14th Feb 2025 Intraday Trades & Concept

Market Opens

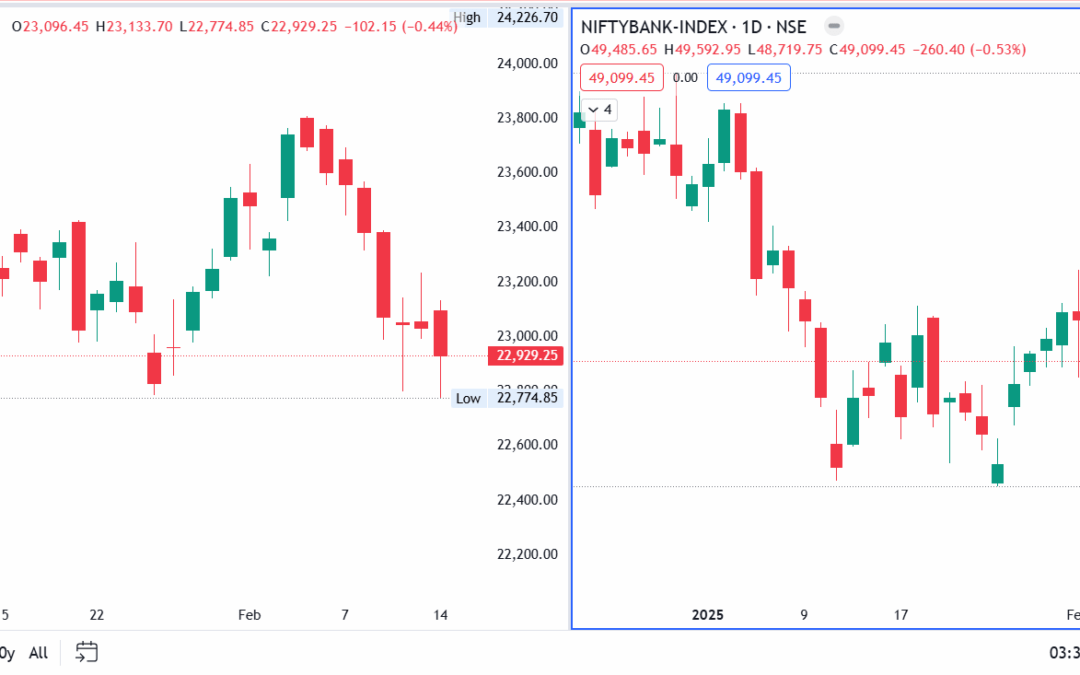

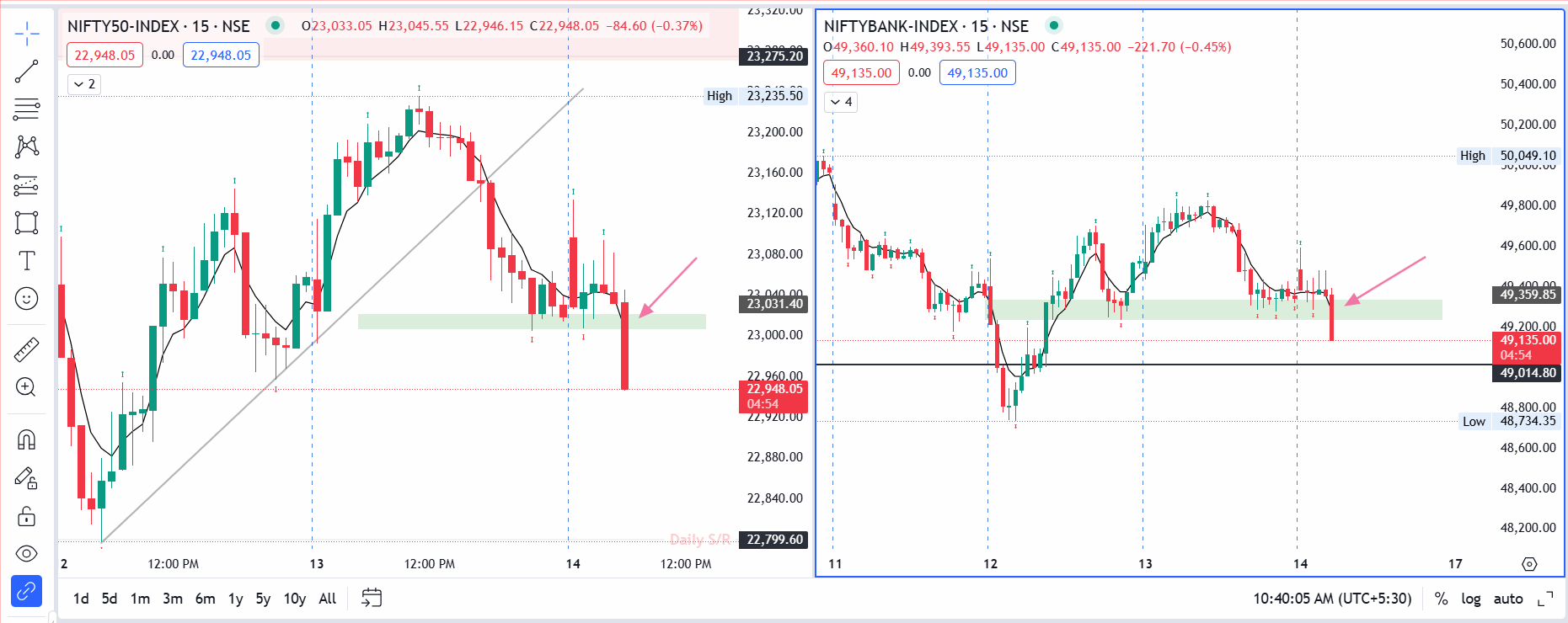

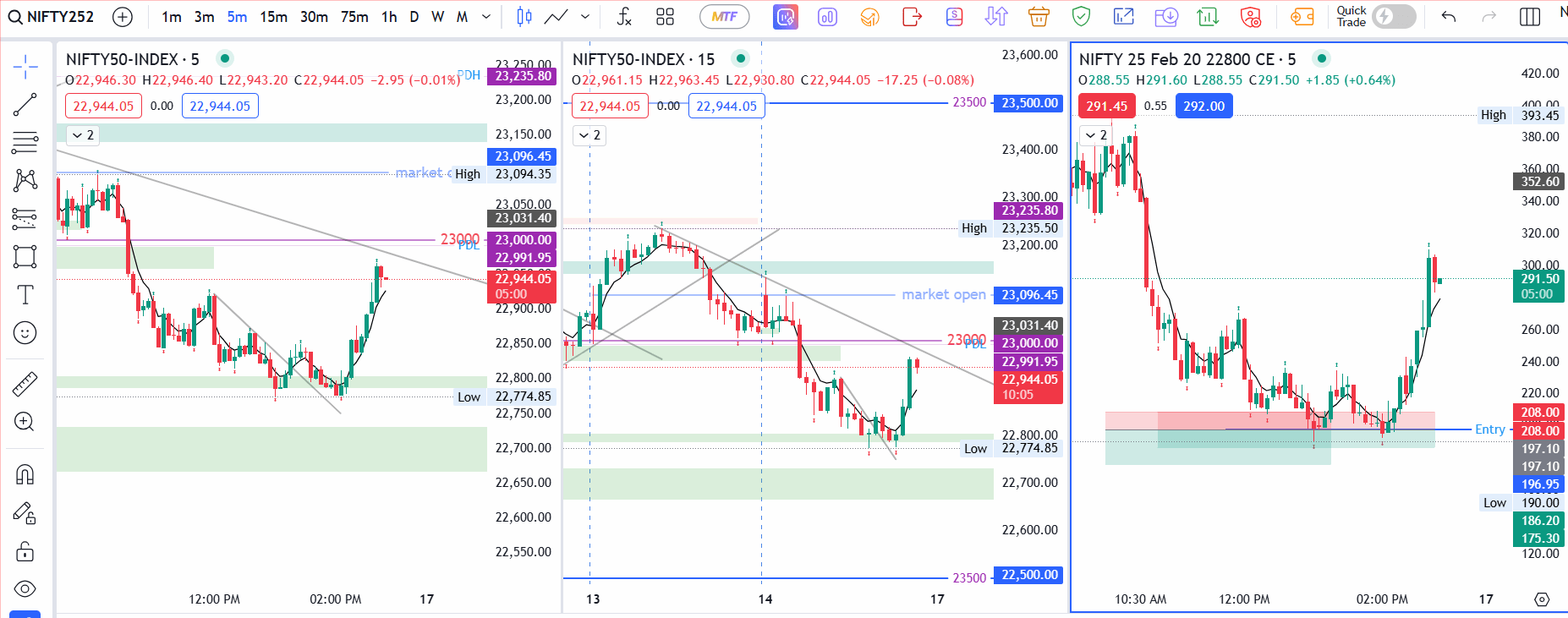

The market opened on a positive note today, with Nifty gapping up by +65.05 points at 23,096.45 and Banknifty also climbing +125.80 points to 49,485.65.

Despite these encouraging signs, the session soon revealed another story—one of uncertain price action, unexpected breakdowns, and the temptation to jump into trades at times I’ve historically tried to avoid.

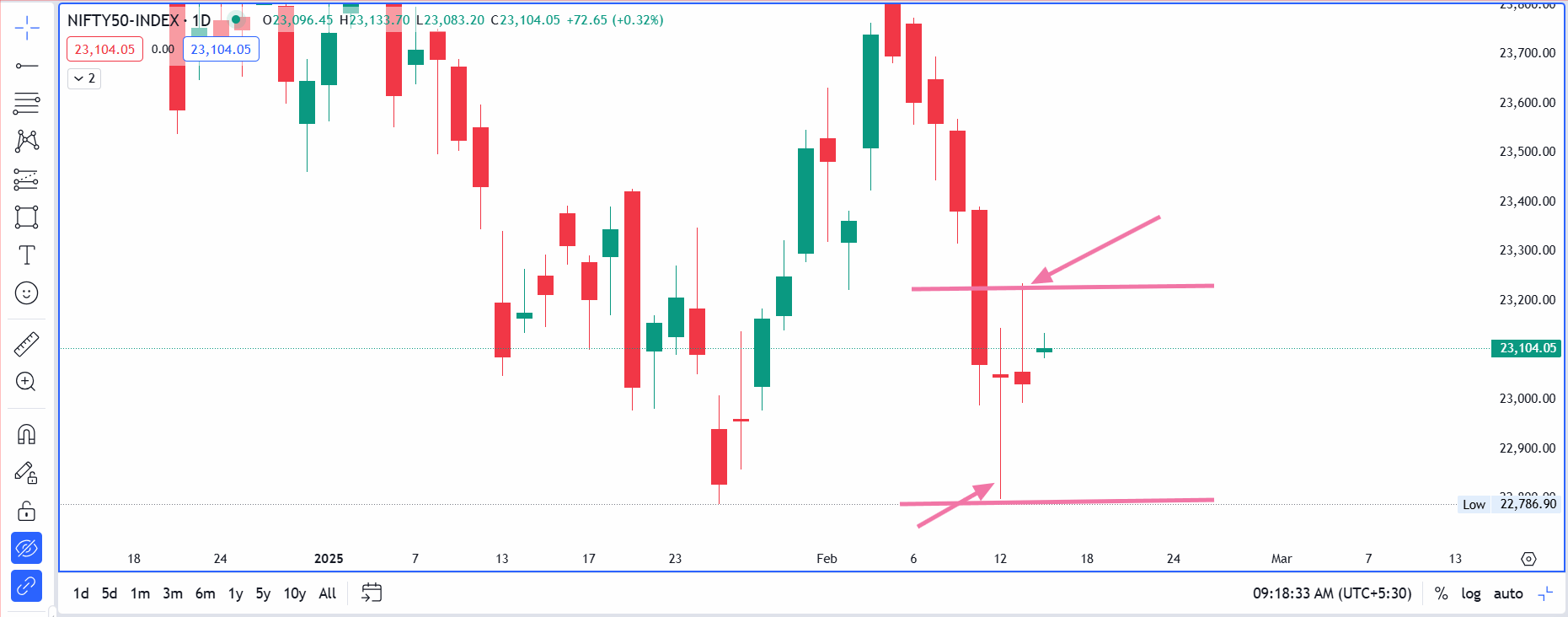

Early Observations: Candles with Long Wicks

Before diving into any trade, I noted that Nifty’s last two daily candles featured long wicks on both sides. This often signals indecision or repeated attempts by buyers or sellers to push the market, only to fail at a certain level. My initial plan was to set up a strangle—possibly selling 23,250 CE and 22,750 PE—and then wait for a decisive breakout or breakdown.

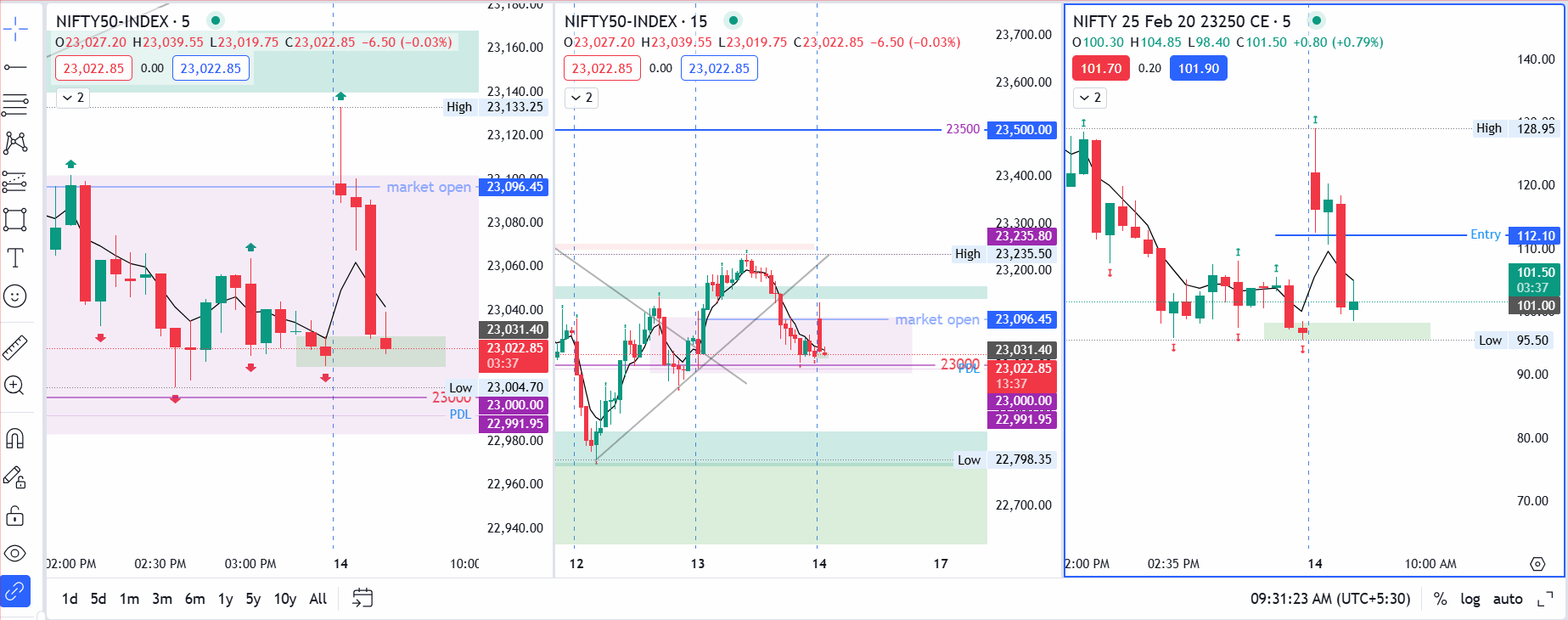

Shortly after the open, Nifty broke its day’s low, prompting me to sell 23,250 CE at ₹112.10. My target was modest: a quick scalp until the spot chart filled its opening gap. Once it got close to that gap zone, I exited at ₹109.50, netting a small profit.

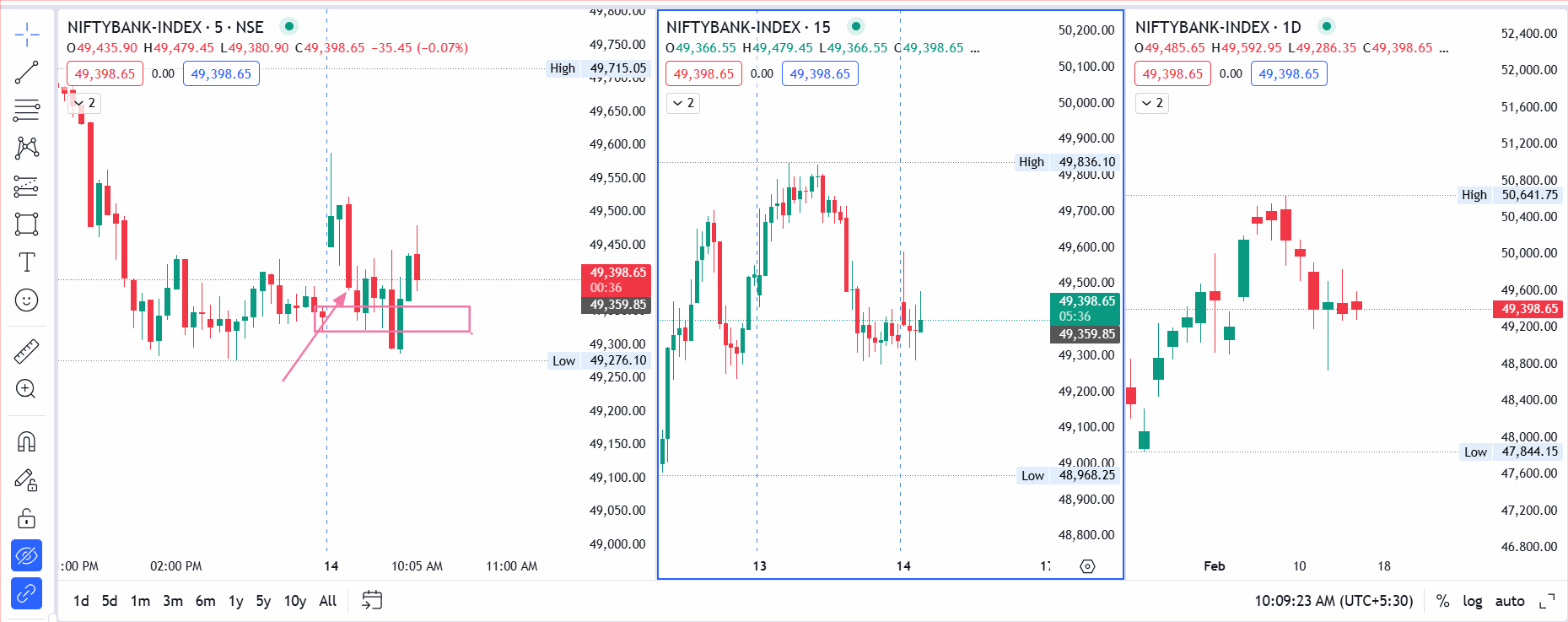

Meanwhile, Banknifty mirrored Nifty’s downward move, but I chose not to enter a corresponding trade there.

Discrepancies Between Spot and Options Charts

This morning showcased another recurring theme: the options chart gave certain signals more quickly than the spot chart, particularly when it came to day-low breaks. While options traders might find these discrepancies beneficial for early entries, the spot chart remains my preferred anchor for confirming actual price levels. Sensing mixed signals can lead to confusion and potential stop-outs if the two charts diverge too much.

By around 10:30 AM, both indices broke down simultaneously—a far cry from previous sessions, where Nifty and Banknifty often moved out of sync. Despite the more convincing alignment, I stuck to my rule of not trading around 10:30 AM, especially since I had already captured a small profit from my earlier scalp.

A Sustained Decline and Round Numbers

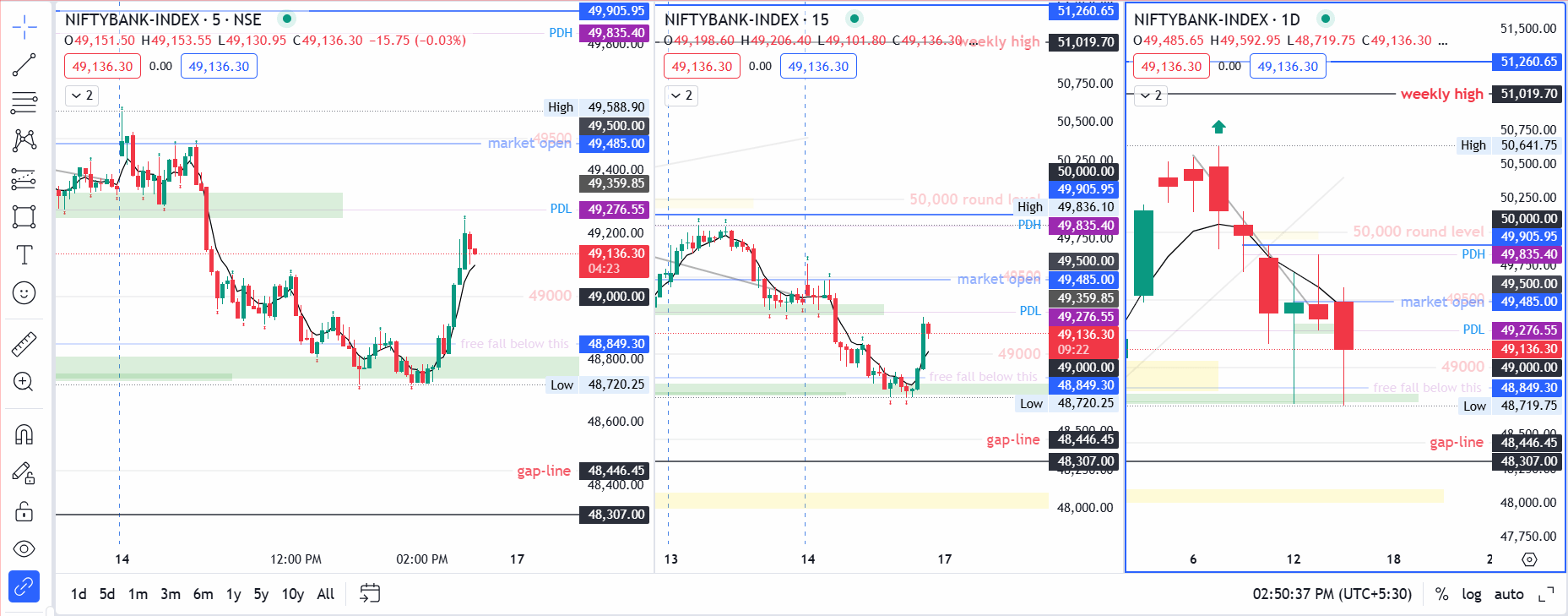

The market continued to slip lower as the day progressed. Banknifty soon tested the 49,000 round level—a number it’s flirted with multiple times in recent sessions. This time, it barely held, consolidating around the figure, then breaking down near 12:00 PM. Over in Nifty, the price briefly paused between 22,816 and 22,919, making 22,800 a critical level to watch.

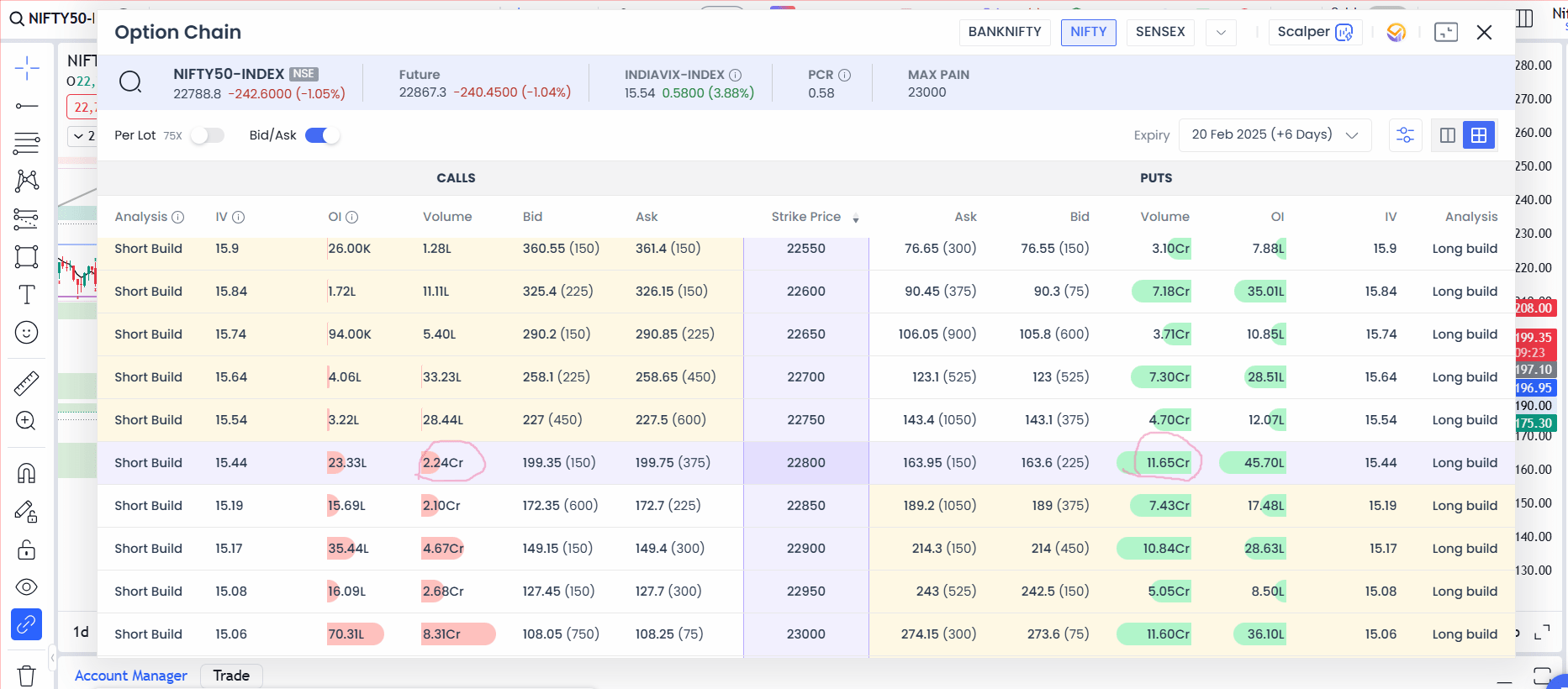

Open Interest Data at 22,800

OI (Open Interest) data can offer insights into market participant expectations:

- Put Volume: 11.65 crore at 22,800

- Call Volume: 2.24 crore at 22,800

- Put OI: 45.7 lakh (indicating potential support)

- Call OI: 23.33 lakh (suggesting limited overhead supply)

This data hinted that buyers might defend 22,800 strongly, creating a floor. Sometimes, a significant discrepancy in put vs. call OI at a specific level indicates a pivot zone where price might bounce or stall.

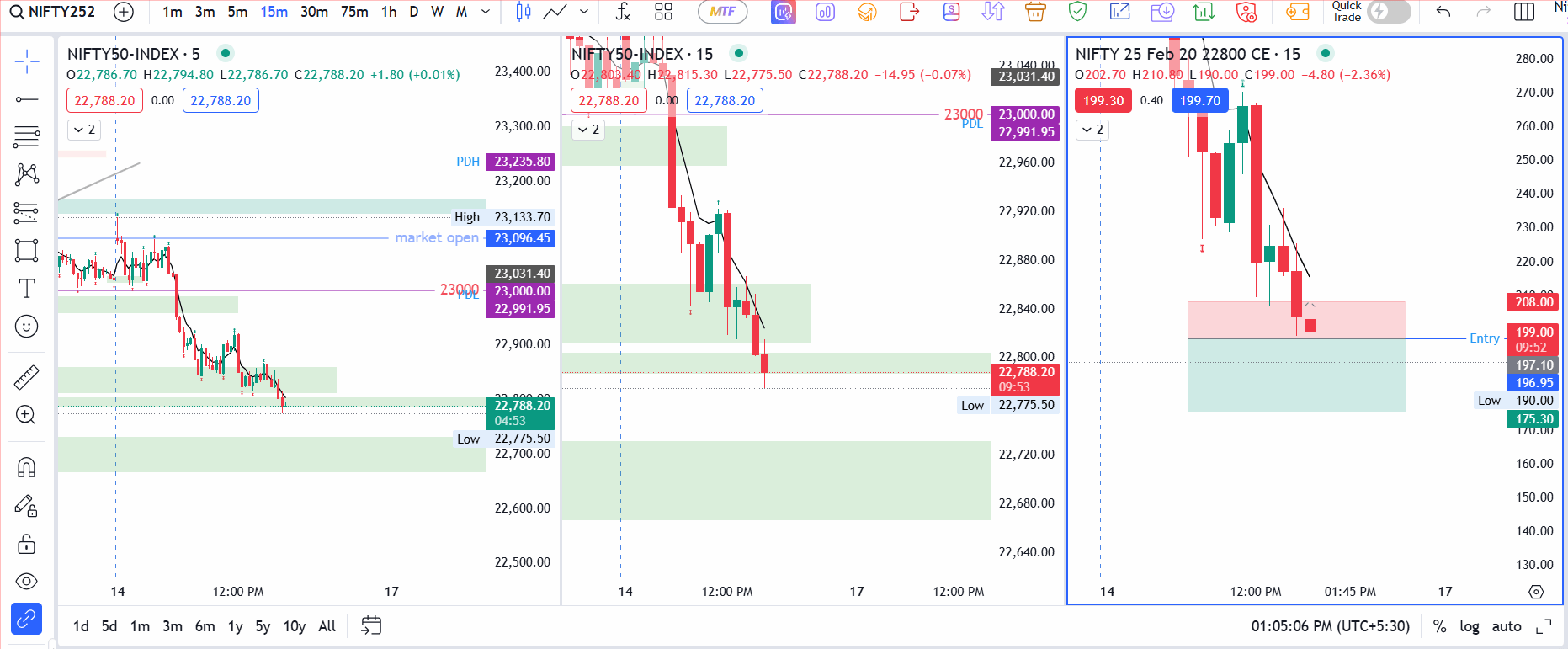

A 15-Minute Setup Gone Wrong

Despite the bullish OI data around 22,800, my actual trade didn’t pan out as hoped. I took an opposite trade following a 15-minute setup. I sold strike price 22,800 CE at ₹196.95 and placied a SL at ₹208. Minutes later, the Stop Loss was hit.

Briefly, I considered reversing my position after the SL triggered—but I decided to step back and stick to my plan. A tilt in my emotional balance or fear of missing out could have led to another rushed trade.

The Late-Day Reversal

By 2:47 PM, a sudden reversal materialized. The earlier OI analysis came into play: it seemed that buyers finally stepped in around 22,800, propelling prices upward. Watching the market bounce after I had closed my position was bittersweet—had I held on or waited for a secondary signal, I might have captured a portion of that surge.

Still, the day offered several reminders:

- Use the Spot Chart for Confirmation: Even when the options chart moves first, I find that waiting for the spot chart to validate those levels reduces my risk of premature entries.

- Avoid Forced Trades at 10:30 AM: This remains a valuable rule—mid-morning can bring whipsaws and false signals.

- Open Interest Is Powerful: It is worth checking the OI data at key levels. This can help in taking decision in a better way.

Closing Figures

By the closing bell:

- The Sensex dropped 199.76 points to 75,939.21

- The Nifty slipped 102.15 points to 22,929.25

- Banknifty fell 260.40 points to 49,099.45