22nd Jan 2025 Intraday Trades & Concept

Market Opens

Market openings can sometimes set the tone for the entire trading session.

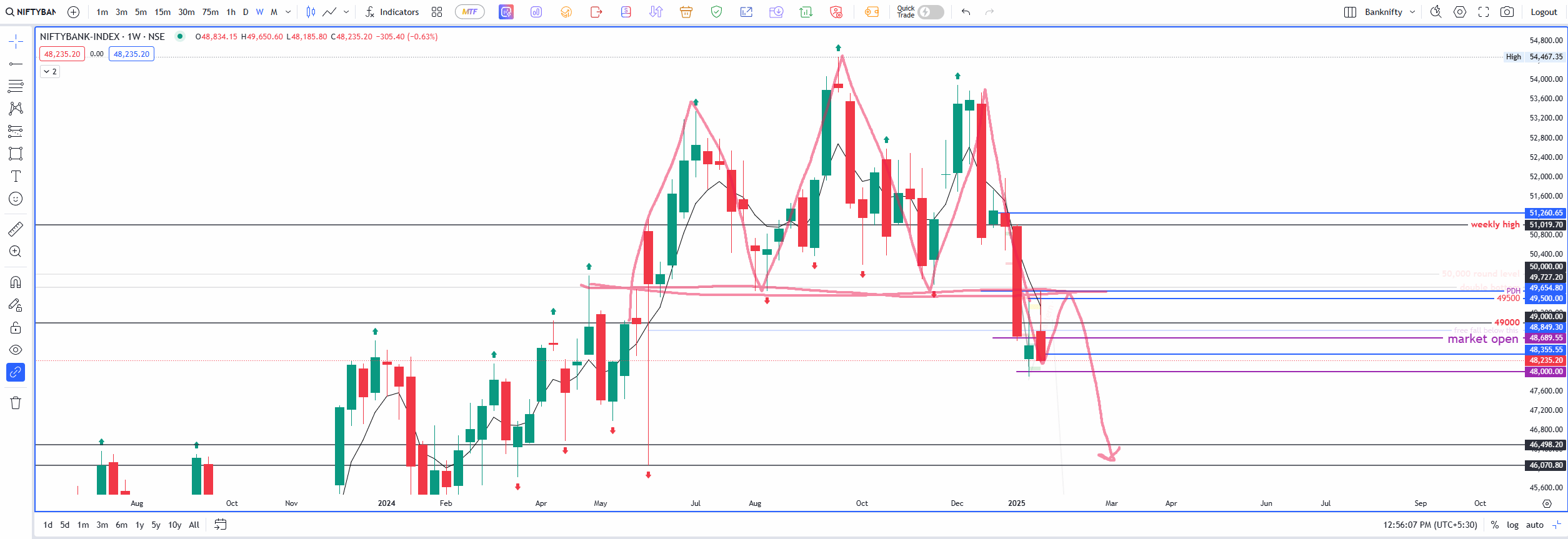

Banknifty

Banknifty opened with a +118.65 points gap-up.

Nifty

Nifty opened with a +74.50 points gap-up.

At first glance, these gap-ups suggested a bullish undercurrent—but my confidence in the market moving down any further was already low.

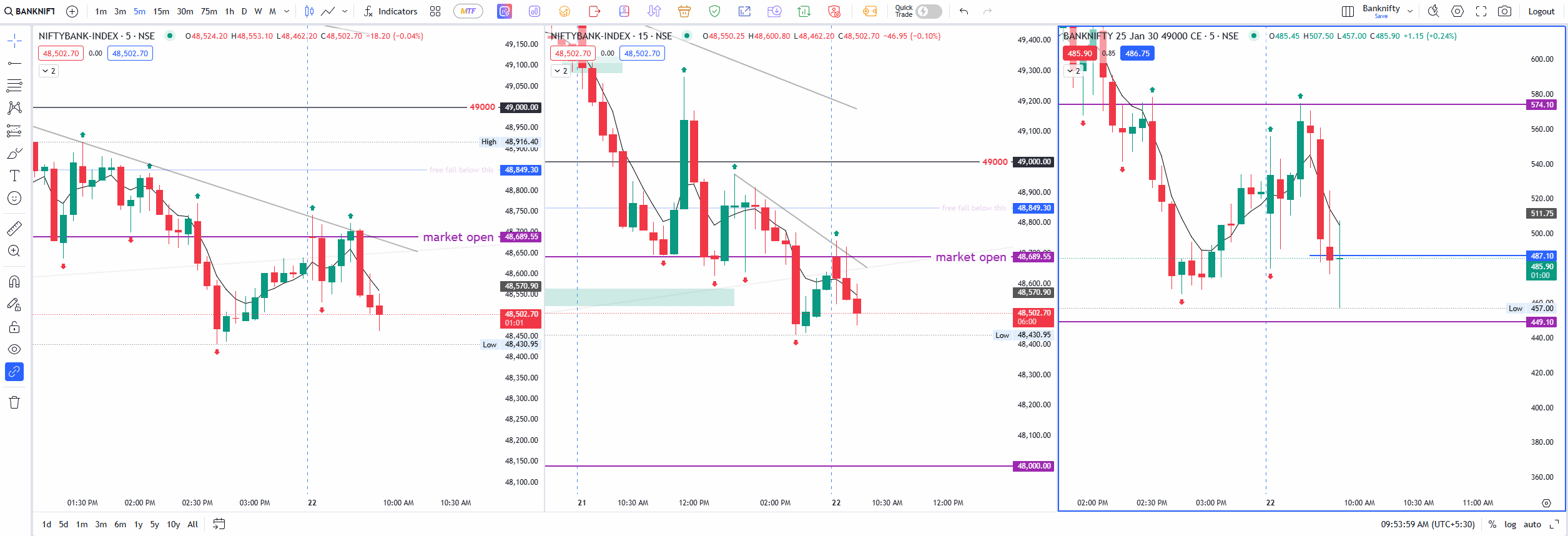

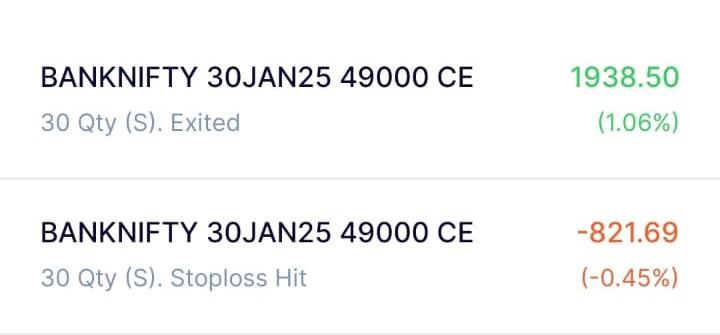

I started my day by watching both indices closely. My usual approach involves scanning for trades based on a 5min or 15-minute price action setup, and I found a potential opportunity in Banknifty. Specifically, I decided to sell 49,000 CE at ₹487.10 (30 quantities).

The selling happening in Banknifty is not supported by high weightage stocks like HDFC Bank and ICICI Bank actually. Due this I am not confident that this selling will be fast unless these two stock turn bearish.

Early Hurdles and Slow Option Movement

Initially, the trade felt promising. However, I noticed an odd discrepancy: the option premium wasn’t moving down in tandem with the spot price. Even though Banknifty spot began drifting downward, the options chart seemed stuck, barely budging. This mismatch can happen when implied volatility doesn’t align with price action, or when the market remains uncertain about the next move.

Shortly thereafter, my Stop Loss (SL) was hit at ₹512, cutting the trade short. It wasn’t the best start, but I’ve learned over time that letting a small loss run too long usually leads to bigger losses.

Both Nifty and Banknifty had filled their morning gaps fairly early, which can sometimes open the door to fresh trends. Unfortunately, neither index looked convincing in either direction. Instead, they lingered in a range bound by the first 15-minute candle. One key lesson emerged yet again: when the market opens near or just above the previous day’s low, it’s often best to wait for a clear breakdown of that low before committing to a short position.

Considering a Possible Range Day

Given the volatility from the day before, I toyed with the idea of a “strangle” or “iron condor” approach—something like selling 49,100 CE and 48,400 PE, then waiting to see if the price would break out or break down. However, I hesitated because the market still looked like it was searching for direction. The indices had shown a lot of up and down movement, and I suspected today might turn into a “range day.”

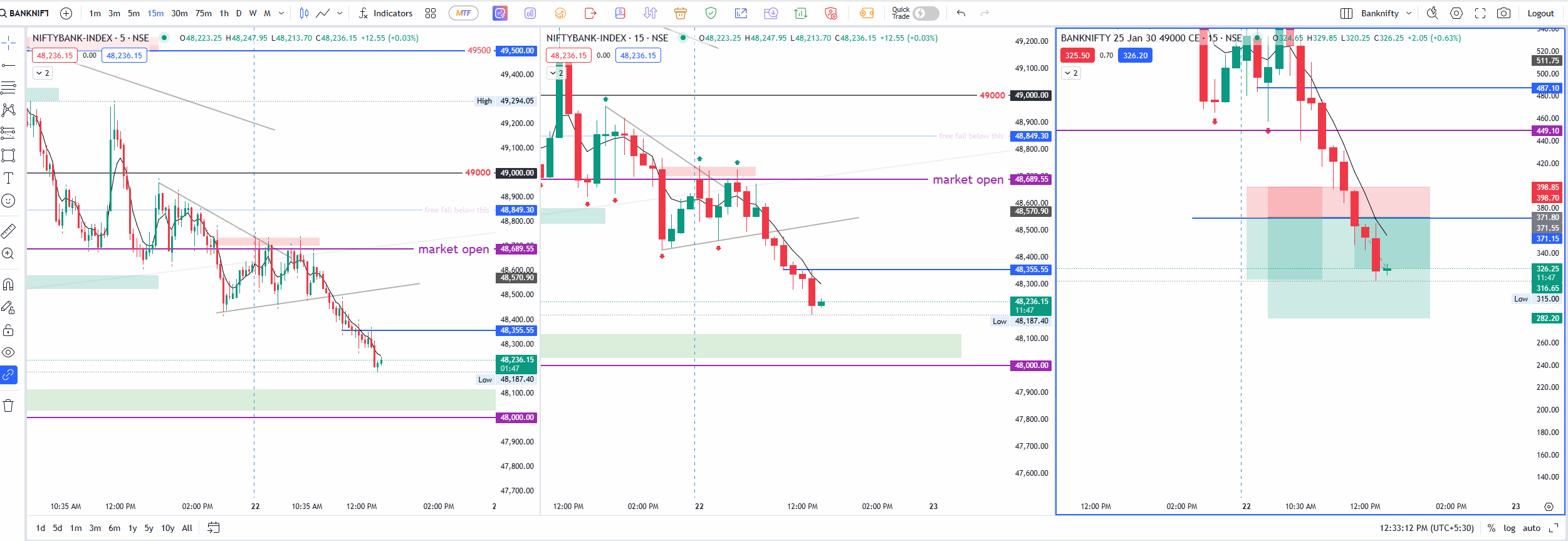

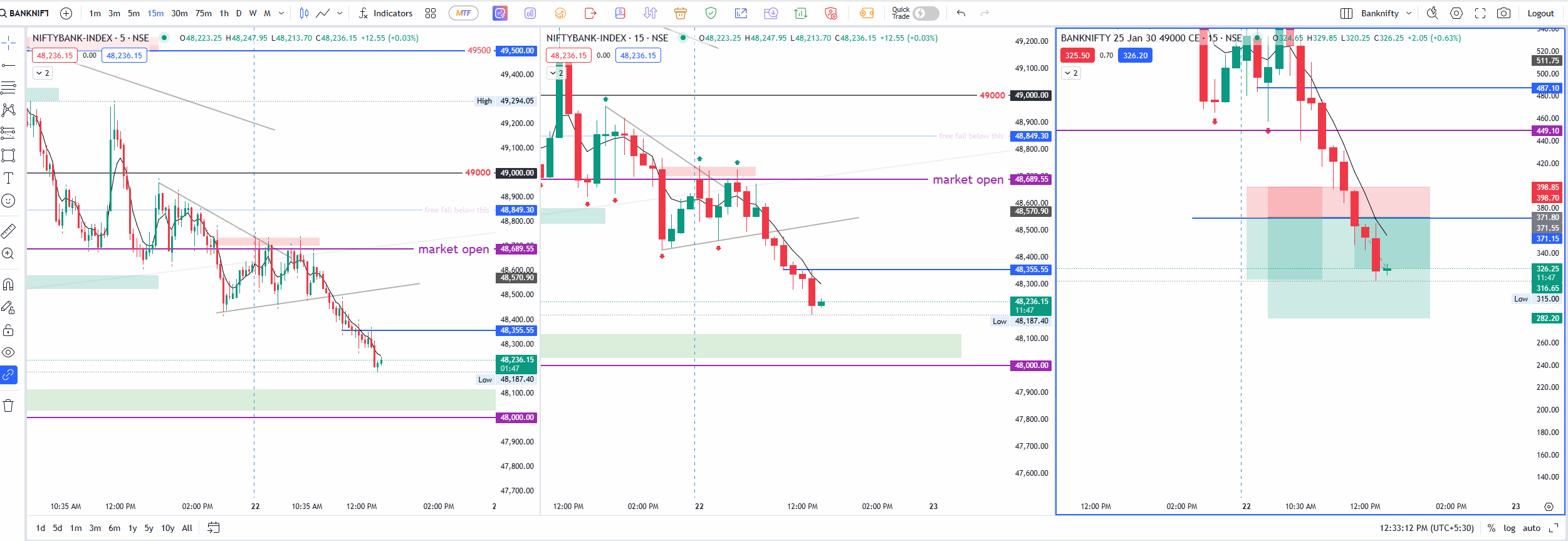

My suspicions started to materialize: Nifty clung to the 23,000 mark, while Banknifty eventually broke below its day low—and even yesterday’s low. That’s usually a solid sign of bearish intent. Around 11:00 AM, Banknifty gave a breakdown, but I tend to be cautious about trades that set up between 10:30 AM and 11:00 AM. I typically find that timeframe less predictable.

A Second Attempt in Banknifty

Despite my reservations, around 11:55 AM, I saw another chance to sell 49,000 CE, this time at ₹371.15, aiming for a 1:3 risk-to-reward ratio (roughly a target of ₹289). The 1:2 target was already within reach, but I decided to hold on, hoping to achieve that bigger reward.

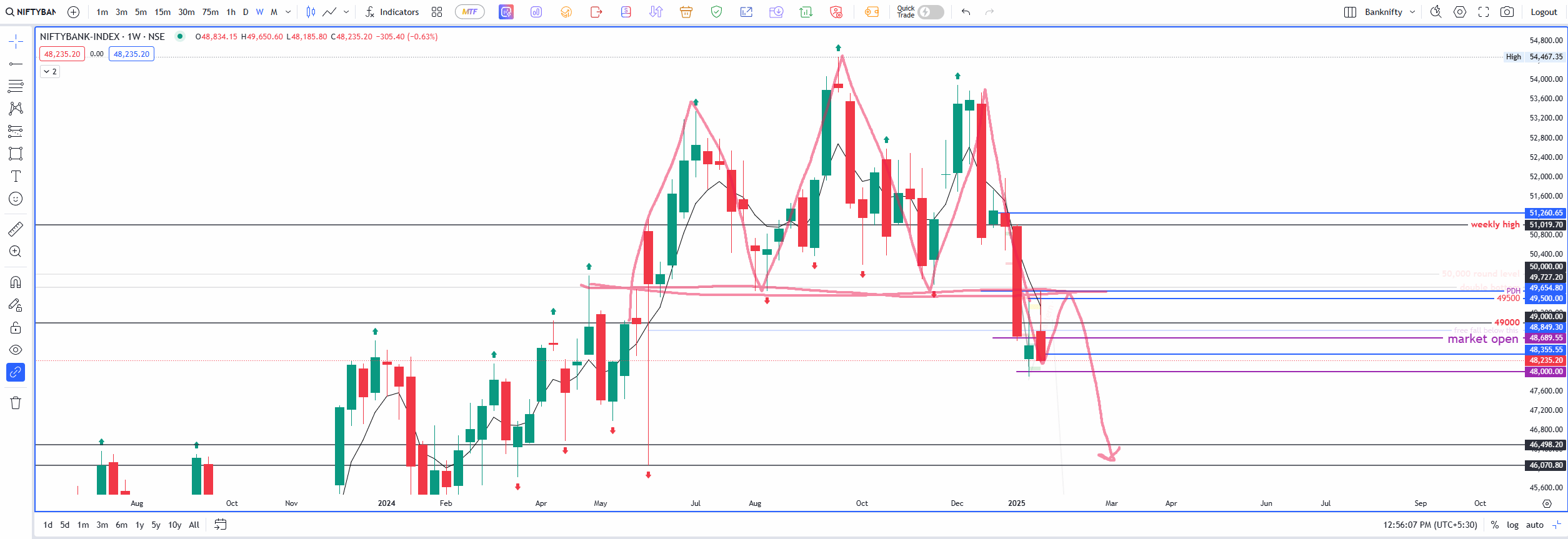

On the weekly timeframe, Banknifty has formed a Head & Shoulder pattern, a well-known bearish signal that can foreshadow more downside.

Weak Bearish Momentum and Price Retracements

I also noticed that the overall selling didn’t seem very convincing. Generally, a strong bearish move sends prices tumbling rapidly, with minimal retracements. But in Nifty—on the 5-minute and 15-minute charts—each red candle was followed by a substantial pullback, creating long wicks. That usually means the momentum might falter if sellers can’t maintain the pressure.

These elongated wicks and frequent retracements often lead prices back to the nearest support—in today’s case, around 22,976 ± 20 points for Nifty. The logic is simple: if sellers aren’t strong enough to break down decisively, buyers can push the market back up from known support zones.

Meanwhile, Banknifty had an unfilled gap from a previous session. I expected it to drop enough to fill that gap before offering any real bounce. Indeed, price eventually touched that gap zone, prompting me to exit my trade. Given the day’s shaky momentum, I didn’t want to overstay.

As if on cue, Nifty found support near yesterday’s low, reversed upward, and validated the idea that the bearish momentum was weak. Banknifty, too, bounced after hitting the gap area, confirming the notion that a real breakdown should be swift and unmistakable—something we didn’t see today.

The Day’s Finale

By the close:

- Nifty 50 ended positive by 130.70 points or 0.57% at 23,155.35

- Banknifty gained 154 points, closing at 48,724, with weak market breadth.

Reflecting on the Day

While I did take a couple of trades, the day’s price action reminded me to trust what the charts are showing:

- Opening Gap Context: A market opening near the previous day’s low can easily trap early sellers if no clear breakdown follows.

- Weak Bearish Signals: True selling pressure doesn’t typically allow for large wicks and near-complete retracements candle after candle.

- Head & Shoulder on Weekly: Banknifty’s bigger-picture pattern indicates that if a stronger bearish phase emerges, it might be sustained, but only once the intraday momentum aligns.

- Patience Around 10:30–11:00 AM: My usual caution about mid-morning trades remains valid: quick moves can occur, but they often lack follow-through if the market is still finding its footing.