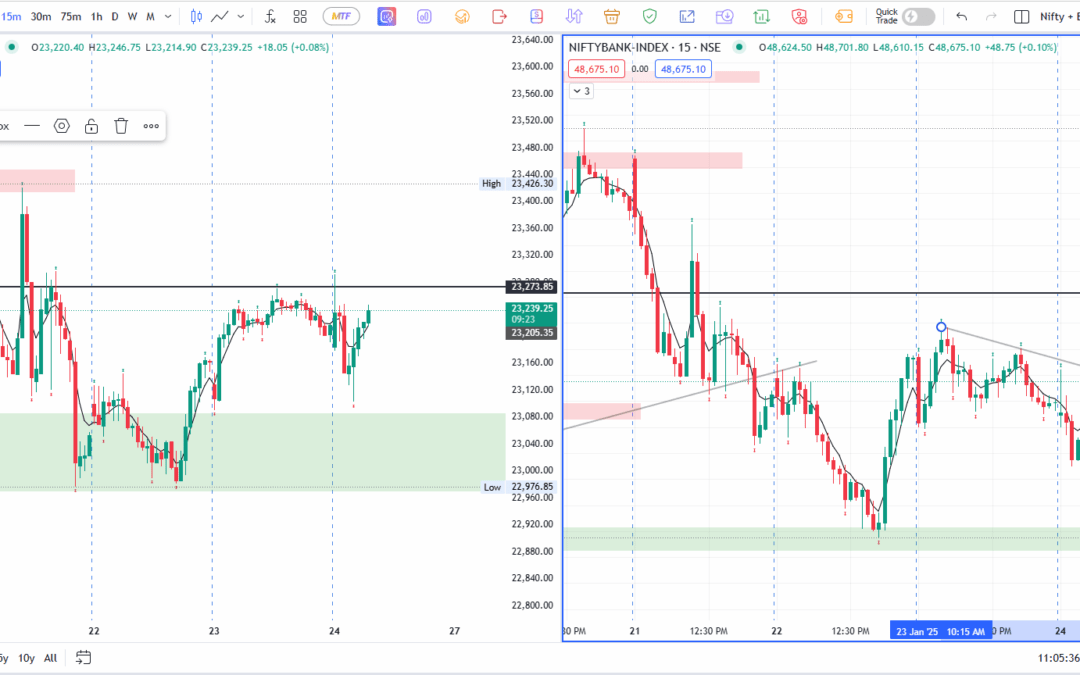

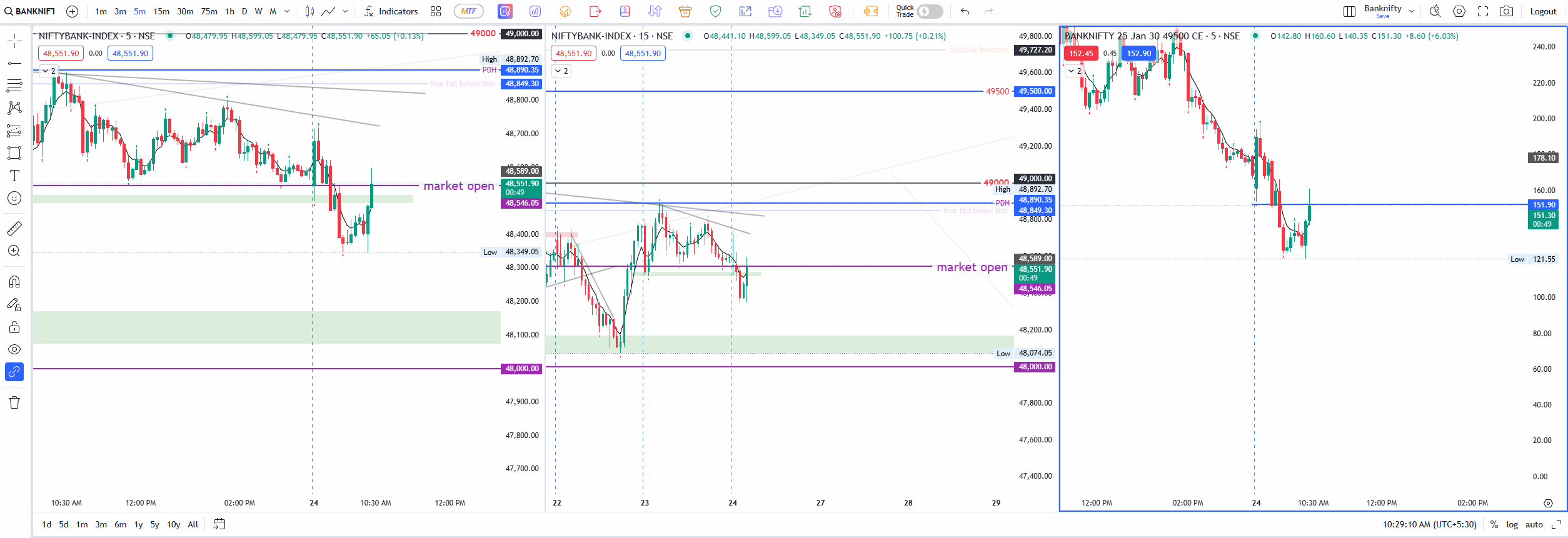

Nifty

Nifty started the session –21.45 points down

Essentially flat openings for both indices. Despite this unremarkable start, there were still a few important moves to catch. Below is a detailed recount of how the session played out, the trades I entered, and a curious discovery about default lot sizes in Nifty.

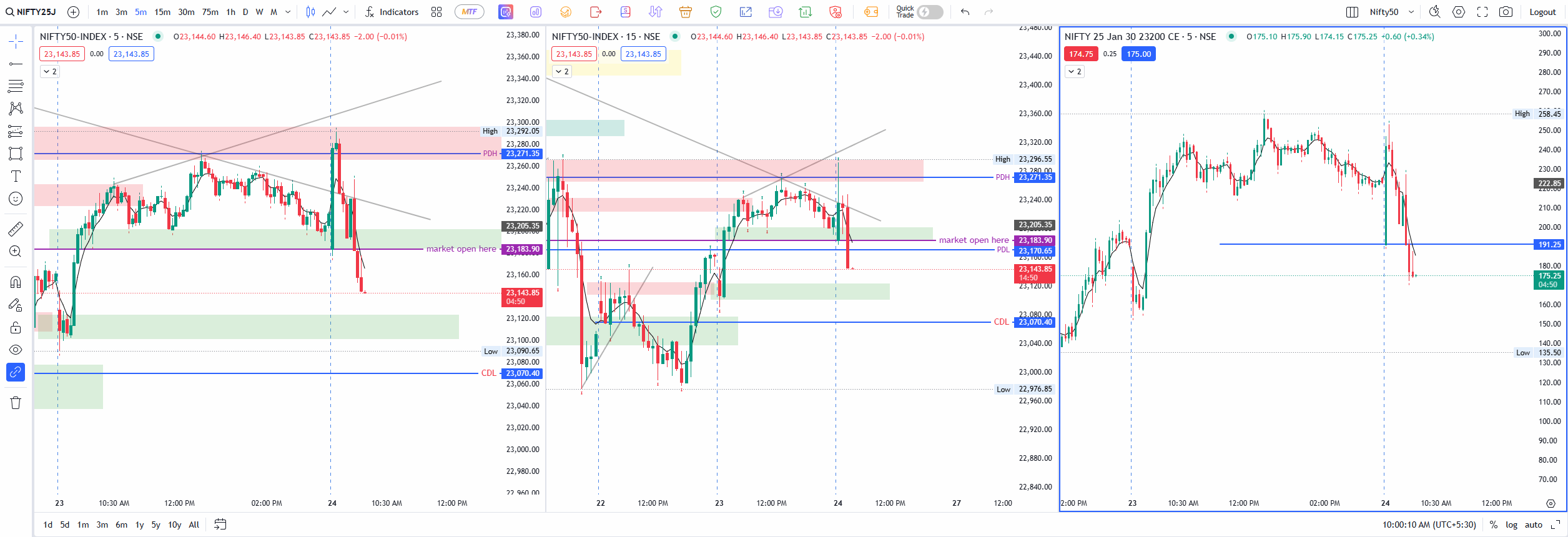

Reflecting on Yesterday: No Trades Taken

Before diving into today’s action, it’s worth noting that I did no trading yesterday at all. The reason was twofold:

- I Woke Up Late: Trading demands focus and preparation. By the time I checked the markets, a significant part of the early momentum had already passed.

- Lack of Follow-Through: After the initial flurry in Nifty, prices settled into a sideways range. Banknifty followed a similar pattern, bouncing between 48,890 and 48,496, leaving little room for high-conviction trades.

Rather than forcing a position in a choppy environment, I decided it was wiser to stay on the sidelines, preserve capital, and wait for a clearer opportunity.

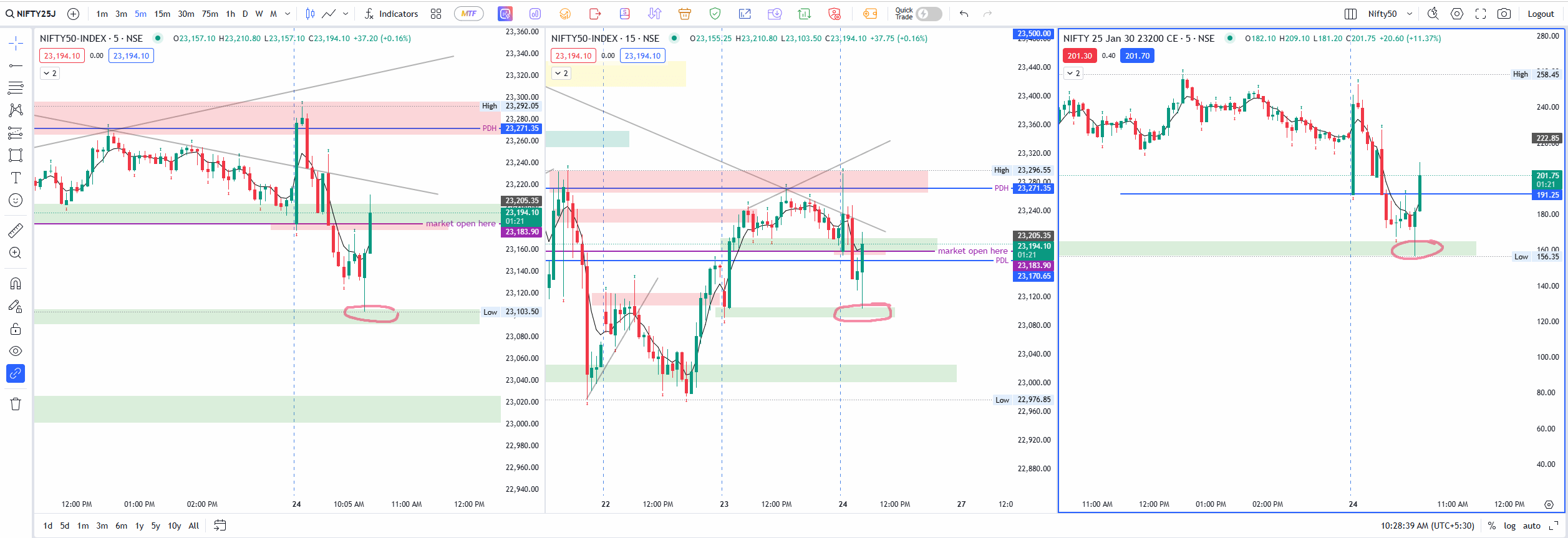

Today’s Opening and Initial Observations

Fast-forward to this morning: both indices opened marginally lower—so close to the previous close that I labeled it a “flat opening.” Within the first hour, both Nifty and Banknifty broke their initial day’s low, a move that caught my attention. I’d already identified potential sell-side zones in both indices if they continued displaying weakness.

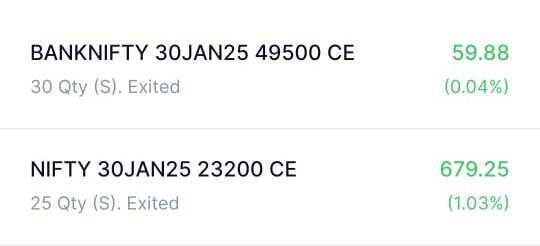

My First Trade: Banknifty CE Sell

Upon noticing the breakdown, I executed a Call Option Sell for Banknifty (49,500 CE) at around ₹151.90, aiming for a target near 48,200 on the spot chart. I kept a 25-point Stop Loss in place.

Shortly after entry, Nifty reversed near its own target area, and Banknifty also stopped falling before reaching 48,200. I decided to exit the trade with a very small gain, instead of waiting and risking a total reversal that could erode my profits. While the exit may have been premature, it felt prudent given the erratic intraday signals.

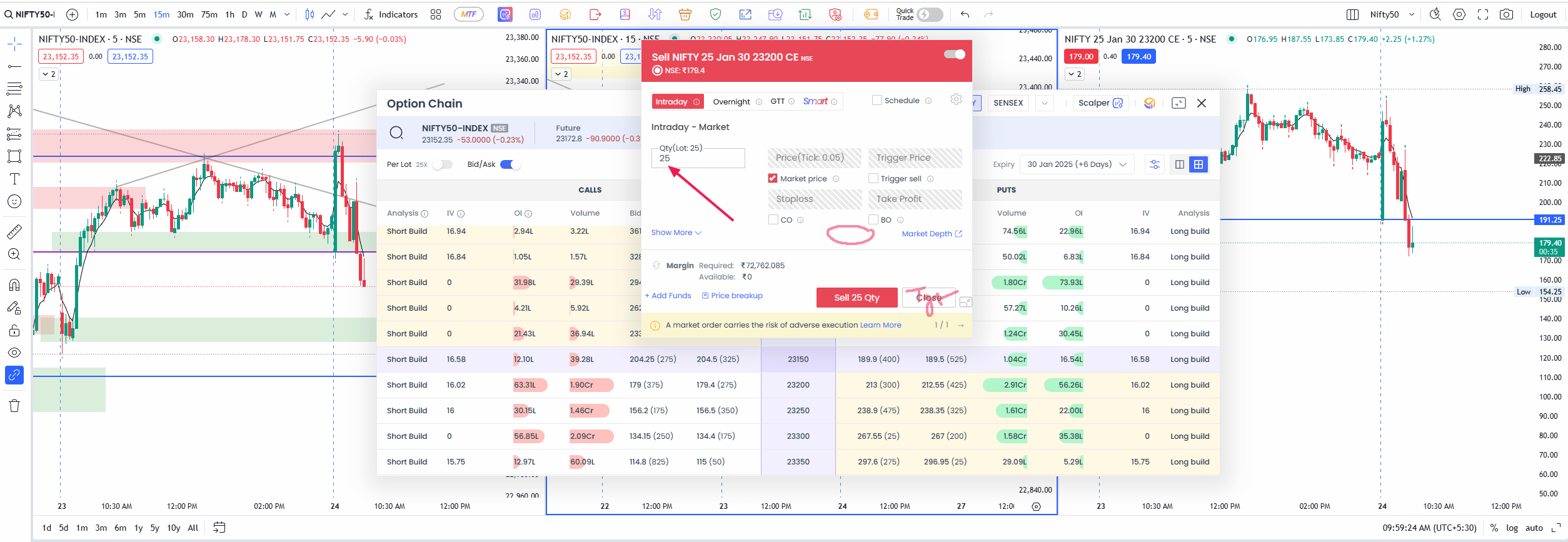

Second Trade: Nifty CE Sell

In Nifty, I identified a shorting opportunity with the 23,200 CE at ₹191.25. My target on the spot chart was 23,120, which is where I believed the market might pause or bounce based on the support zones I had marked. This time, the target was achieved, and I exited at ₹161.85—a decent profit for a relatively quick trade.

What struck me as odd was the default quantity for my Nifty position. I discovered I was only trading 25 units instead of my usual 75. This raised the question: Did the contract size for Nifty change, or was there a glitch in my trading platform? I haven’t seen an official announcement, so it remains a bit of a mystery. But it serves as a reminder to always double-check your lot sizes before confirming a trade, especially when markets are moving quickly.

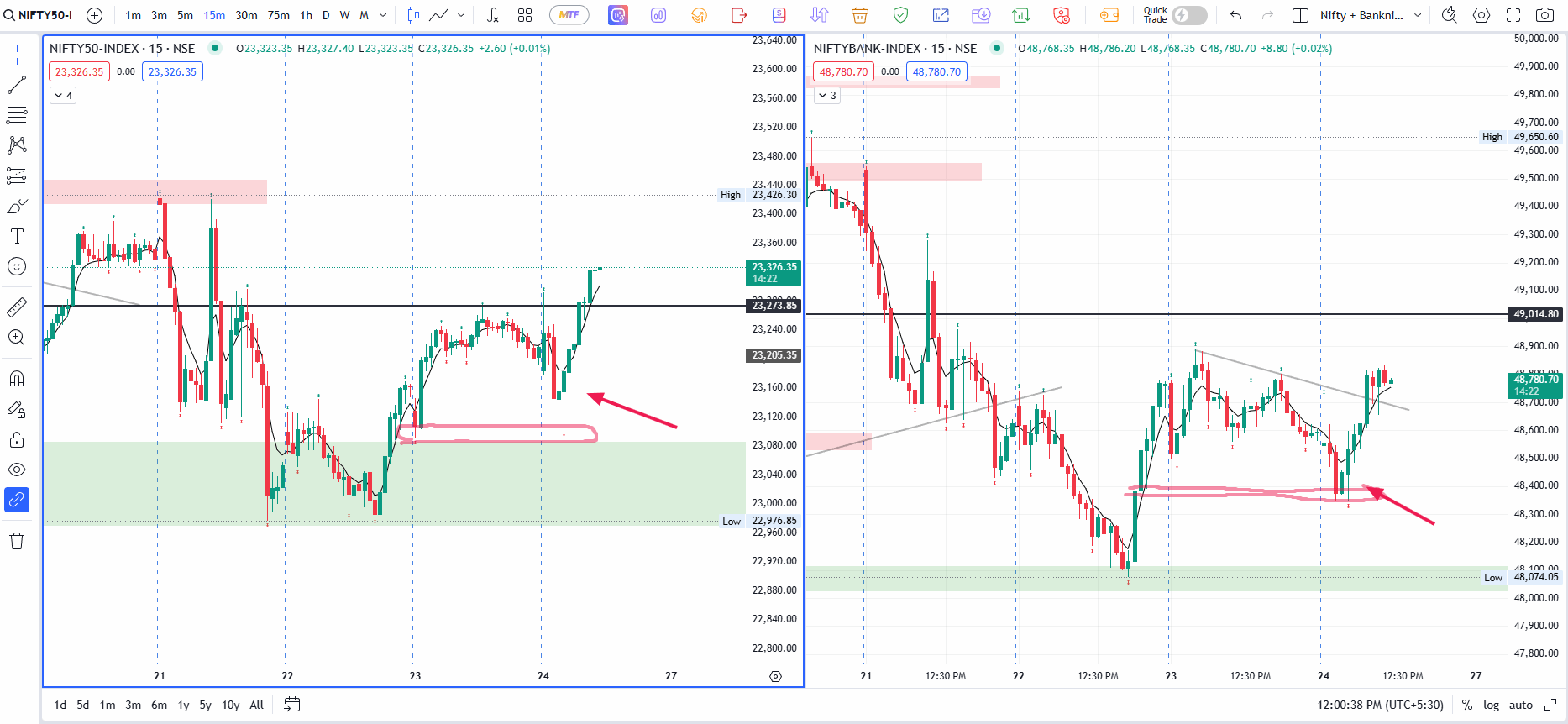

The Friday Pattern: Morning Dip, Mid-Morning Reversal

Anyone who has followed my previous blog posts—particularly those from January 17th and January 10th—knows I’ve been observing a recurring pattern on Fridays. The market often falls during the first half, typically showing some degree of downward pressure. Then, around 10:30–11:00 AM, a reversal frequently emerges, pushing prices back up.

Sure enough, we saw that scenario unfold again today. After breaking below day’s low, Nifty found its footing near a key support zone, and by late morning, it bounced up decisively. Banknifty followed a similar arc, though perhaps not as dramatically as Nifty. Recognizing this pattern can help traders avoid getting trapped in late shorts or chasing breakouts once the initial downside move has already run its course.

The Day’s Finale

By the close:

- Nifty 50 ended positive by 130.70 points or 0.57% at 23,155.35

- Banknifty gained 154 points, closing at 48,724, with weak market breadth.

By midday, I was content with my exits and chose to close all positions and call it a day. Better to secure small gains and remain capital-positive than to risk a choppy market that can easily reverse intraday.

Reflecting on the Day

Here’s a quick summary of my main takeaways from today:

- Flat Isn’t Always Static: A “flat” opening can still break key support or resistance levels early, offering short-lived momentum trades.

- Check Your Lot Sizes: Whether it’s a platform glitch or a contract change, never assume your default quantity is correct.

- Friday’s Intraday Pattern: The market often dips in the opening hour and then stages a rebound near mid-morning. While it doesn’t happen every Friday, it’s frequent enough to keep on your radar.

- Exiting Early Isn’t Always Wrong: In a market known for sudden reversals, capturing smaller gains sometimes beats holding out for a bigger target that may never materialize.

Overall, while the indices didn’t offer a massive trend today, they rewarded traders who were prepared to act quickly on short-term opportunities. As always, the market will open again on Monday (or the next trading day), bringing fresh setups and new lessons—so long as we keep our eyes open, our positions small, and our strategies adaptable.