13th Jan 2025 Intraday Trades & Concept

The Market Opens

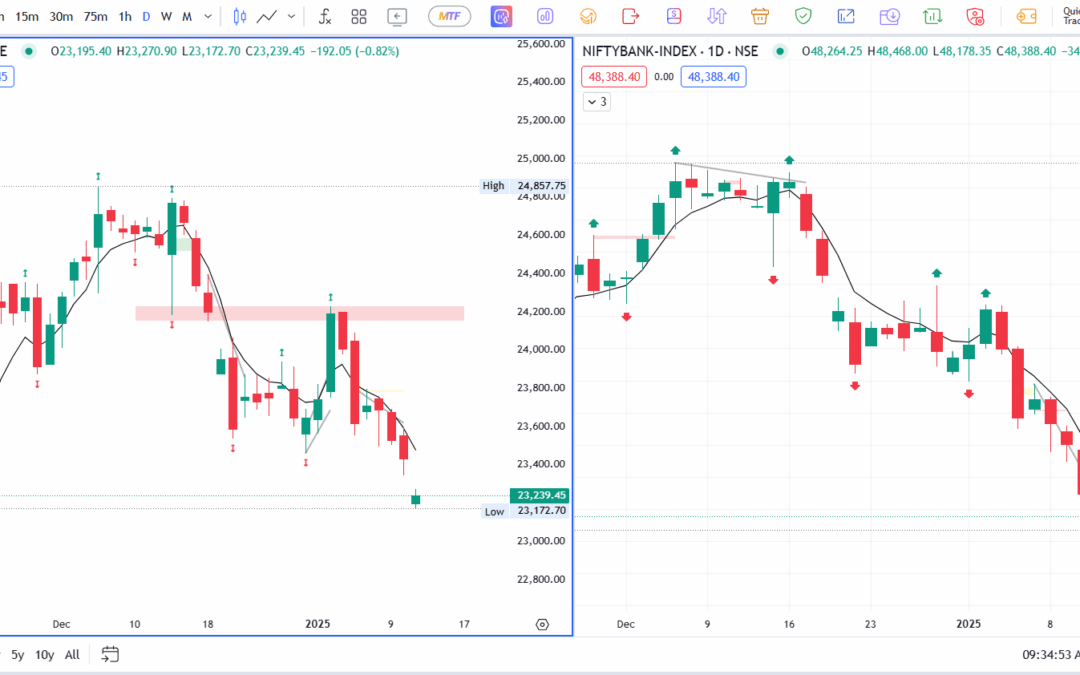

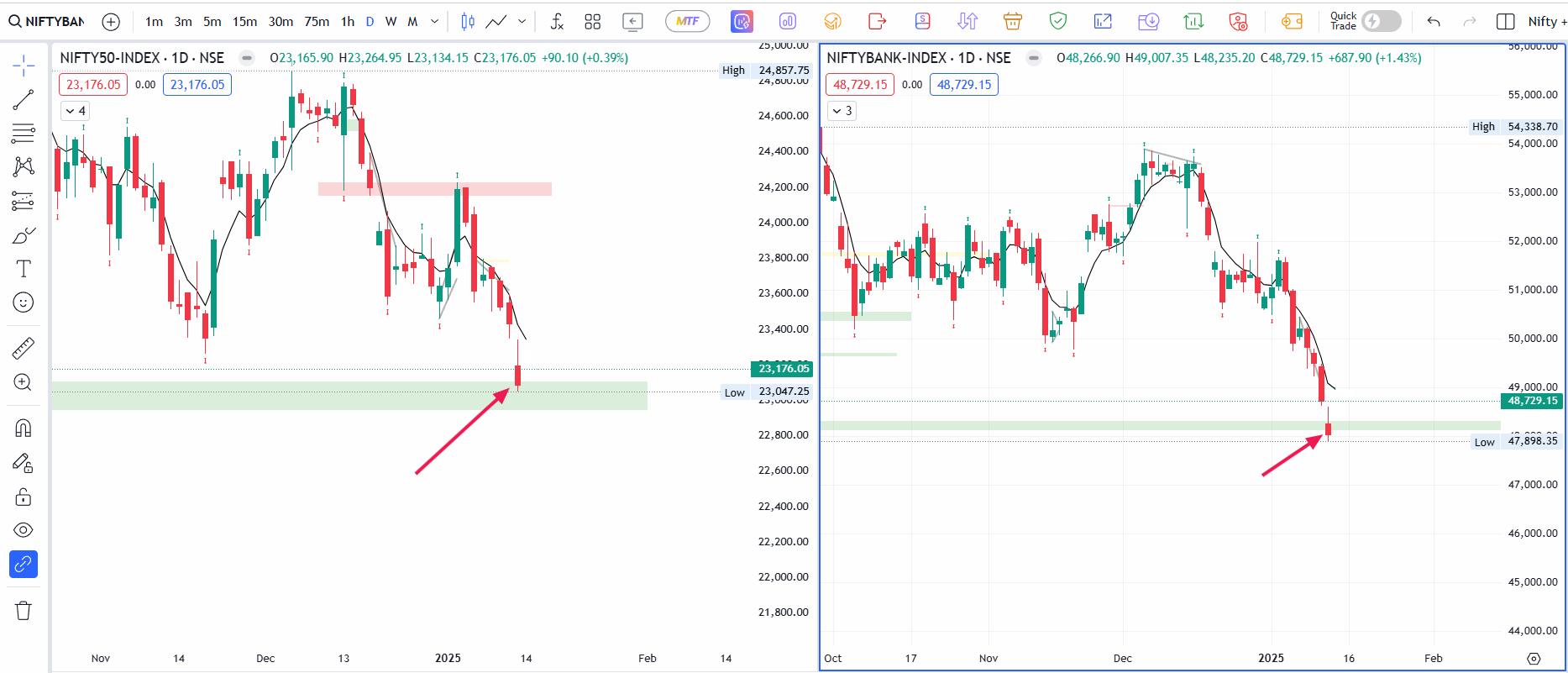

Today started with a jolt: both Banknifty and Nifty opened with big gap-downs.

Banknifty

Banknifty opened -469.90 points

Nifty

Nifty opened -236.10 points gap down right at the opening bell.

Such a large gap-down is not something you see every day. It reminded me of a similar event on December 19th, 2024, when the market also opened much lower than its previous close.

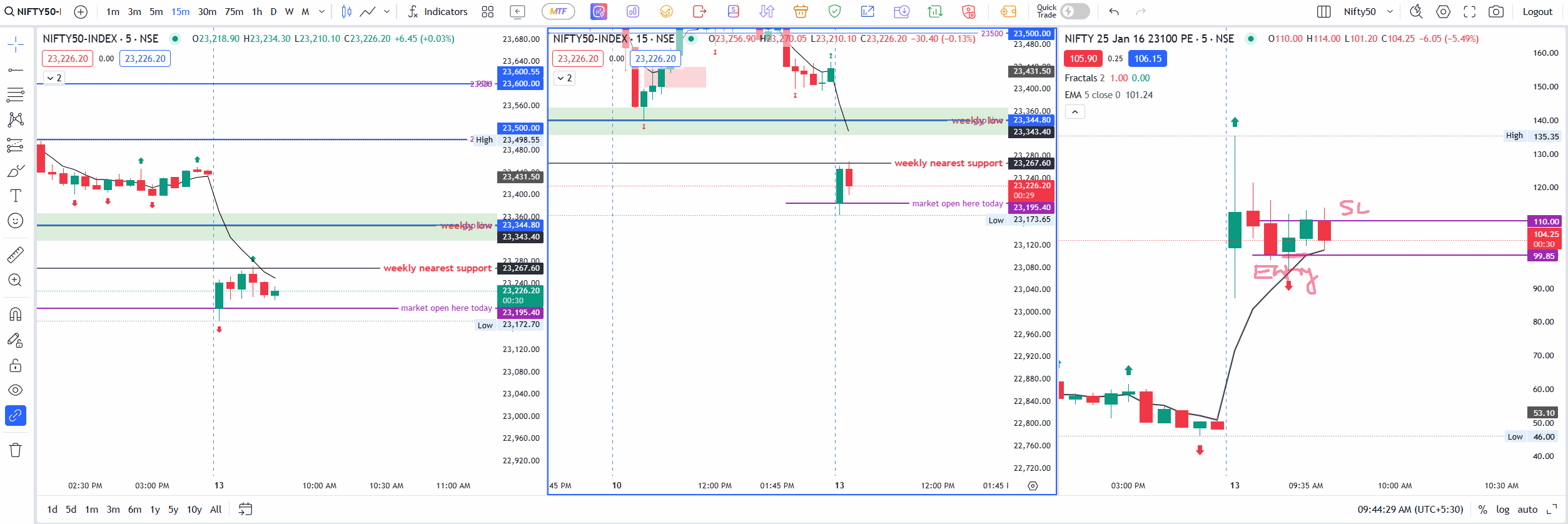

On days like this, I often expect some kind of recovery—at least a small bounce—because after a sharp drop, buyers might step in to pick up shares at a discount. However, I never know for sure how long the bounce will last or whether it will happen right away. So, I decided to rely on price action, especially on the 5-minute chart.

My plan was simple:

- If the market made one red candle at the open and then broke above the high of that red candle, I would take a quick scalp on the long side (expecting a small upward move).

- If the day’s low broke with clear price action, I would sell Call Options with half my usual quantity, just to play it safe.

Early Trades and a Quick Loss

Not long after the market opened, around 9:29 AM, I decided to sell 23,100 PE (Put Option) at ₹99.85. I placed a Stop Loss (SL) at ₹110.00. My idea was that the market might bounce a little to fill the gap and these Put premiums could drop in value. But my Stop Loss was hit, causing a loss of about –₹822.71.

At the same time, I noticed Banknifty made three green candles in a row, which can sometimes hint at more upside. However, Nifty was moving up slowly. When both indices aren’t moving in sync—one being more bullish or bearish than the other—it can create confusion. Still, I stuck to my plan and looked for the next opportunity.

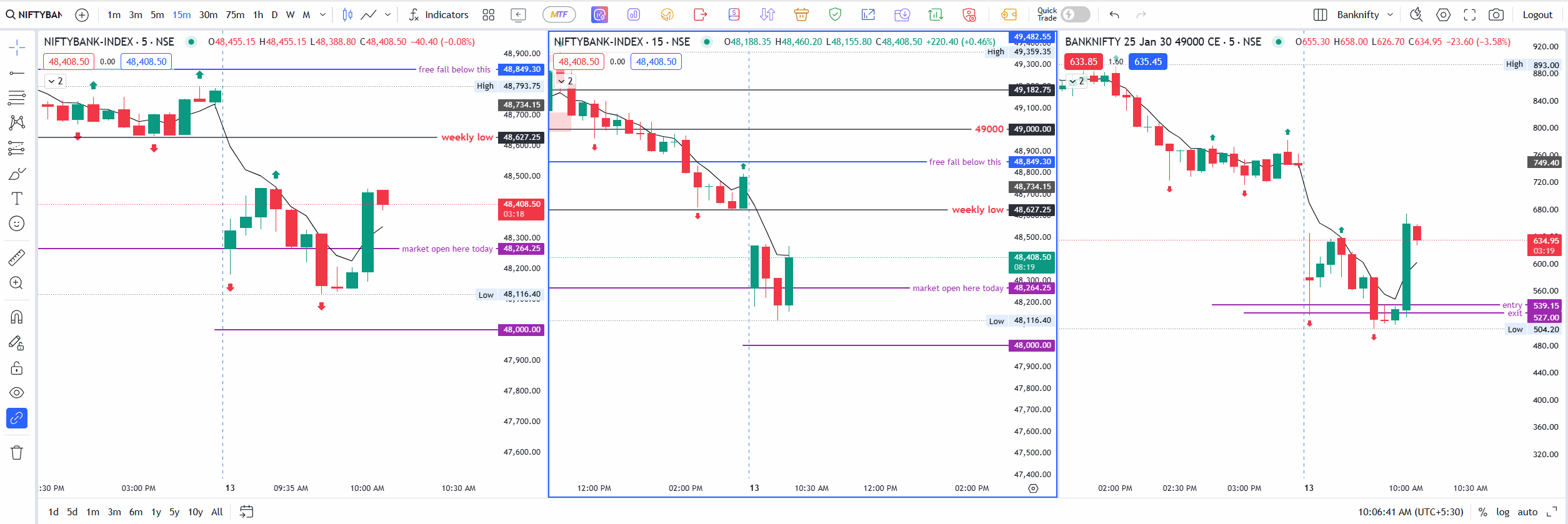

Shifting to Calls in Banknifty

Even though my first attempt with the Put Option didn’t work out, I spotted a chance in Banknifty. The day’s low broke, which matched one part of my trading plan: if the low breaks, look to sell Calls. Around that time, I decided to sell the 49,000 CE (Call Option) at ₹539.15 with a 150-quantity lot. Because the price was moving quickly, I entered during the running candlestick—an early entry that sometimes pays off, but can also be risky if the market whipsaws.

Meanwhile, Nifty did not break its day’s low yet, though it did break a smaller range near the day’s high. But I was waiting specifically for Nifty’s day low to be taken out to confirm my bearish stance. Since that didn’t happen at once, I focused on Banknifty.

Watching Profits Shrink

By around 9:53 AM, my open profit of ₹3,000+ in the Banknifty Call sell started shrinking down to about ₹600. This was because of price spikes. I realized I had to exit the trade, not necessarily out of panic, but because of capital constraints—my margin was mostly locked in that position, and I couldn’t open new trades comfortably. I ended up exiting with a small gain. Right after I got out, the price made a big bullish move. If I had stayed in, that bullish spike might have hit my Stop Loss, so I felt relieved to have taken my profit, even though it was smaller than I had hoped.

Avoiding an In-Between Re-Entry

Sometimes, after exiting a trade, there’s a temptation to jump right back in if the price moves in a favorable way. But this time, I decided not to re-enter immediately. I wanted a fresh setup—like a break of a key level or a clear price action signal—to justify taking another position. In fact, I was looking at a potential trade around 50,200 CE sell if the market set up nicely. But I preferred to wait patiently instead of jumping in and out, which often leads to mistakes.

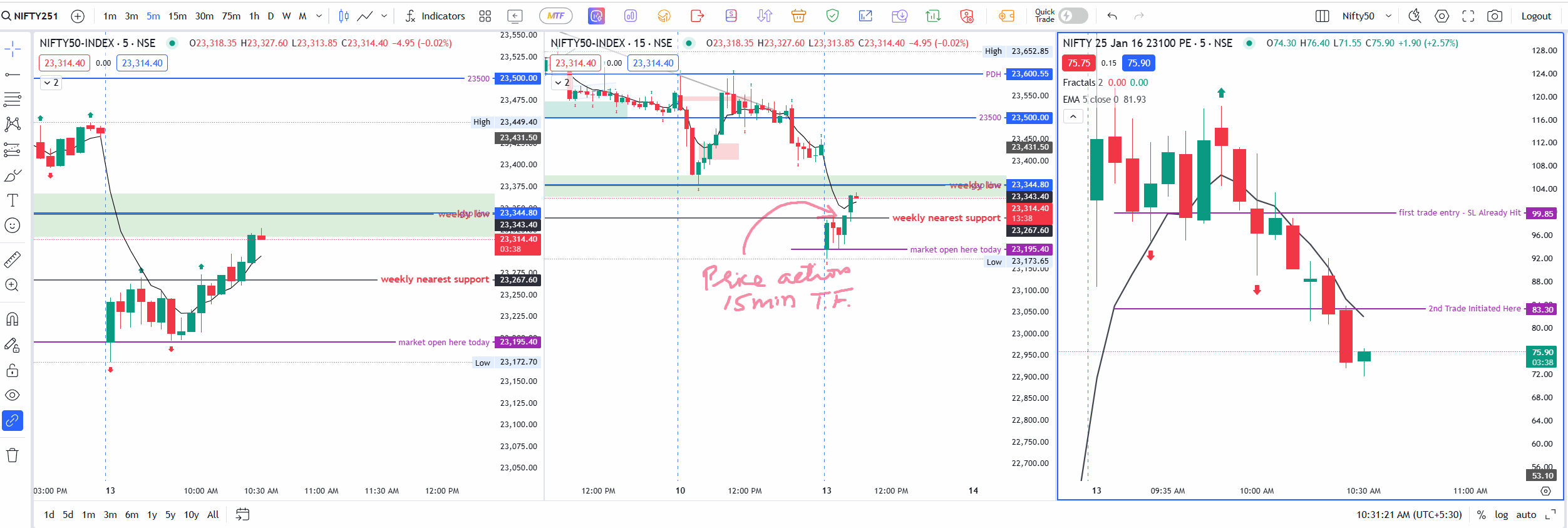

A Second Shot at 23,100 PE

Later in the morning, I saw another chance on the 23,100 PE (the same strike that hit my Stop Loss earlier). I re-entered at ₹83.30. This time, my goal was to ride the move toward a weekly line I had marked on my chart—a key resistance level that I expected to act like a magnet for the price. Thankfully, the price did touch that line, started to retrace and I exited my trade with some profits.

I also had a second target in mind: a gap-fill. Often, when there’s a huge gap-down open like today, the market may try to fill that gap if enough buyers step in. I used the memory of December 19th, 2024, when the market opened similarly low and then recovered into a green close. I thought something like that could happen again. However, I couldn’t hold the trade for too long because I had to step out. So, I exited any positions I had and left the market alone.

Afternoon Surprise

When I got back to check the market around 2:30 PM, I discovered that the recovery didn’t behave the same way as on December 19th. Instead, the market made a red candle and continued to stay weak. In other words, the big gap-down didn’t get reversed; the market remained subdued and bearish.

Rather than feeling disappointed, I was actually happy to see that my earlier analysis—staying cautious and somewhat bearish—was correct. Now, I feel the market looks like a “sell on rise” scenario until I see signs of a bullish turnaround.

The Day’s Finale

By the end of the session, Nifty dropped -345.55 points approx with a strong bearish candle totally opposite to the 19th December 2024 move.

Banknifty on the other closed approx -714 points making a strong bearish candle today also.

Both the indices are falling continuously for the past 4 days nows, I am expecting a green candle or an inside candle tomorrow. Generally, after so much fall we see a bullish move. This is because teh premiums of PE side are higher so market tries to go the mean position before making it next move. Let’s see how the market behaves tomorrow.

Lessons from Today

- Don’t Let One Loss Define the Day: My first Put trade ended in a Stop Loss, but I stayed focused and found a winning Call sell in Banknifty.

- Capital Constraints Matter: Sometimes you have to exit a position to free up margin, even if you think the move isn’t over yet.

- Comparison to Past Gaps: Just because December 19th, 2024, had a big gap-down and then recovered, it doesn’t mean the market will repeat that pattern exactly. Every day is unique.

- Avoid In-Between Entries: Re-entering a trade right away after exiting can lead to errors. Waiting for a clear setup can pay off better.

- Bearish Until Proven Otherwise: The continuation of red candles and lack of a strong bounce suggest the market may keep falling unless a strong bullish signal appears.