19th Feb 2025 Intraday Trades & Concept

Market Opens

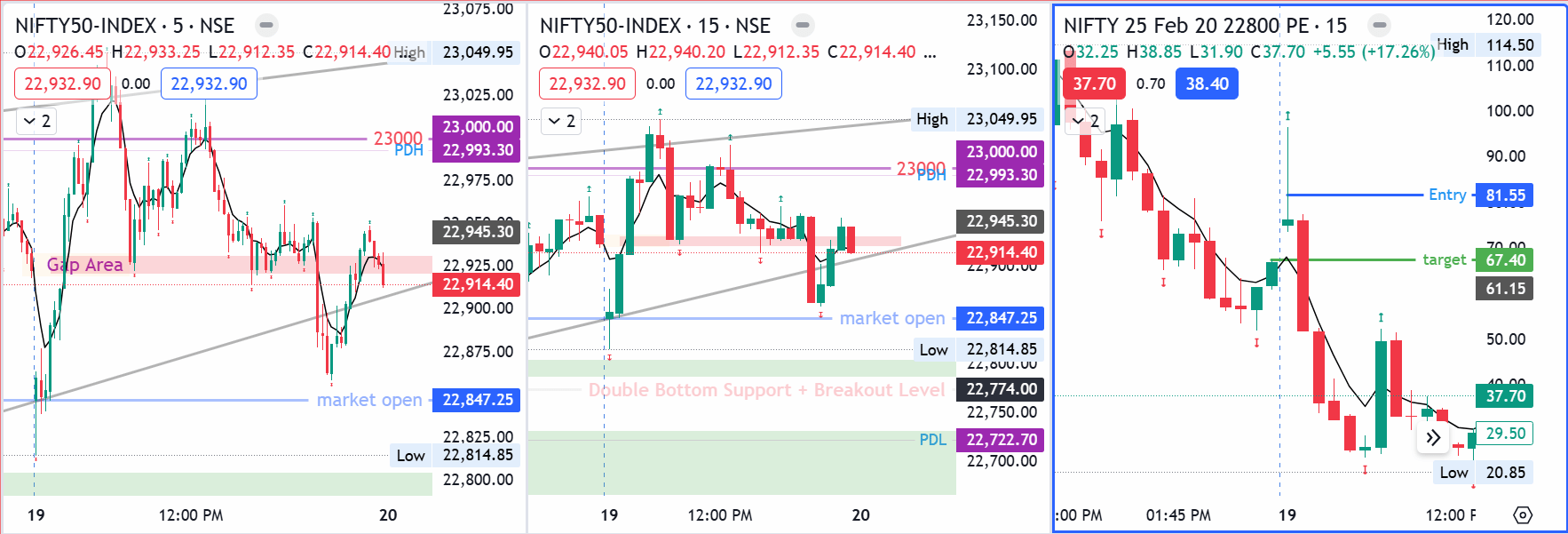

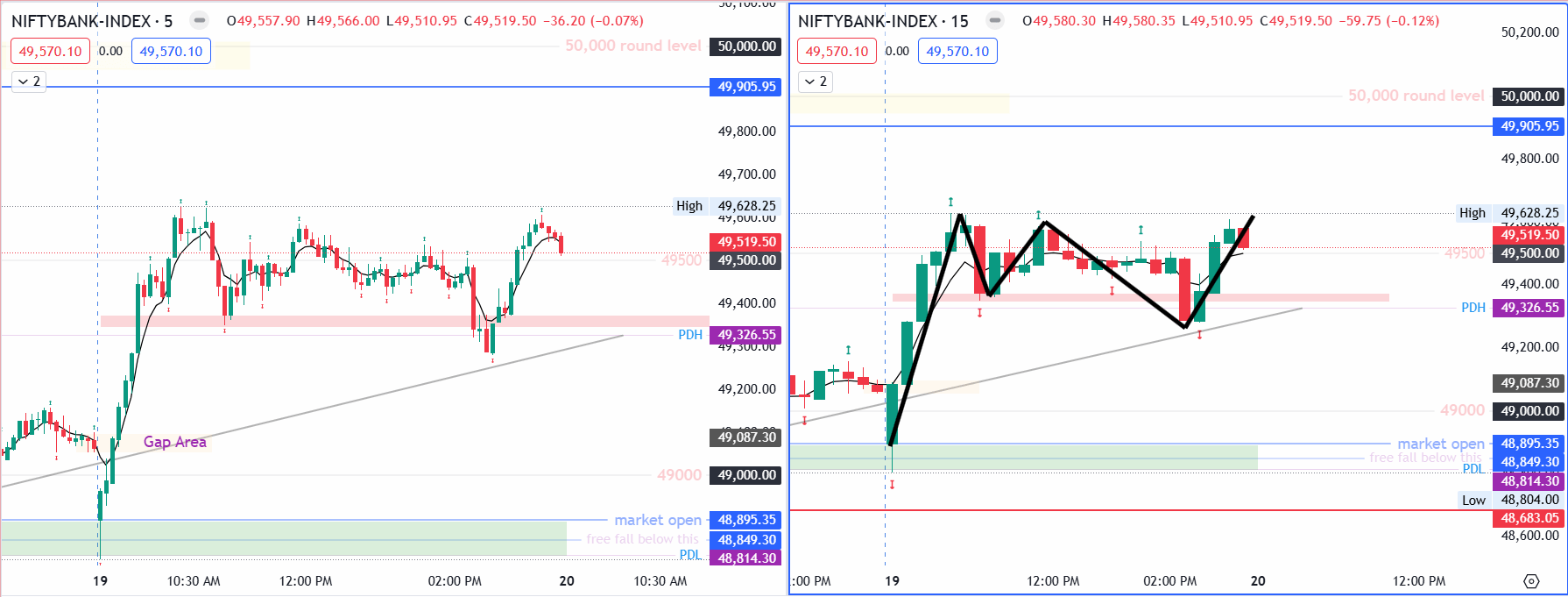

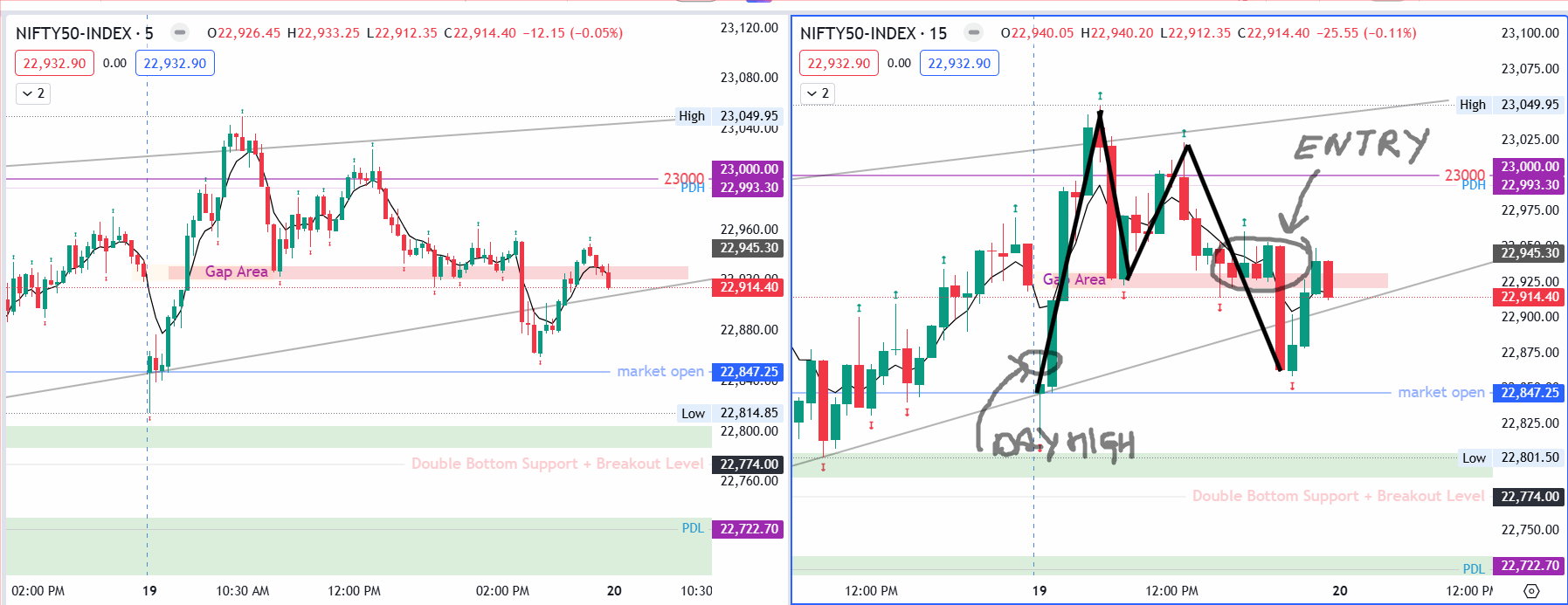

Both indices started the day under pressure: Banknifty opened at 48,895.35 with a –191.95 point gap-down, while Nifty fell –98.05 points to 22,847.25.

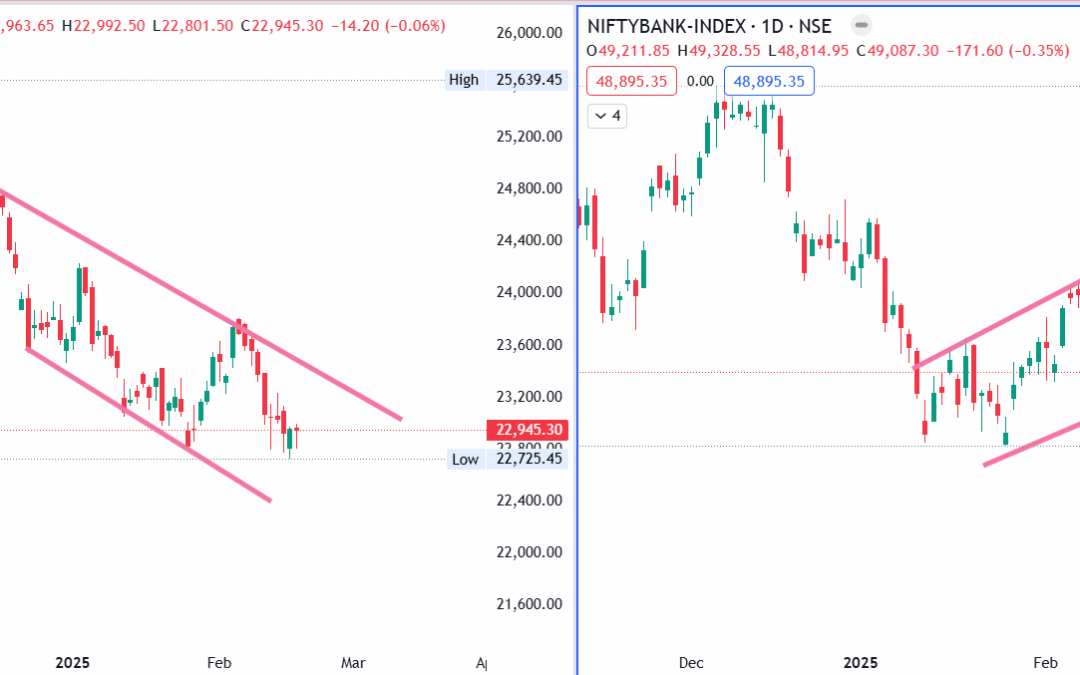

Coming off yesterday’s session, Nifty closed in the red but printed a bullish hammer on the daily chart. Banknifty formed a somewhat indecisive red candle. In Nifty there is a door open for a potential “W” pattern if buyers held key supports near 22,700–22,800. Below is how the session unfolded, including some early trades, shifting intraday momentum, and the final push toward 23,000 for Nifty.

Early Bullish Move and First Trades

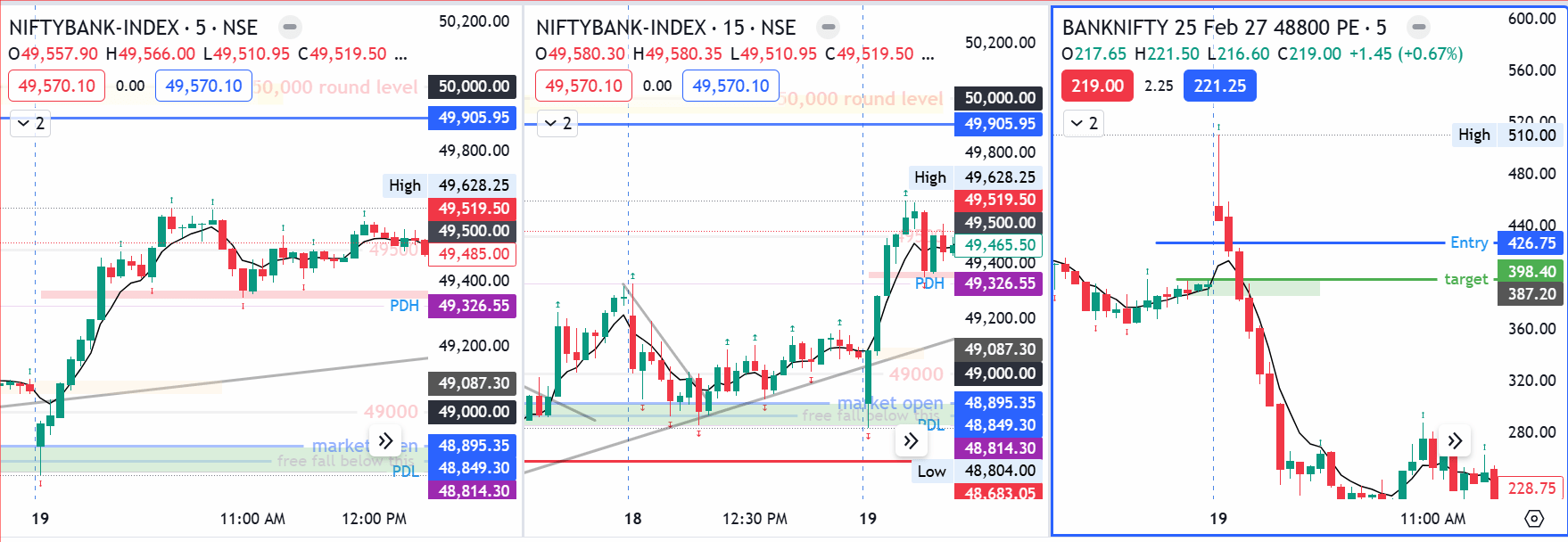

Observing a bullish move soon after the gap-down, I switched to the 1-minute timeframe (briefly departing from my usual 15-minute setup) to catch any immediate momentum. My first trade:

- Banknifty: Sold 48,800 PE at ₹426.75, targeting about ₹398.40 (a quick gap-fill move).

- The trade yielded around 25 points profit before I exited, yet the price continued surging further—eventually reaching near 49,500. A missed chance for bigger gains, but it felt prudent to secure what I had.

Shortly after, I took a trade in Nifty by selling 22,800 PE at ₹81.55. The index initially showed little follow-through, retraced, and I exited at ₹84.70 with a small loss. While Nifty’s options chart displayed some range-bound action, the spot chart lagged behind, filling its own gap later. By the time it did, Nifty had climbed to 23,000.

Intraday Observations and OI Data

By 10:30 AM, I stepped away from trading to prepare for a doctor’s appointment around 12:30 PM. Before shutting down, I glanced at Open Interest (OI) data—the tool I use to gauge market sentiment. While I tried to capture a screenshot, a technical glitch prevented it. From what I recall:

- Call volume seemed notably higher than Put volume, hinting that bullishness might persist.

- Nifty was still climbing, and the OI data reinforced the possibility of continued upside.

However, soon after, price started dropping again, illustrating how quickly intraday sentiment can flip. Banknifty also gave signs of a possible breakdown but without strong follow-through—another example of how OI data and actual price moves can diverge.

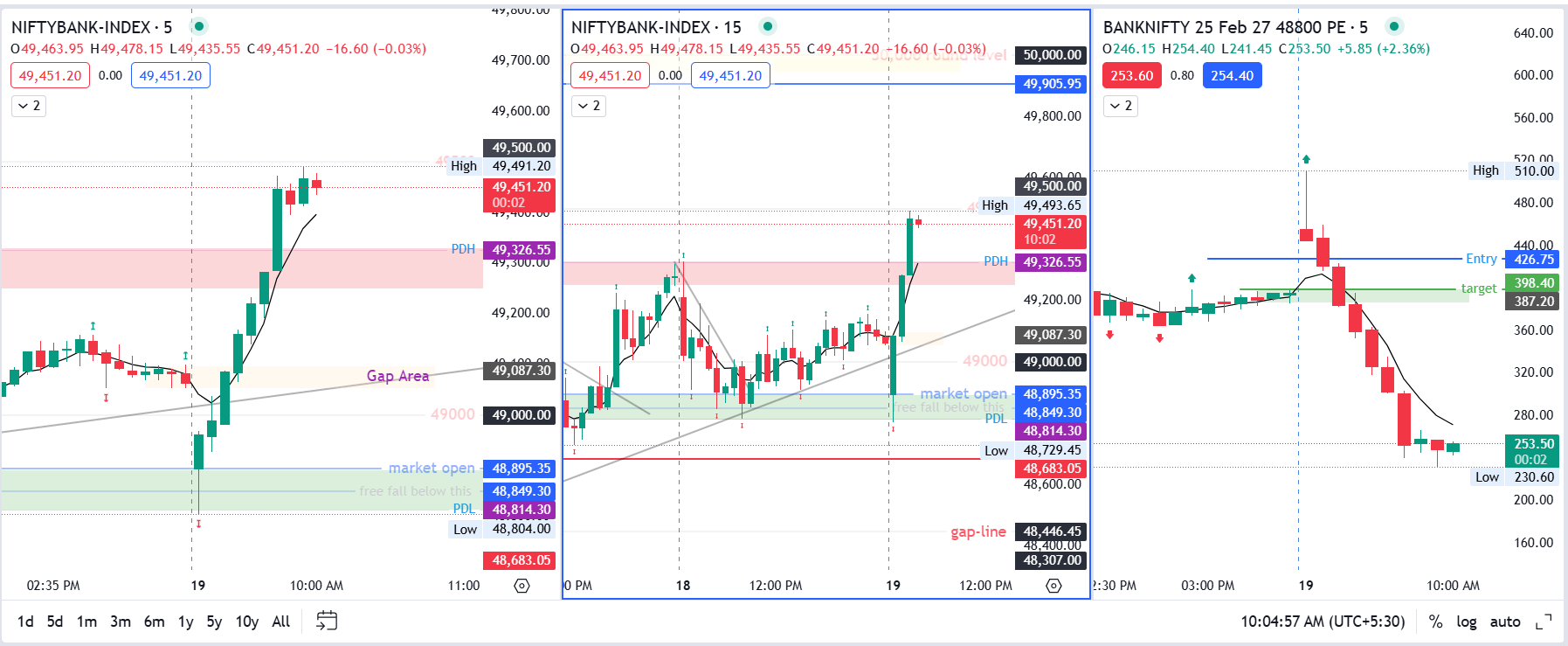

Afternoon Action: Missed Breakdown and a Bullish End

Around 12:30–12:45 PM, I rechecked the charts (15-minute timeframe). I considered shorting Calls if a strong “m pattern” formed and a breakdown confirmed. At 2:15 PM, a sudden breakdown showed up, but in just one candle, the index snapped back to the day’s high—eliminating my opportunity for a clean entry. The same applied to Banknifty: a breakdown occurred, but no follow-through candle solidified the move. By the time the 15-minute candle closed, a bullish candle had formed, pushing Banknifty above 49,500.

Eventually, Banknifty closed firm, supported by most banking stocks. Meanwhile, Nifty ended below 23,000, thanks to half its components showing weakness late in the session. This partial participation helps explain why Nifty couldn’t maintain a close above that round number.

Closing Figures

By the closing bell:

- Sensex was down by 28.21 points at 75,939.18

- Nifty 50 was down by 12 points at 22,933

- Bank Nifty rallied 483 points (0.98%) to 49,570