17th Feb 2025 Intraday Trades & Concept

Market Opens

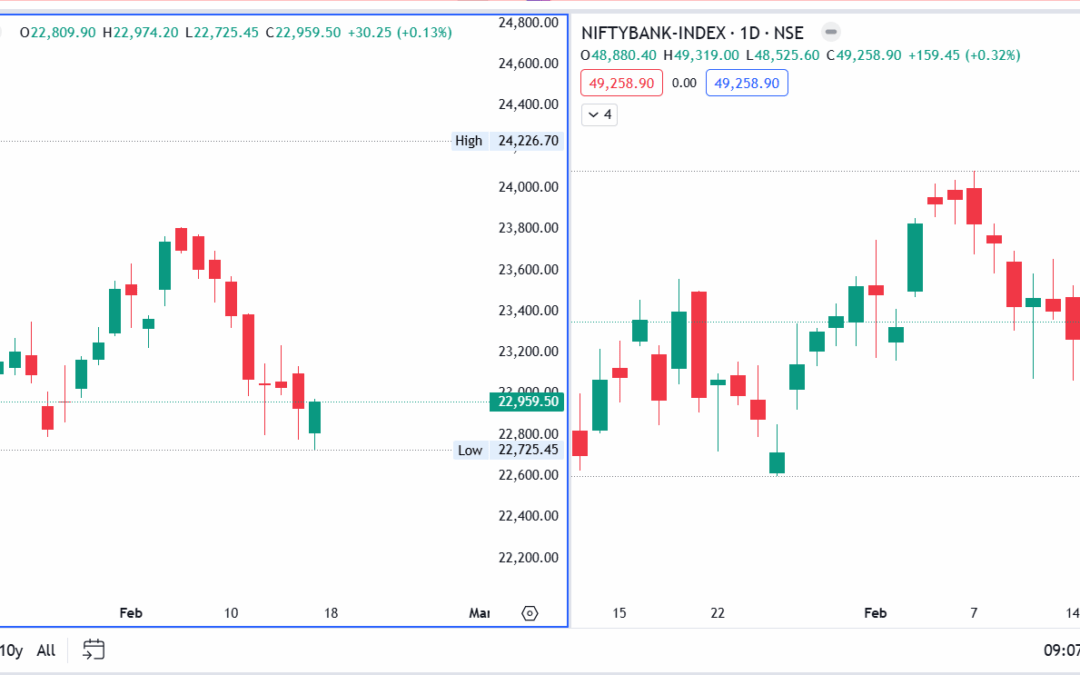

Both indices opened significantly lower today, with Banknifty falling –219.05 points to 48,880.40 and Nifty losing –119.35 points at 22,809.90.

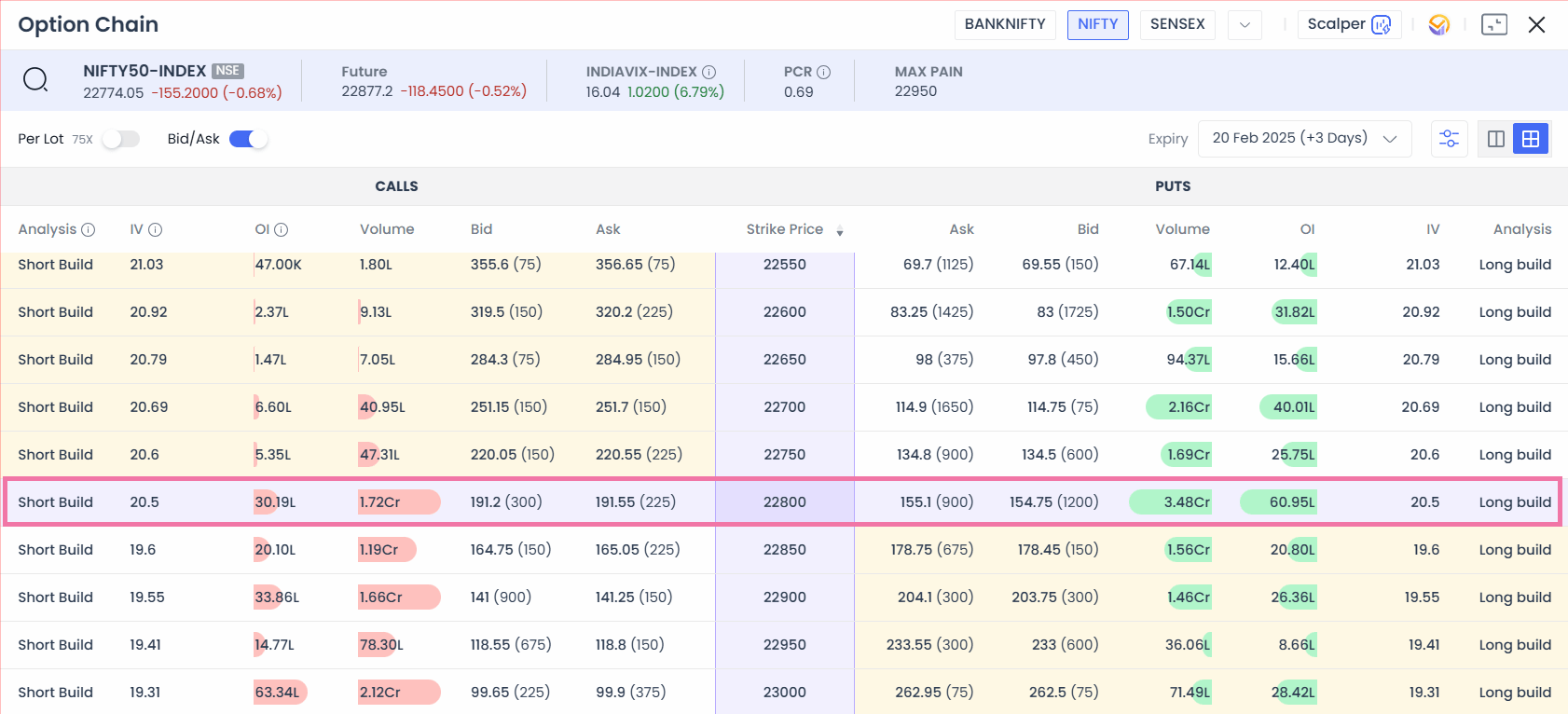

This move firmly broke below the 22,800 level that I discussed in my previous blog—a level supported by notable Open Interest (OI) data. Below is how the trading session unfolded, including a brief look at changing OI volumes, a potential fresh level at 22,700, and how small decisions about entry and exit shaped my day’s trades.

Revisiting OI Data from Friday

Last week, I noticed that for Nifty at 22,800, there was a significant Put Volume of 11.65 crore vs. Call Volume of 2.24 crore, with Put OI at 45.72 lakh and Call OI at 23.33 lakh. These figures suggested strong put-side support. Fast-forward to today:

- Put Volume shrank to 3.48 crore

- Call Volume dipped to 1.78 crore

- Put OI ballooned to 60.95 lakh

- Call OI rose to 30.19 lakh

- India VIX climbed +7.74% to 16.18

I haven’t analyzed OI deeply before, but it seems more traders added positions on both calls and puts this morning, while volumes receded.

Early Trades in Both Indices

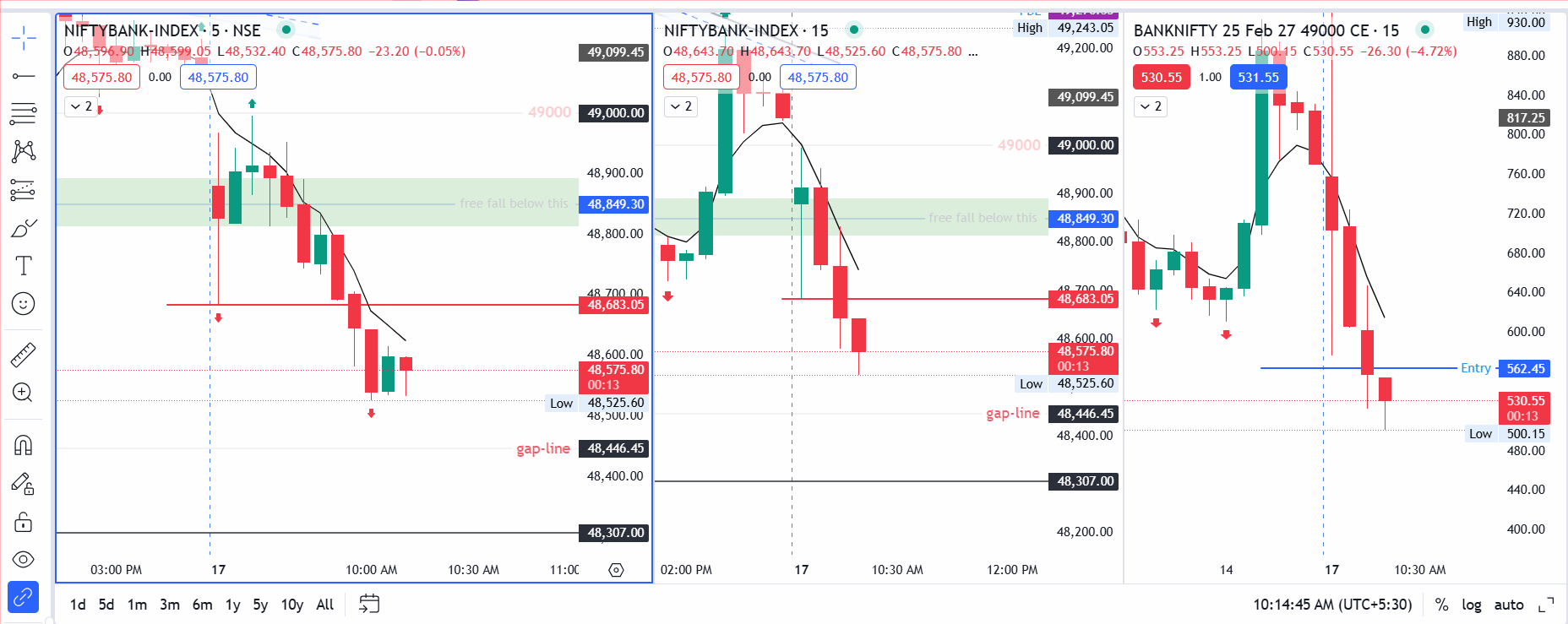

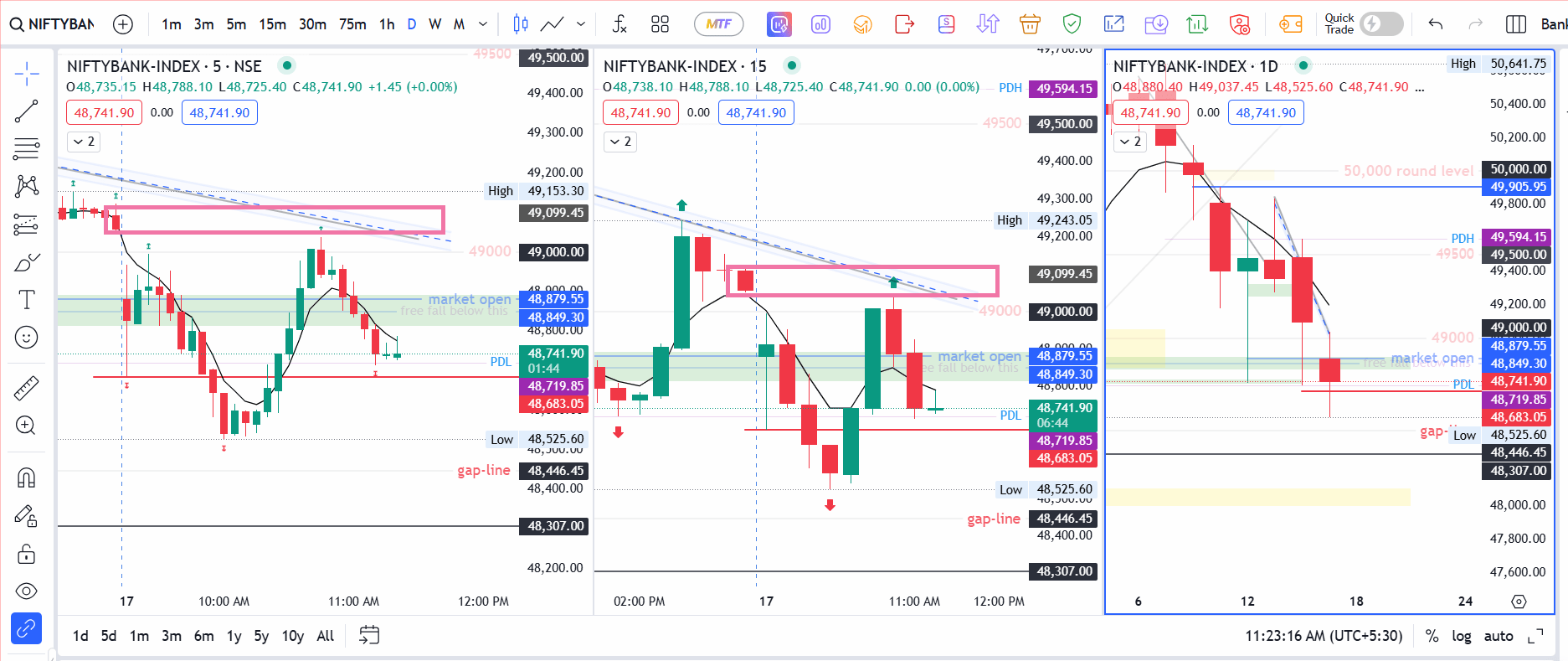

Banknifty 15-Minute Setup

Spotting a breakdown of Banknifty’s day low, I sold 49,000 CE at ₹562.45. Given the consistent selling in the first few candles, this trade seemed to align with my usual 15-minute chart strategy. Nonetheless, I remained cautious because selling pressure in Banknifty can sometimes reverse rapidly—especially near round numbers like 49,000.

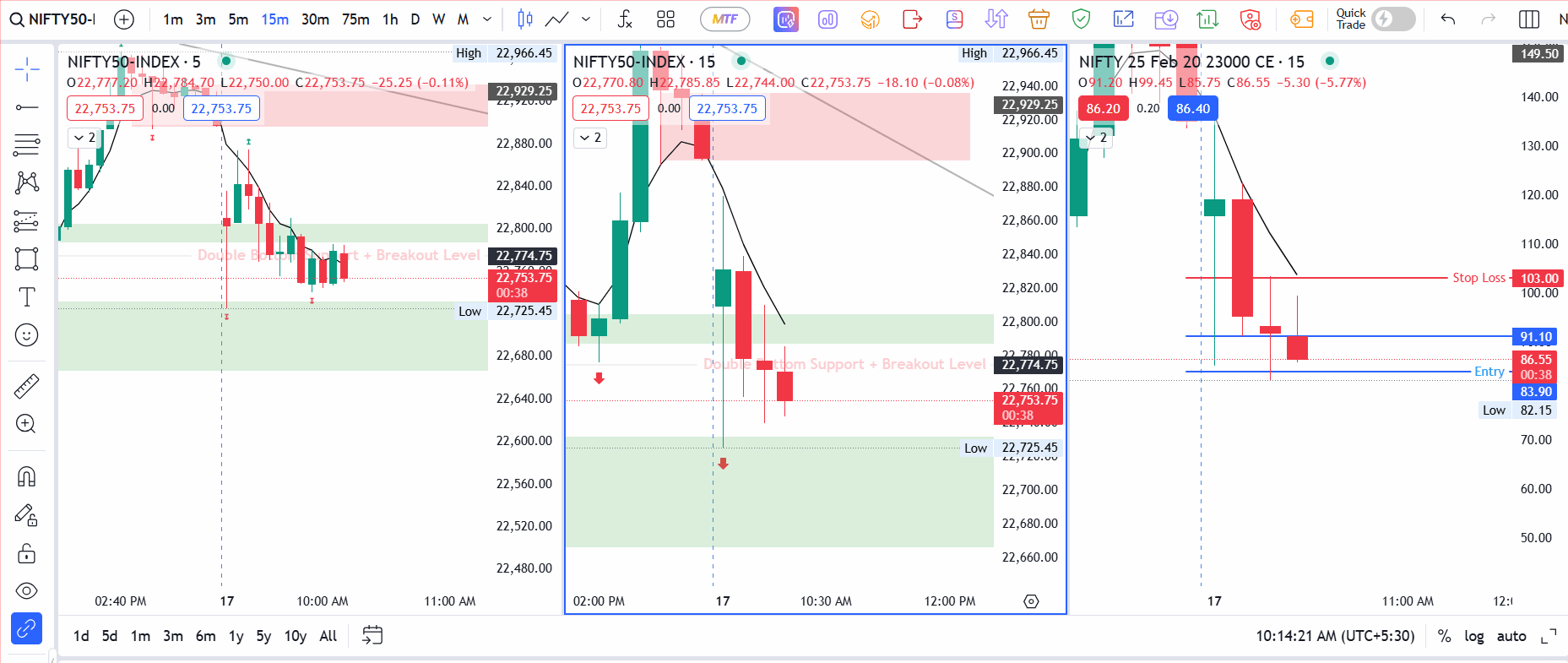

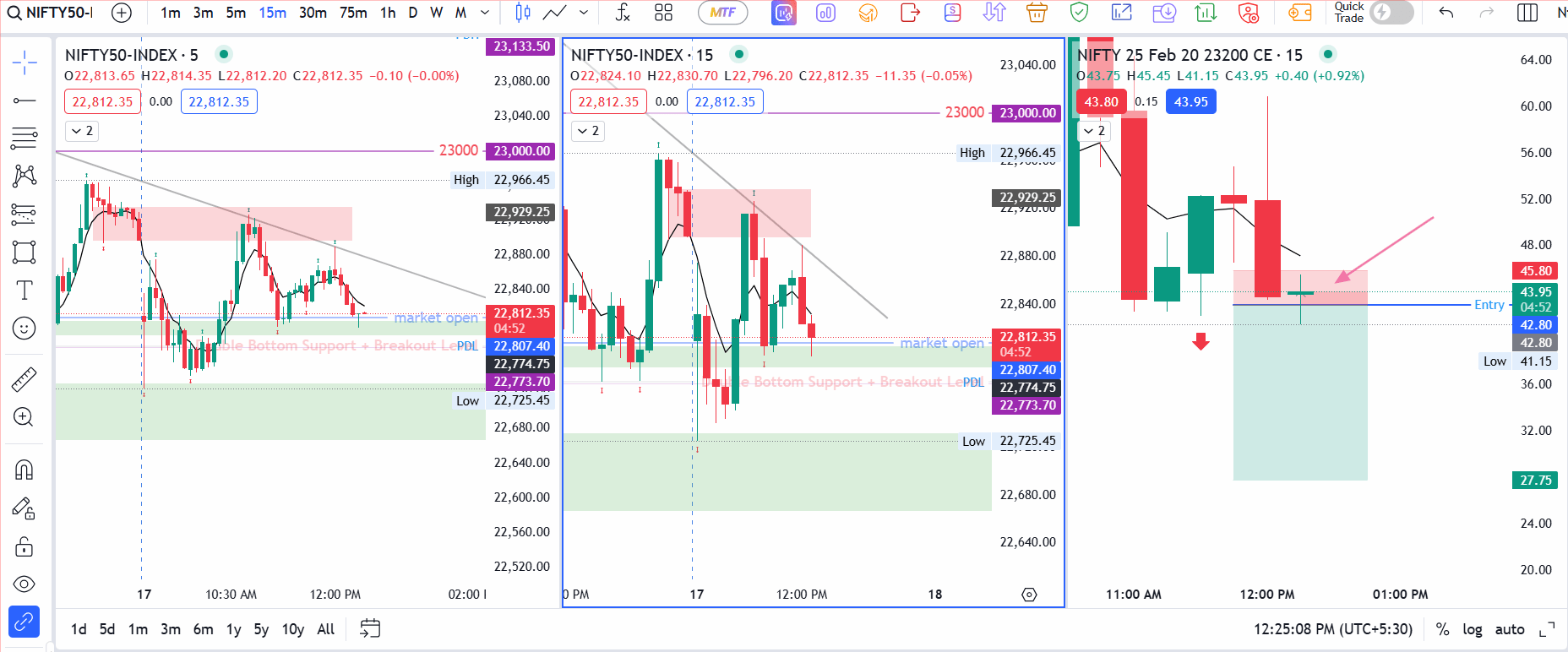

Nifty 15-Minute Follow-Through

Simultaneously, I sold 23,000 CE at ₹83.90, anticipating that Nifty’s day low would break down in concert with Banknifty. However, when I saw the pace of selling slow, I decided to exit both positions. Typically, strong selling is swift and decisive; when the market hesitates too long around a key level, it often reverses or consolidates.

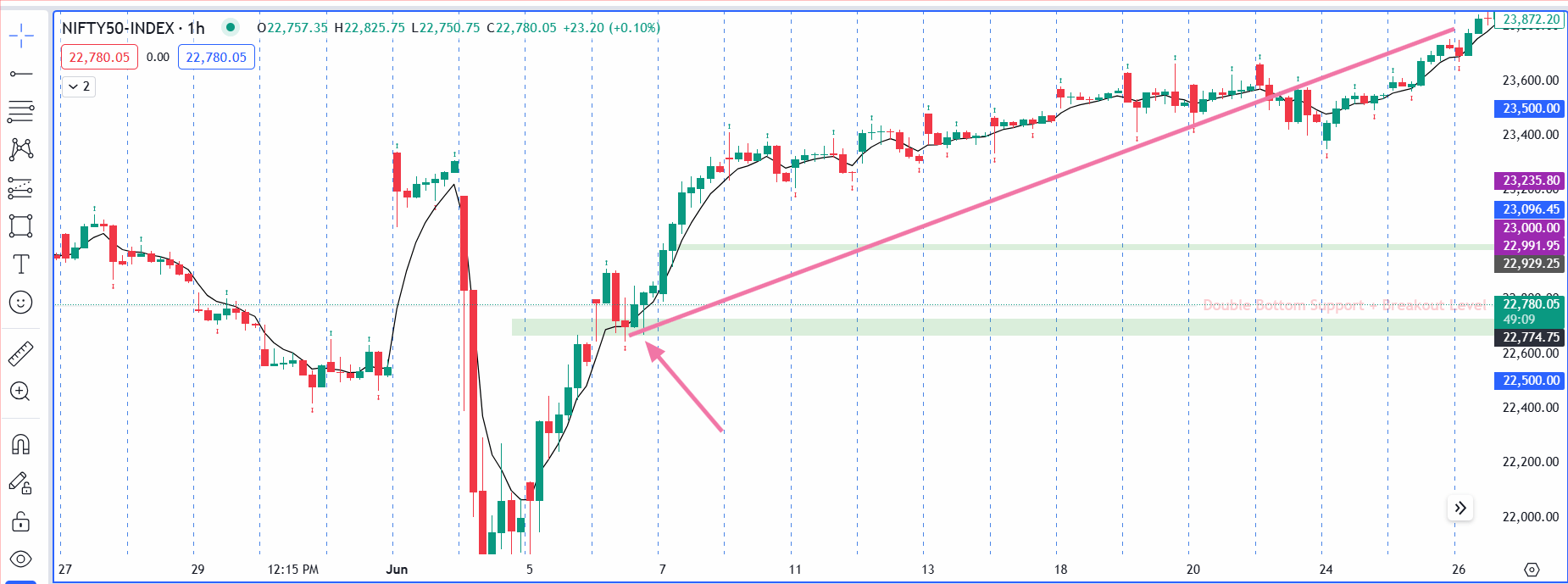

The Role of a Fresh Level at 22,700

Digging into Nifty’s 1-hour chart from 6th June ’24, I noticed a rally that originated around 22,700—a zone not in the recent two-month data set but still potentially relevant because it was a “fresh” level. I’ve learned that even older support/resistance zones can matter if they remain untested for an extended period.

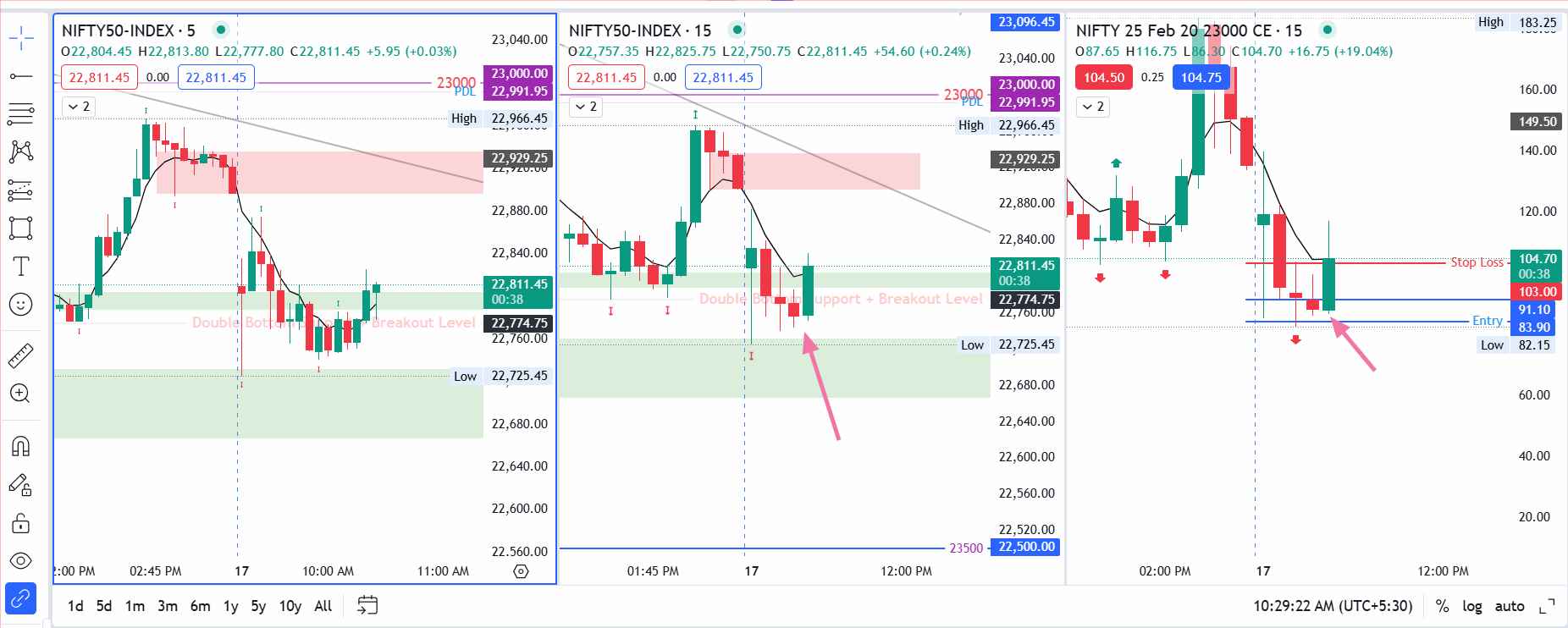

Observing Nifty’s morning price action, the index stabilized around that older region. That prompted me to exit my trades earlier than planned. I also identified a possible bullish 15-minute setup around 10:30 AM but chose not to enter a long position, staying consistent with my rule of avoiding trades at certain times of the day.

Gap Fills and Midday Observations

After the market found a foothold, both Nifty and Banknifty reversed and filled their morning gaps. For Banknifty, the next challenge was consolidating near 49,000, while Nifty needed to hold a trendline retest. My initial target in the Banknifty trade was a quick 50-point capture, and I briefly saw that in unrealized profits—but I held on, hoping for a deeper breakdown in Nifty that never came. Ultimately, I exited to protect capital.

A Trade Against the Rules?

Looking back, my Nifty short at 23,000 CE was questionable. Generally, if day low is nearby, I wait for a cleaner breakdown to confirm momentum. The 15-minute chart looked okay, but the retracement from that bearish candle was about 60%, exceeding my typical 10% threshold. Going forward, I’ll be stricter about taking quick exits upon reaching initial targets—unless both indices align with a solid chart pattern breakdown or breakout.

Spot vs. Options Chart Nuances

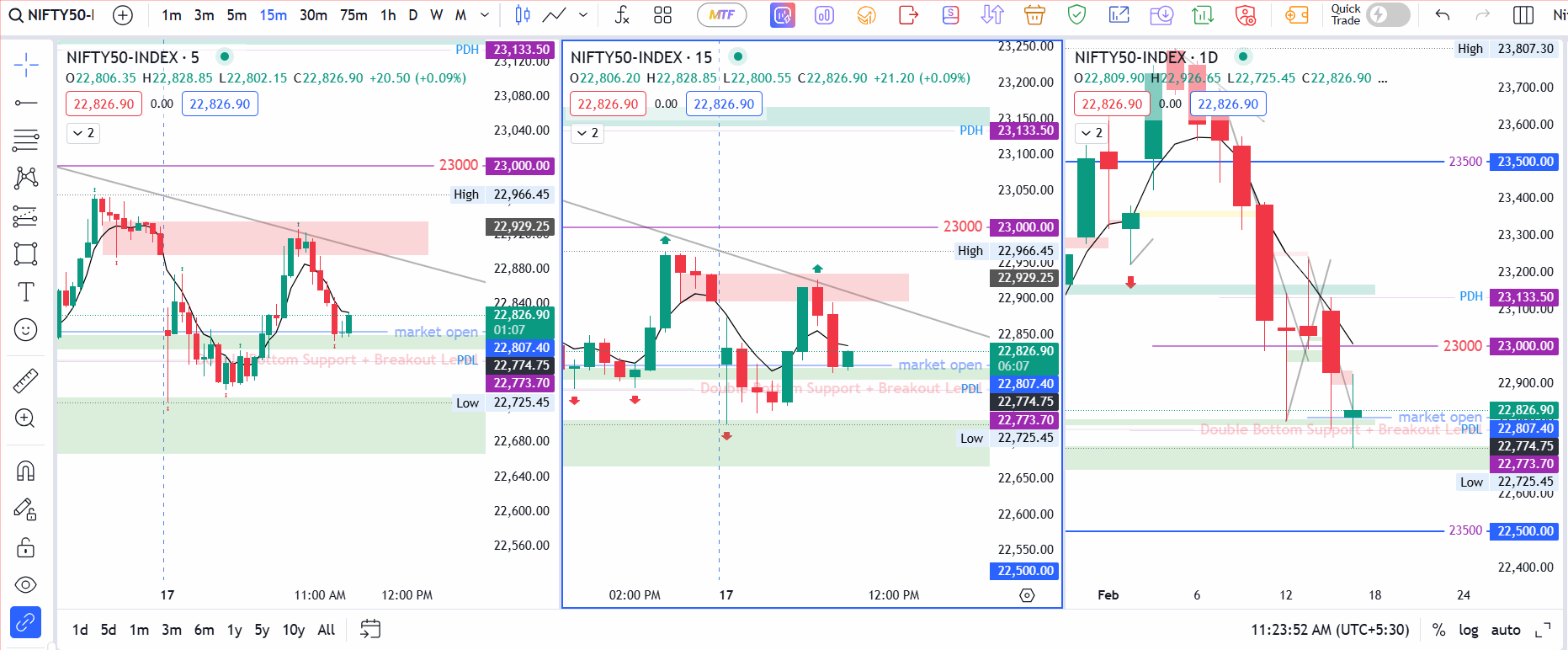

Intraday, the options chart sometimes signaled trades faster than the spot chart, or indicated levels that didn’t align perfectly with actual spot moves. This discrepancy can trigger confusion, and it’s why I typically anchor my decisions in the spot chart. While the 5 EMA setup offered additional short opportunities, I chose to remain sidelined, preferring to check the market again at noon.

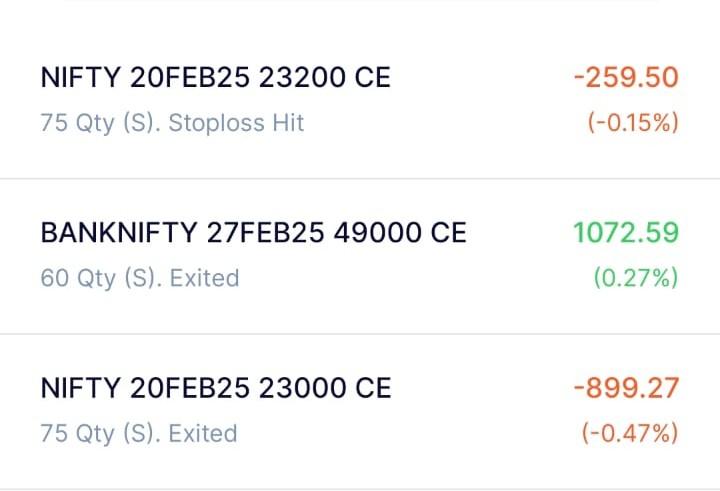

Near midday, I tried one last small-stop-loss trade in Nifty, noticing a 5-minute trendline breakdown that also matched a 15-minute candle setup. With a 3-point SL, I aimed for a 1:5 reward, but the price reversed, hitting my SL almost immediately.

Closing Figures

By the closing bell:

- The Sensex dropped 199.76 points to 75,939.21

- The Nifty slipped 102.15 points to 22,929.25

- Banknifty fell 260.40 points to 49,099.45