17th Jan 2025 Intraday Trades & Concept

Market Opens

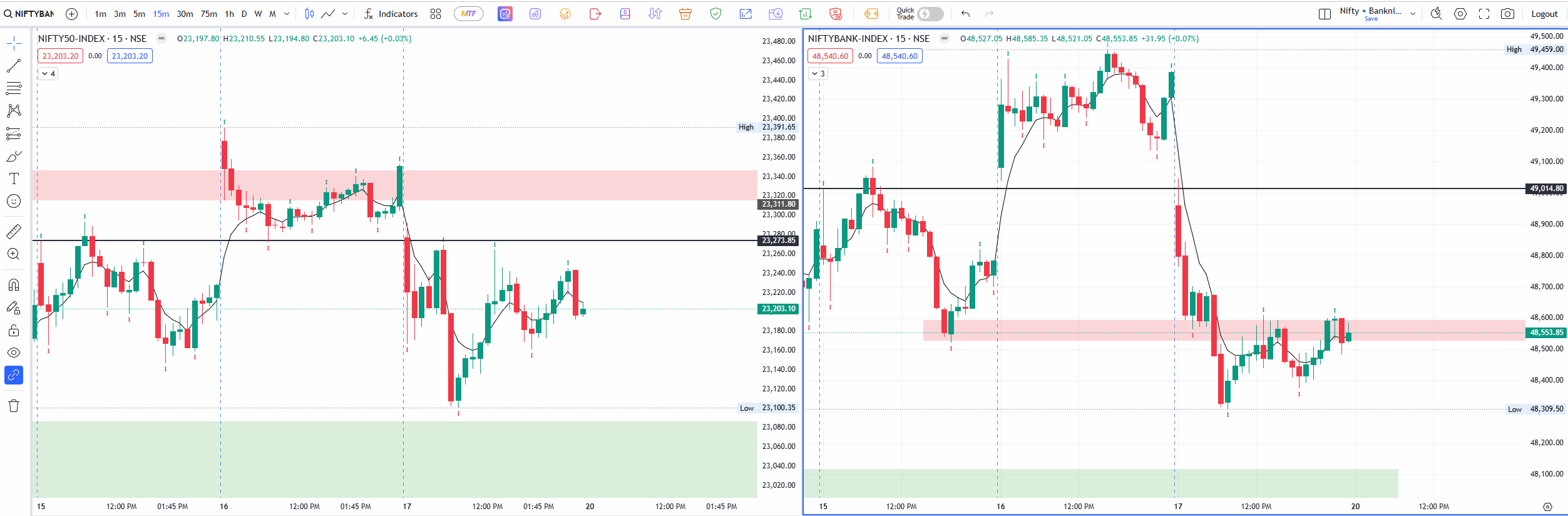

Trading days can be full of twists, especially when both indices open with a gap-down. Past three consecutive days market has opened gap-up so today it should open gap-down as per probability and it did.

Banknifty

Banknifty opened -319.20 points gap-down lower at 48959.

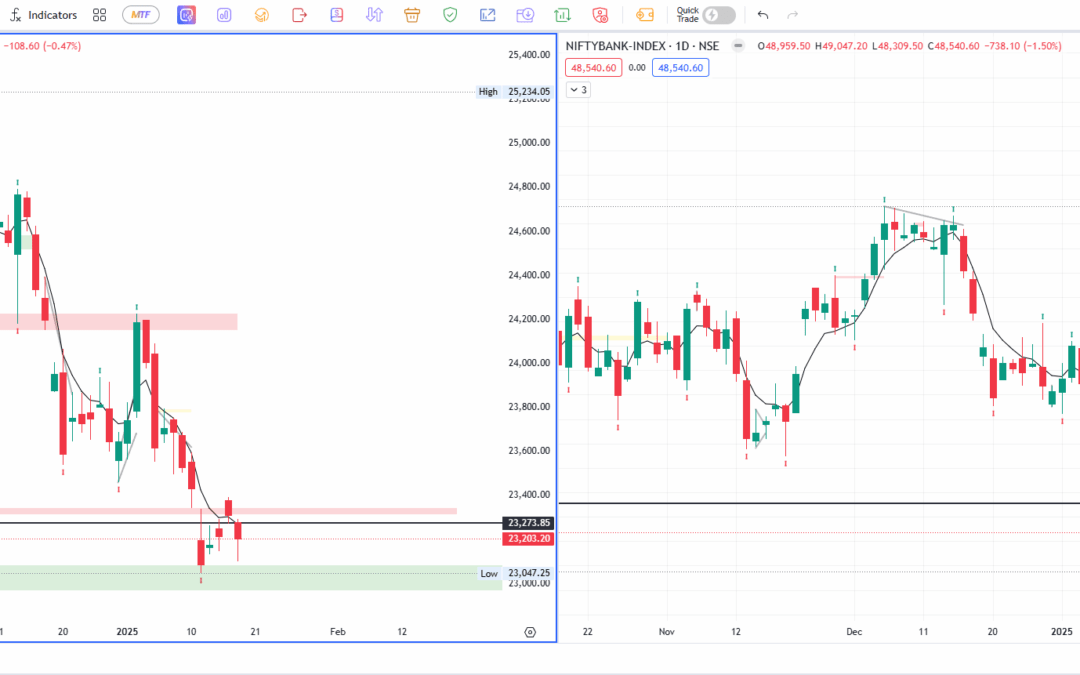

Nifty

Nifty opened -34.90 points down at 23177.10.

Below is a detailed look at how the day unfolded, the trades I took (and exited), and the lessons I noted along the way.

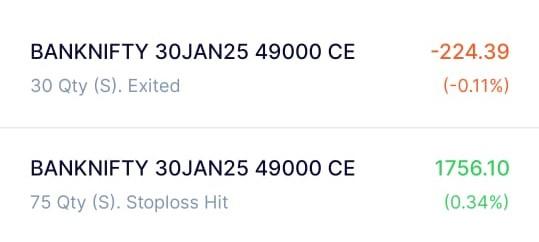

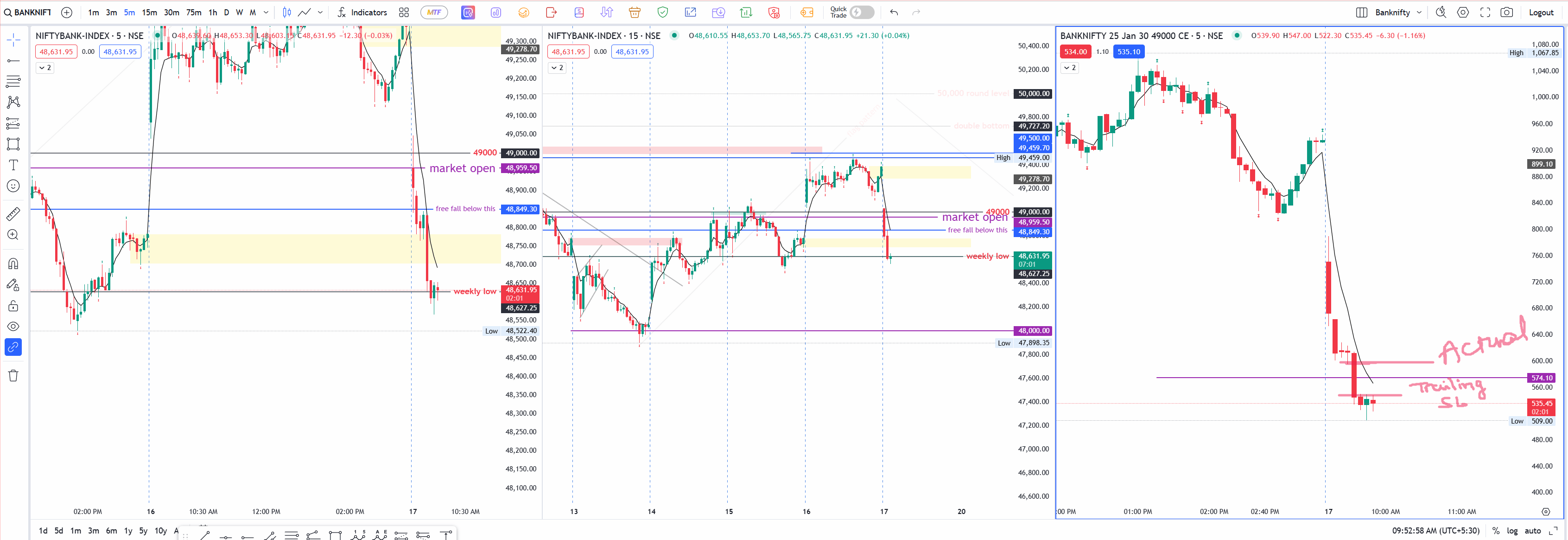

Early Gap-Down and Quick Gap Fills

Right from the open, Nifty’s very first 5-minute candle closed the gap I had marked on my chart in a yellow zone. Meanwhile, Banknifty took a bit longer to fill its gap. As the morning progressed, it showed a price action setup on both the 5-minute and 15-minute time frames. This confluence gave me the confidence to enter a CE Sell position (49,000 strike) at ₹574.10.

All 12 Banknifty stocks were in red, which added to my conviction. In the first few minutes of trading, ICICI Bank and HDFC seemed to resist the downward momentum, but they eventually turned negative as well. That broad-based weakness across banking stocks was a strong indication that Banknifty might continue lower.

Trailing Stop Loss (SL) Hit

By 9:55 AM, Banknifty had already fallen around 630 points from its opening level. My initial trailing Stop Loss at ₹549 got triggered, exiting me from the 49,000 CE Sell trade. Although I secured some profit, I found myself debating whether Banknifty could keep dropping. A typical daily move in Banknifty is 400–500 points, so with 600+ points already gone, a consolidation or small bounce wouldn’t be surprising.

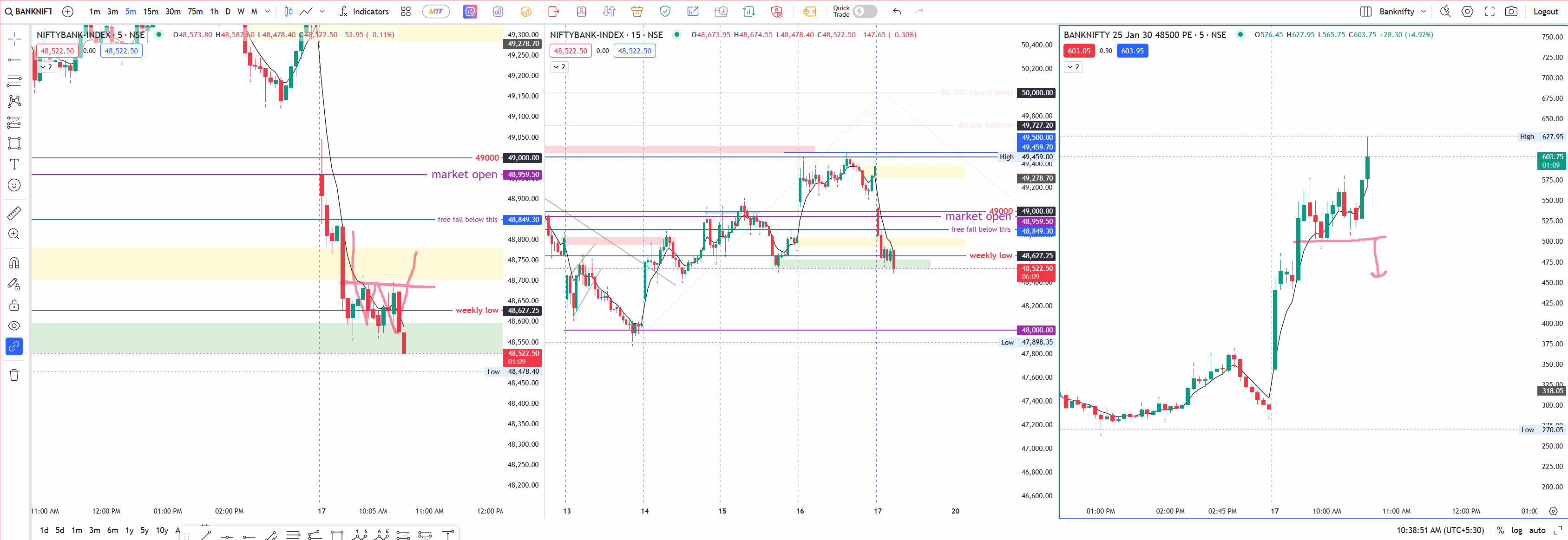

Considering Support and the “W Pattern”

Not long after, Banknifty appeared to find support, forming a potential “W pattern”—a double-bottom-like shape that sometimes signals a short-term reversal or bounce. In theory, I could have taken a small scalp trade for 25–27 points in the options chart. However, my personal rule is not to trade around 10:24 AM, especially if I’ve already booked a profit or taken a stop loss earlier. Since I had a winning position earlier (though a small one), I decided to keep my gains and avoid additional risk.

By 10:30 AM, the “W pattern” didn’t hold up; the pattern failed to produce a clear breakout. The market seemed unconvincing in forming strong upward or downward moves, making it difficult to trust any new entry. I reminded myself that if the pattern isn’t clear, there’s no reason to force a trade.

Key Insights and Cautionary Notes

I also noted a few important points for my future trades:

- Prepare Option Charts Early: Having the options chart ready beforehand helps avoid missing the right entry. A small delay can mean a missed opportunity or a rushed position.

- Spot vs. Options Chart: On a non-expiry day, if the options chart shows a breakout or breakdown just before the spot chart confirms it, there might be a quick opportunity. But I must always have a Stop Loss ready.

- Avoid Trading in a Running Candle: I briefly broke this rule again, entering a trade before the candle closed. Recognizing my mistake, I exited quickly—better to step out than to hope the market aligns with a hasty decision.

- Large First Candles: The first two 15-minute candles in Banknifty spanned about 250 points each, indicating heavy selling pressure. Such strong moves often call for a “let it confirm” approach. If the market later recovers, it’ll have to climb 500+ points, which doesn’t happen instantly. Usually, we see some form of consolidation or a clear sign before a reversal.

Discrepancies in the Options Chart

An interesting observation today was that Banknifty spot prices continued to decline, but the option chart sometimes lagged. The option premium movement seemed slower than the spot’s drop. This can happen due to shifts in implied volatility or changes in the order flow. If I don’t have the correct entry, the market will quickly move away, and trying to jump in mid-fall often results in a losing position. That’s when you see the market bounce the moment you enter, only to continue falling once you’ve given up on the trade.

Ending the Day on a Cautious Note

By the time I stepped away, it was clear that forcing more trades could easily reverse any profits I already had. Banknifty’s ongoing fall might have tempted me to re-enter, but the morning’s sharp drop hinted at a possible slowdown or bounce at any moment. Without a clean setup, I saw no reason to gamble on a trade that wasn’t well-aligned with my rules.

I closed my trading around mid-morning, watching as Banknifty continued to fluctuate. Reflecting on the day, I concluded that the right entry at the right time is crucial. Especially on days when the index has already moved 600–700 points, jumping in late can be risky. If you don’t capture the move early, the market will often turn around just as you enter, leaving you with regrets and losses.

The Day’s Finale

By the end of the session, Nifty closed at +60 points approx but closed in a red candle, thanks to the gap-up.

Banknifty on the other hand rallied approx +448.25 points closing in green candle today.

Today showed me once again that patience pays off. The early gap-down led to swift moves in Banknifty and Nifty, but those moves can be deceptive if you’re not prepared. A correct read on the spot chart, options chart, and market breadth (all 12 Banknifty stocks in red) gave me an initial edge, but it’s all too easy to give those gains back by overtrading later.

For any trader—new or experienced—the key lies in planning trades carefully and sticking to stop losses. Observing the pace of the market, acknowledging typical daily ranges, and knowing when a reversal might be on the horizon are all part of refining one’s craft. With that in mind, I wrapped up my session confidently, albeit early, knowing that preserving capital and profits sometimes matters more than squeezing out an extra point or two in uncertain conditions.