In the world of intraday trading, not every day will align with our favorite setups or yield the spectacular results we hope for. Sometimes, the price action and our trade ideas just don’t gel. Today was one of those sessions. Despite noticing early signs that a smaller, more range-bound day (often referred to as an “inside day”) might be on the cards, I still decided to test my skills in Banknifty and Nifty. The outcome wasn’t exactly rosy. Here’s the breakdown of my trades, the thought process behind them, and the lessons I’ll carry forward.

Market Open and Initial Observations

Banknifty

Opened at 50,061.20, a modest +139.20 points gap-up from the previous close.

Nifty

Opened at 23,679.90, gaining +63.85 points over the prior session’s close.

Given these openings, it was entirely possible that both indices would either consolidate or make only minor moves, especially after the sizeable price swings we saw in the last session. My plan for such days is usually to “wait and watch,” possibly skipping trades unless there’s a compelling reason. Yet, the temptation to test my abilities got the better of me, and I dived in with an aggressive approach—something I’d eventually regret.

“Wrong Thought” Trade on the 1-Minute Timeframe

I openly acknowledge that today’s market was not ideal for trading, especially on 1-minute timeframes. Still, I jumped into a short-term trade right after the low of the first green candle broke in both indices—Banknifty and Nifty.

Nifty

- Added 23800 CE selling at ₹142.05.

- The setup was predicated on a quick trade after low of first green candle breaks down. The target was to capture some points till the gap is not filled.

- Stop Loss (SL) got hit almost immediately.

Banknifty

- Added 50500 CE selling at ₹866.65, anticipating a similar trade as in Nifty.

- Once again, the SL was triggered.

Both trades took a hit largely because the 1-minute timeframe can be extremely choppy, especially during the first half hour of trading. In hindsight, sticking to a 5-minute chart—my usual morning timeframe—would have been far less risky. The smaller the timeframe, the more false signals and market noise you have to contend with.

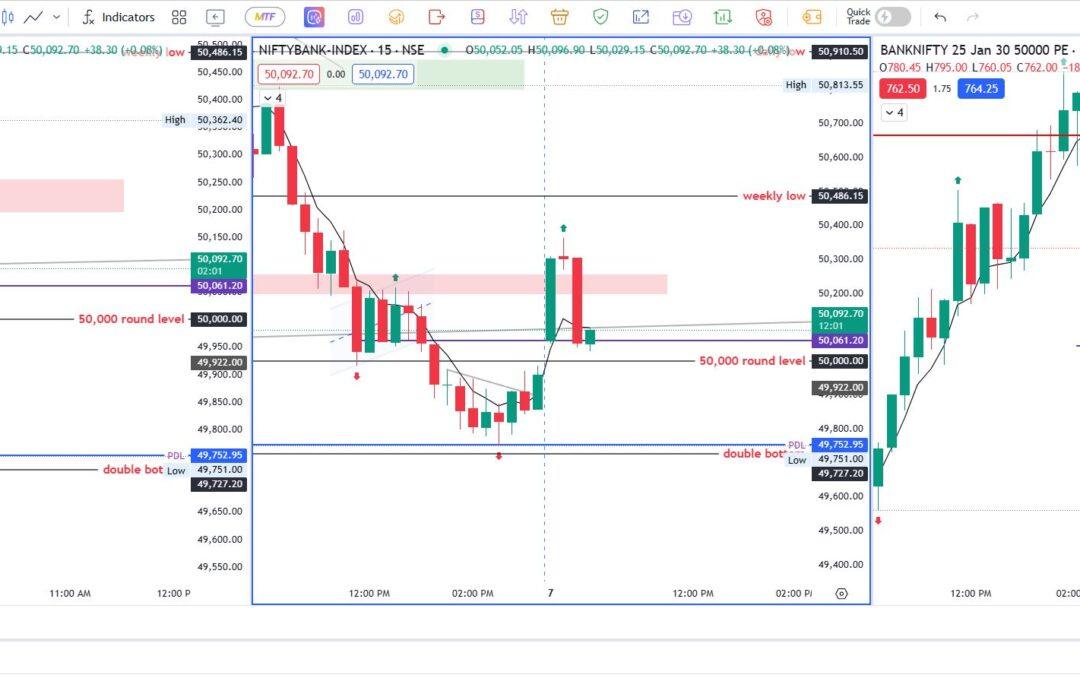

The 5-Minute and 15-Minute Perspective

Typically, my approach in the morning session is to use the 5-minute timeframe for any immediate setups that align with the market’s opening momentum. Then, after around 10:00–10:30 AM, I transition to a 15-minute timeframe, which filters out some of the noise and provides clearer signals. Had I followed this plan diligently, the early losses might have been avoided.

I did manage to place a 15-minute chart setup trade later in the day:

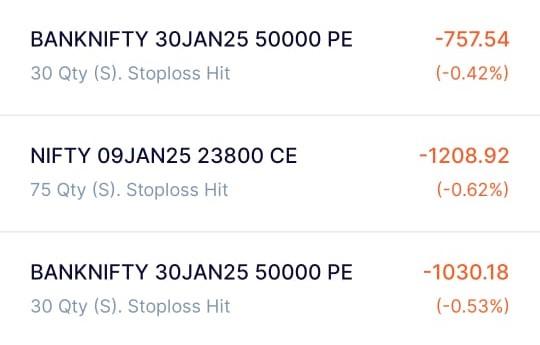

- Added 50,000 PE at ₹646.45, with a 30-quantity position (2 lots).

- My stop loss was hit at ₹678.00, resulting in a net loss of ₹1,030.18.

The idea behind this trade was to capitalize on a potential reversal if Banknifty slipped below its opening levels or showed renewed bearish momentum. However, the market’s volatility and lack of follow-through ended up taking me out of the position.

A Glimmer of Hope: 5-Minute Entry on 23800 CE

After sustaining losses, I reassessed the charts, noticing a decent 5-minute price action setup around the day’s low in Nifty. Hoping for a bounce, I entered:

- 23800 CE at ₹98.25.

- Exited at ₹113.55.

Although I managed a profitable exit, I still ended the trade with around –₹1,208.92 once I factored in my earlier losses and brokerage/transaction costs. This underscores how unpredictable the market was and highlights the challenge of trying to “recover” losses by forcing trades in choppy conditions.

Midday Volatility and Strategy Adjustment

By 11:15 AM, Banknifty printed a bullish candle, which seemed promising. However, the indices then drifted sideways, offering few clean entries. Nifty also appeared to be trading inside the range of its first 15-minute candle—another sign that momentum was lacking.

Banknifty did push above its day high temporarily, but Nifty did not confirm with a similar move. This divergence often leads to failed breakouts or range-bound price action.

Since I’d already hit two stop losses and wasn’t seeing a clear, high-conviction setup, I considered sitting on the sidelines for the rest of the day—an approach that often preserves capital when the market is indecisive.

A Late Attempt and Stop Loss Hit

Despite my better judgment, I tried one final trade in Banknifty, planning to go long only if it traded above 50,400 in the spot. Upon seeing a move, I entered:

- 50,000 PE at ₹574.40, aiming for a quick target if Banknifty rallied toward 50,500.

- However, since Nifty didn’t confirm a breakout, my stop loss ended up being hit at ₹597, resulting in another –₹757.54 loss.

At this point, I called it a day. The market simply wasn’t in sync with my setups, and forcing more trades would likely exacerbate my losses. It’s always better to protect your trading capital than to chase every possible move.

Potential Scalps Missed—But Capital Preserved

Interestingly, there was a fleeting opportunity to scalp a CE sell or PE buy off the 15 EMA as Banknifty fell. Such a trade might have yielded about 40–45 points, but I chose not to take it. My reasoning was straightforward: I’d already suffered multiple stop-loss hits, and I didn’t want to risk further erosion of my account. Sometimes, stepping away is the smartest decision you can make.

The Day’s Finale

By the session’s close:

- Banknifty was up by 140 points approx. from its opening levels.

- Nifty up by approx. 30 points 428 points.

PnL of 6th Jan Trades

Concluding Thoughts: Not Every Day Is a Trading Day

Today’s roller coaster underscores a fundamental truth in trading: not every day is a good day to trade. When the market is choppy or lacks directional clarity—especially after a big previous day’s move—the most prudent course may be to wait, watch, and preserve capital. The day was a net loser for me, largely due to:

- Trading on a lower timeframe (1-minute) right off the open.

- Ignoring the possibility of an inside day, which meant reduced volatility and fewer trending moves.

- Forcing trades even after two stop losses.

Despite the setbacks, I gained vital insights that will refine my approach going forward:

- Respect Higher Timeframes: If the daily chart suggests an inside day, it’s often best to wait for clearer setups or avoid trading altogether.

- Stick to Familiar Timeframes: My usual 5-minute and 15-minute strategies tend to be less choppy and more reliable than 1-minute scalp entries.

- Capital Preservation Over Recovery: Sometimes, the urge to “make back” losses leads to bigger setbacks. Discipline in risk management is paramount.

Ultimately, these experiences—though painful in the short term—are invaluable steps in the journey toward consistent profitability. Every red day provides lessons in patience, discipline, and the willingness to stand aside when conditions just aren’t right. If there’s one thing I take away from today, it’s this: listen to the market’s context, and never be afraid to let a tough day pass without big trades. Tomorrow is another session, another set of opportunities, and (hopefully) a clearer sense of direction.