20th Feb 2025 Intraday Trades & Concept

Market Opens

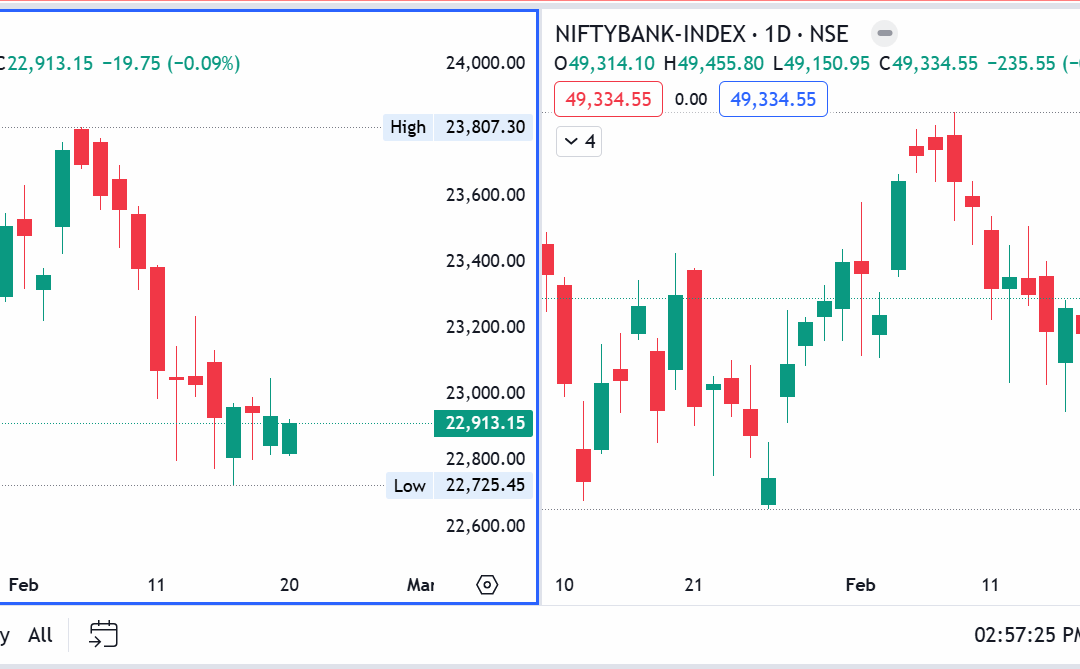

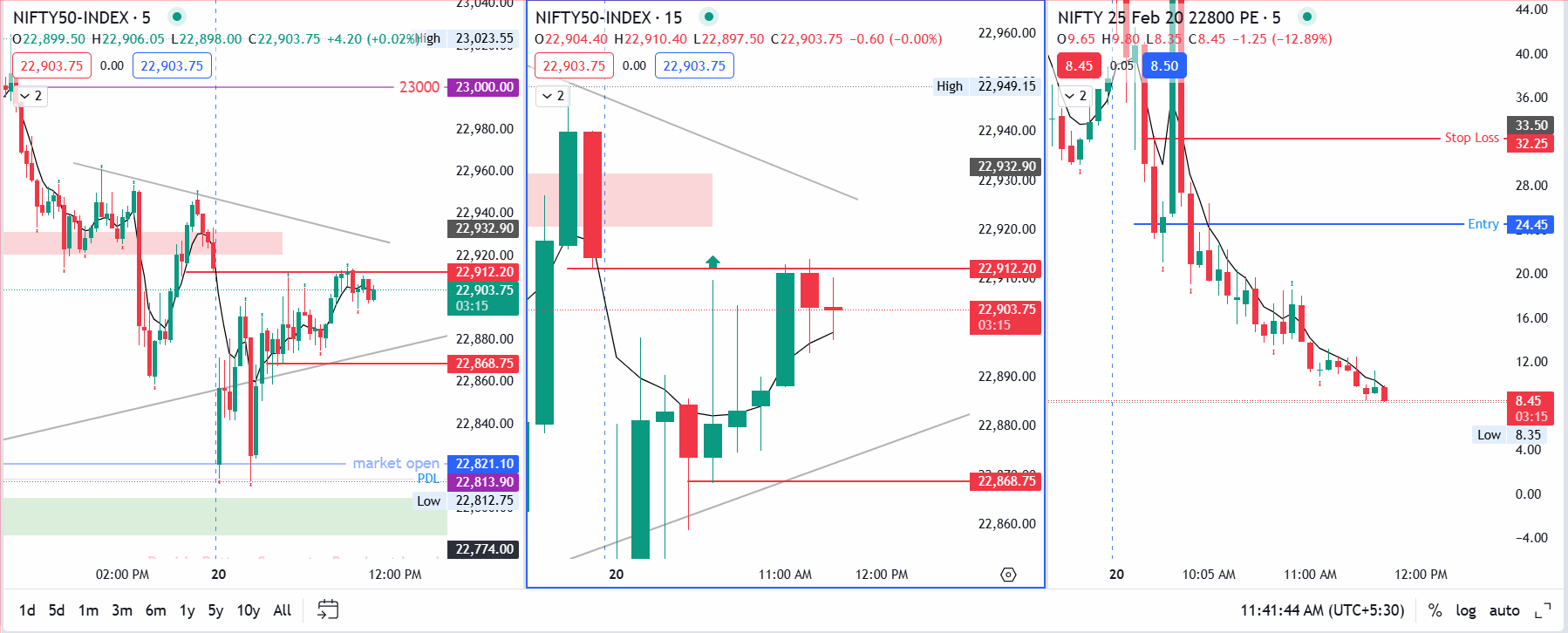

Markets often defy expectations, and today’s session was a perfect example. Nifty opened –111.80 points lower at 22,821.10, while Banknifty gapped down by –256.00 points, settling at 49,314.10—unexpectedly large, considering Banknifty’s late bullish push yesterday. Below is how the day unfolded, from missed bullish opportunities to paper trades aimed at a sideways expiry.

Gap-Down Open: Contradicting Yesterday’s Moves

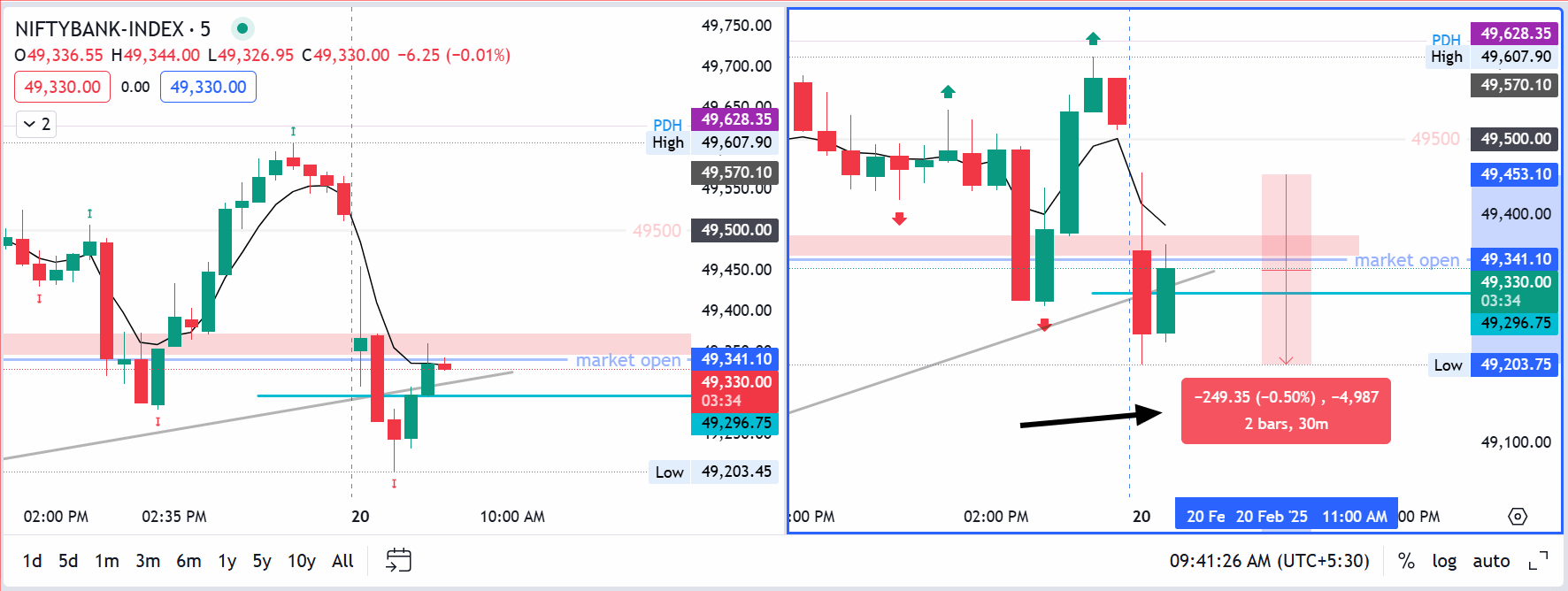

Banknifty’s Disappointment

The –256 point gap-down in Banknifty was particularly surprising. After showing strength in the final hours of the previous session, many anticipated at least a neutral or mildly negative start, not this substantial drop. In fact, the first 15-minute candle spanned around 256 points, and for much of the morning, the price remained bound by this single candle’s range.

Nifty’s Weak Close and Predictable Gap-Down

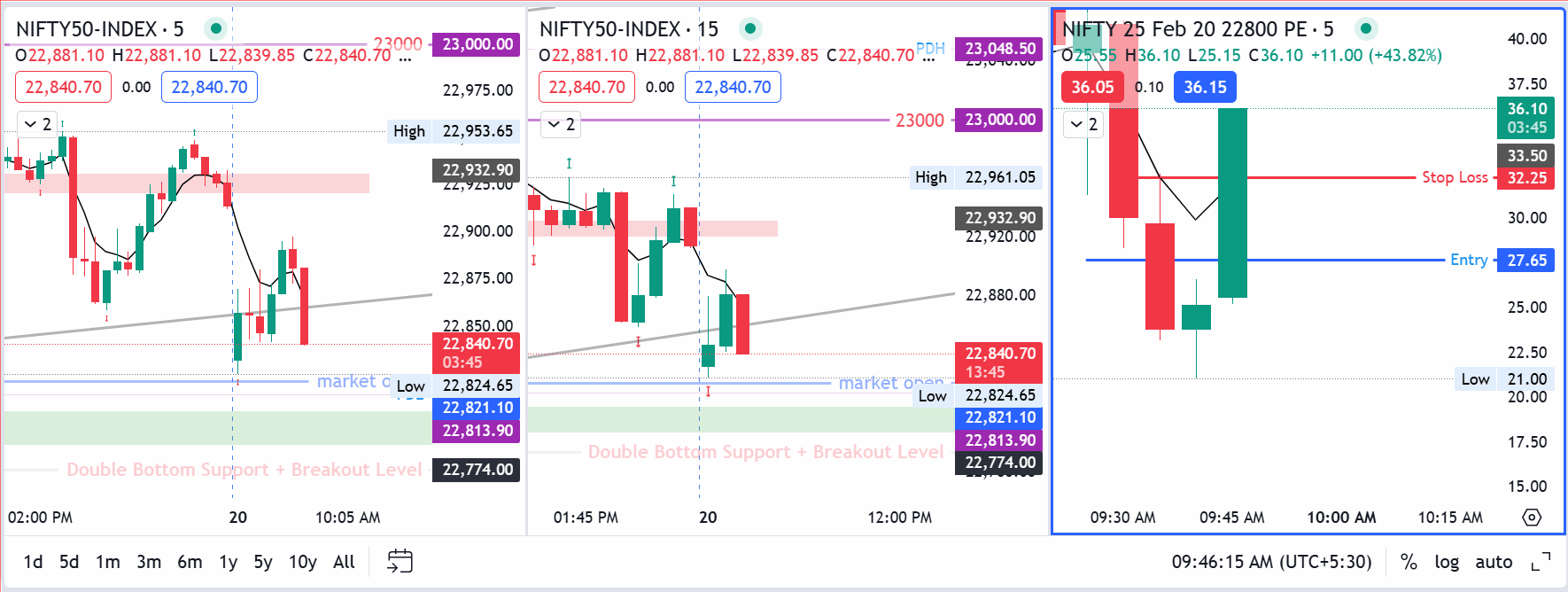

Nifty’s final candle yesterday lacked conviction, making today’s gap-down somewhat expected in comparison. Yet, upon the open, Nifty briefly showed hints of bullishness on the 5-minute chart, but a retracement quickly undercut that momentum. The index tested 22,800—a support level it has repeatedly touched in recent sessions—before inching up again.

Missed Trades, System Issues, and a Paper Position

Banknifty Setup Canceled

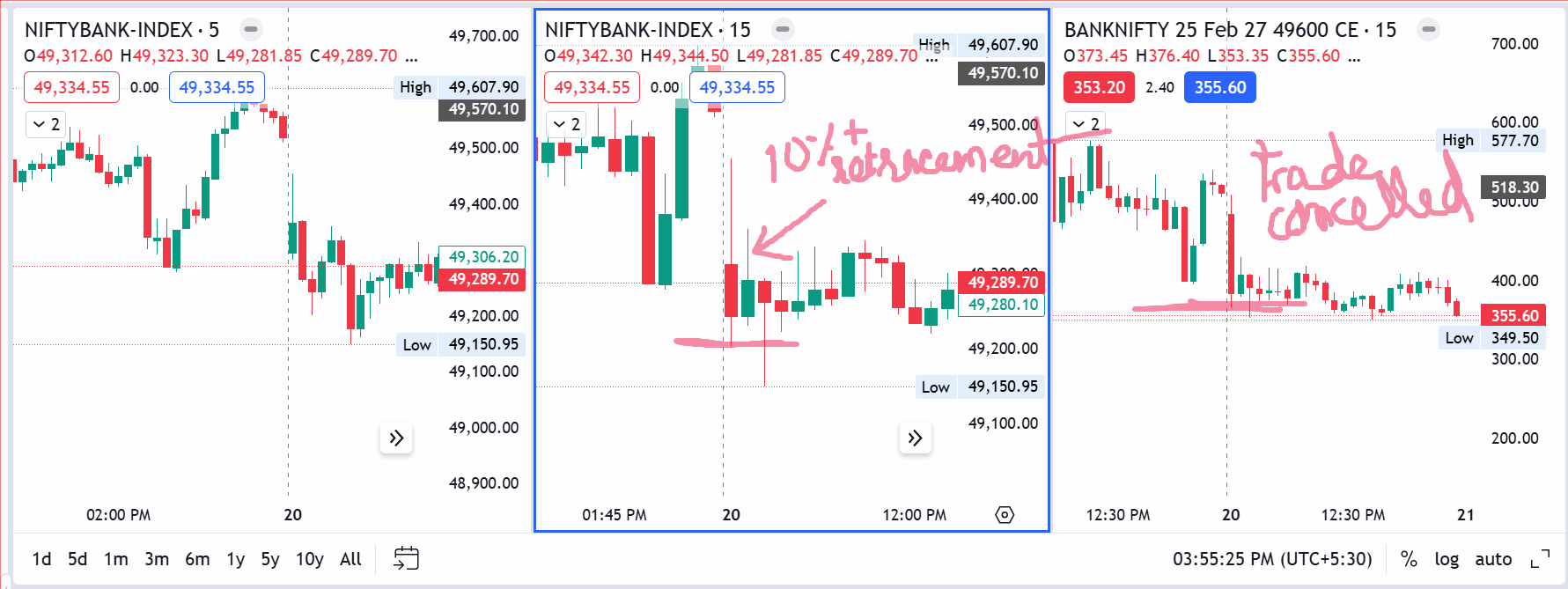

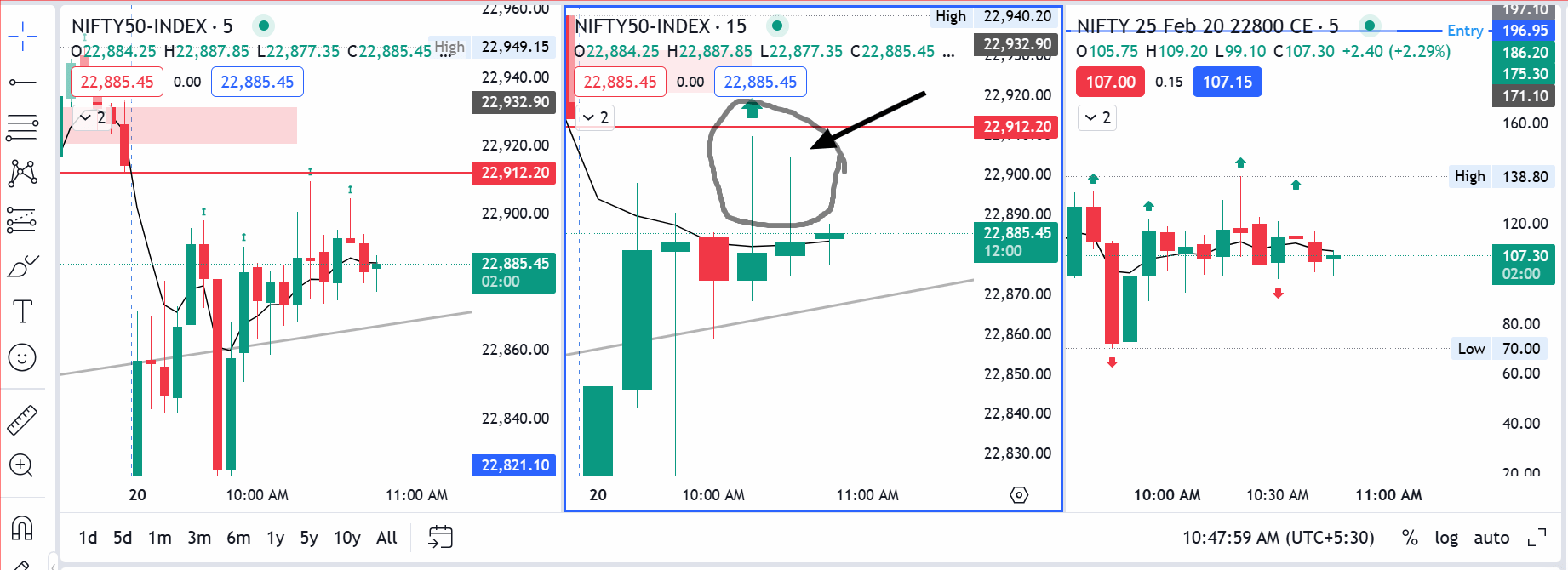

I initially spotted a 15-minute bullish setup in Banknifty, but the subsequent candle’s retracement canceled my entry conditions. Instead of forcing a trade, I stayed on the sidelines, waiting for more clarity.

Nifty’s Early Bullish Candle Fizzles

Nifty offered a quick price action setup on the 5-minute chart. I planned an entry, but system issues prevented the order from triggering. The price then swiftly dropped to the day’s low. Recognizing that 22,800 is strong support, I took a paper trade by selling 22,800 PE at ₹24.45, anticipating a sideways or slightly bullish move.

As Nifty approached the “gap candle”—a reference point from the morning’s opening candle—I considered selling 23,000 CE and 22,950 CE to further capitalize on what I believed would be a range-bound session. On the other hand, Banknifty wasn’t displaying the same bullish intent. Its price hovered under the initial candle’s high, occasionally dipping to 49,150 and bouncing back, indicating indecision rather than a strong recovery.

Option Selling Strategy and Closing Trades

By around 10:46 AM, Nifty displayed multiple inverted hammer candles on the 15-minute chart. I decided that if Nifty broke below 22,868 with a strong bearish candle, I’d sell Calls at 22,950 and 23,000. In the meantime, the index finally retested its gap-up candle from the open.

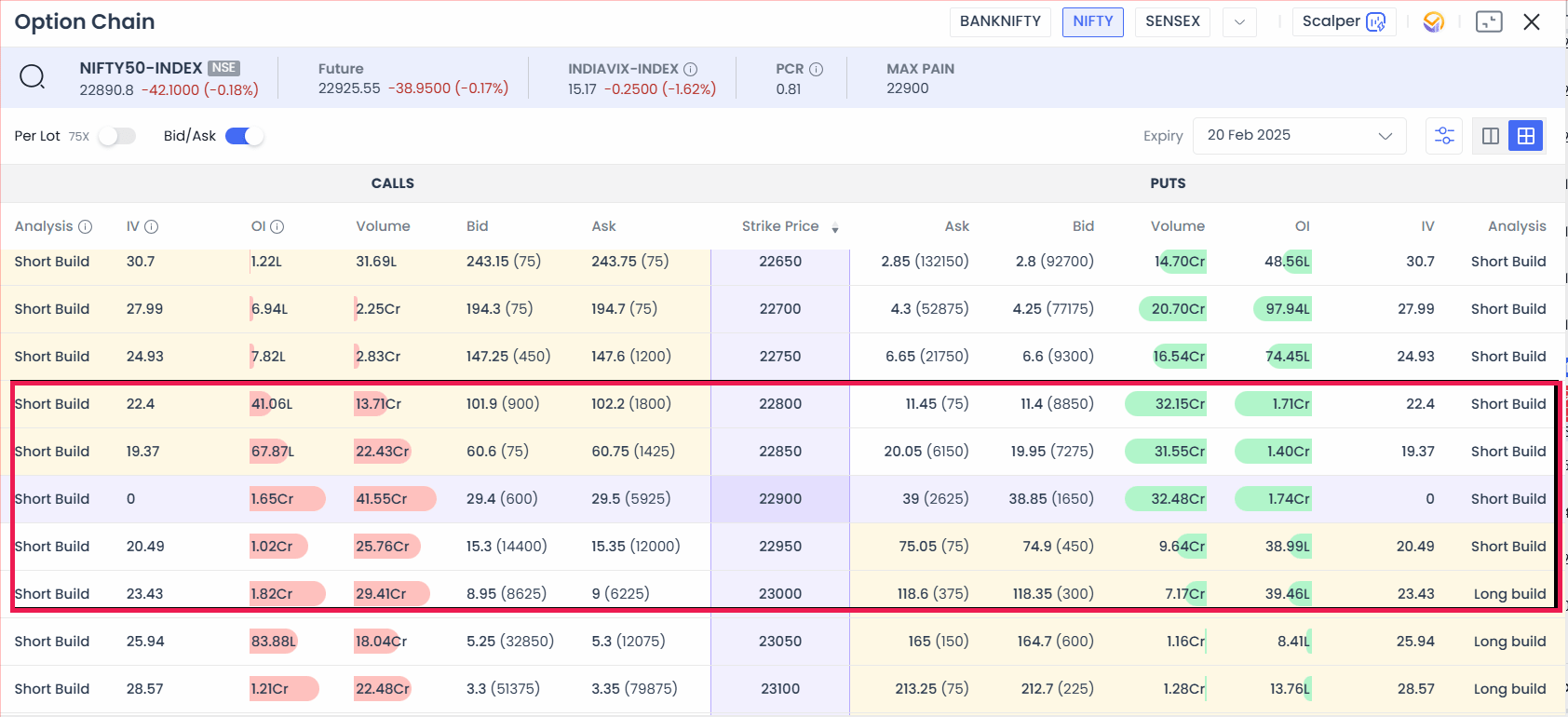

With significant OI battles among 22,800, 22,950, and 23,000 strikes, I expected a sideways drift, reminiscent of last week’s expiry.

Paper Trades in Calls

- Sell 22,950 CE at ₹17.20

- Sell 23,000 CE at ₹10.20

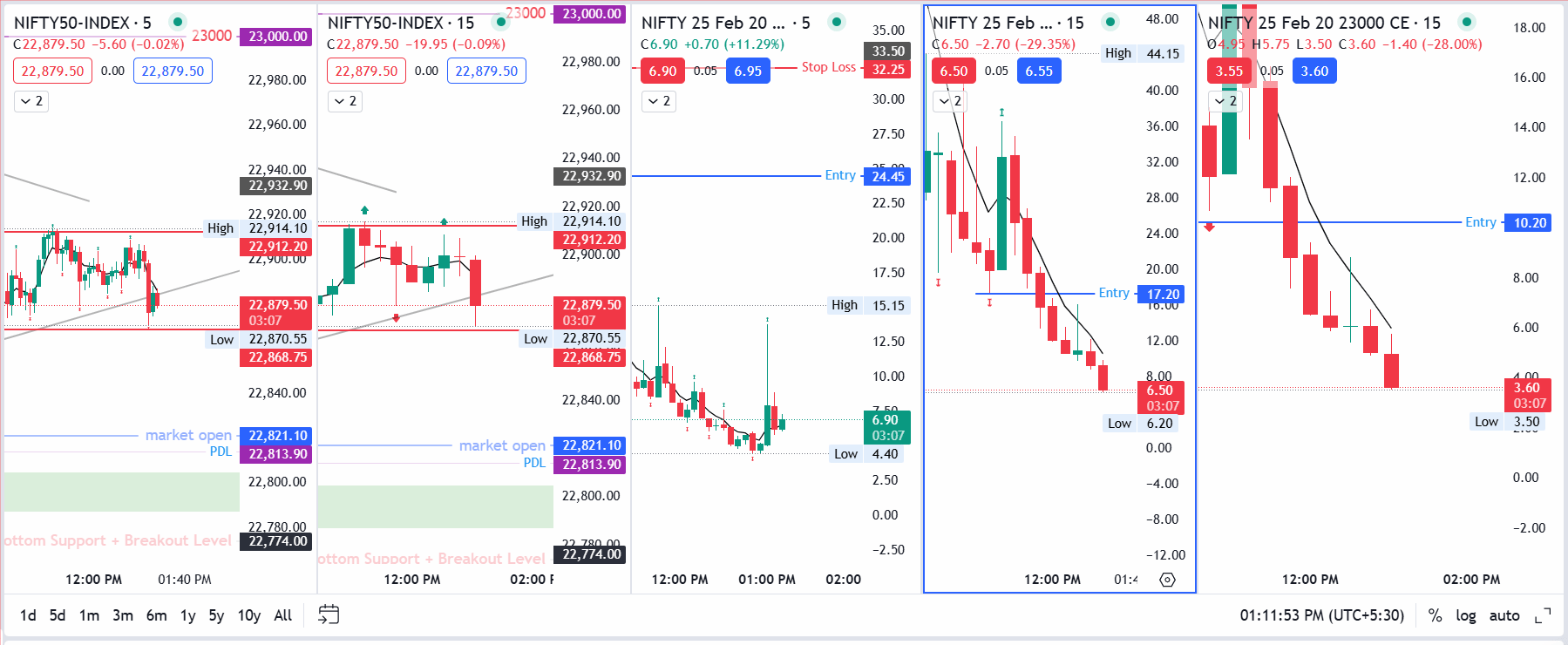

I soon closed 22,800 PE at ₹5.75, 23,000 CE at ₹5.45, and 22,950 CE at ₹9.70, effectively ending the day’s paper trades in a modest profit zone. Since it was still relatively early, I stepped away from active trading, planning to revisit the market near 2:45 PM–3:00 PM if another opportunity arose.

Overall I captured 18.7 points 22800 PE trade, 7.5 points in 22950 CE and 4.75 points only in 23000 CE trade. In total it comes out to 30.95 points. With 75 quantity the total profit comes out to Rs 2321.25 and this does not include charges. So let’s put maximum charges of Rs. 300 so today’s profit comes out to be Rs. 2021.25.

Final Hours and Market Close

I did not initiate any more trades in the afternoon. By the close:

- Nifty reversed enough to finish in green, forming a strong bullish candle.

- Banknifty ended with a doji—an inside candle on the daily timeframe—showing indecision.

- Sensex dipped 203.22 points (–0.27%) to 75,735.96

- Nifty 50 slipped 19.75 points (–0.09%) to 22,913.15

- Banknifty declined 235.55 points (–0.48%) to 49,334.55

This divergence between Nifty’s bullish close and Banknifty’s doji highlights the uneven nature of today’s session. Nifty found enough support and participation to climb off its lows, whereas Banknifty remained subdued, bogged down by selling pressure.