13th Feb 2025 Intraday Trades & Concept

Market Opens

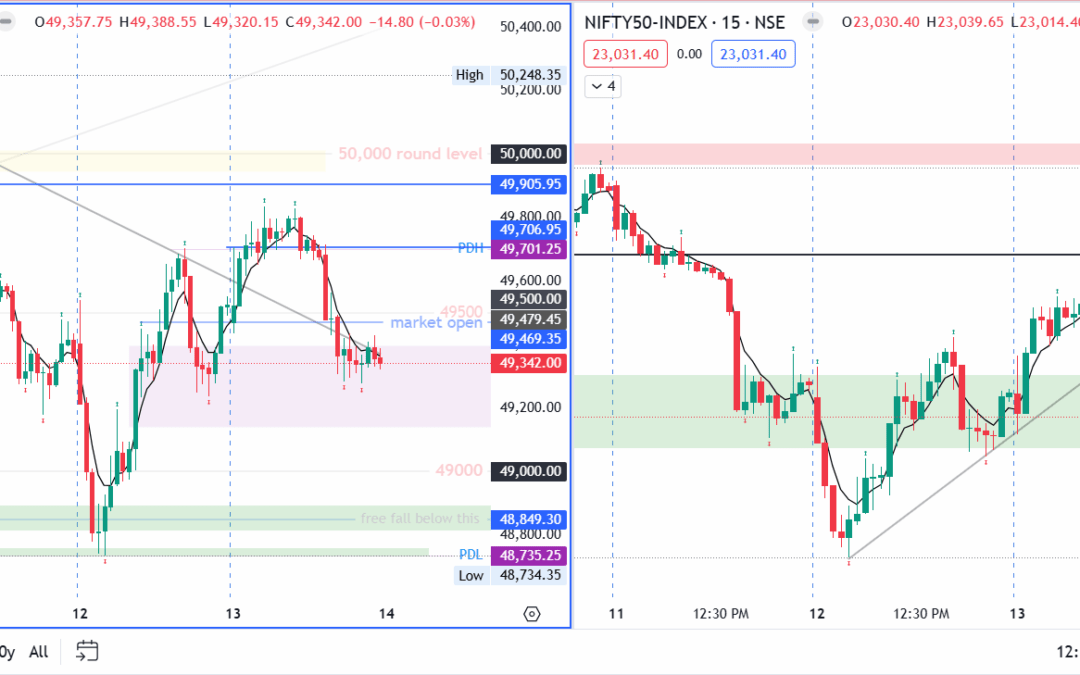

The market opened with Banknifty slightly down by –10.10 points at 49,469.35 and Nifty edging up by +10.50 points to 23,055.75.

This modest divergence followed a sharp reversal in both indices the previous day, where Banknifty managed a green daily candle but Nifty ended with a red one—albeit a bullish-type candle.

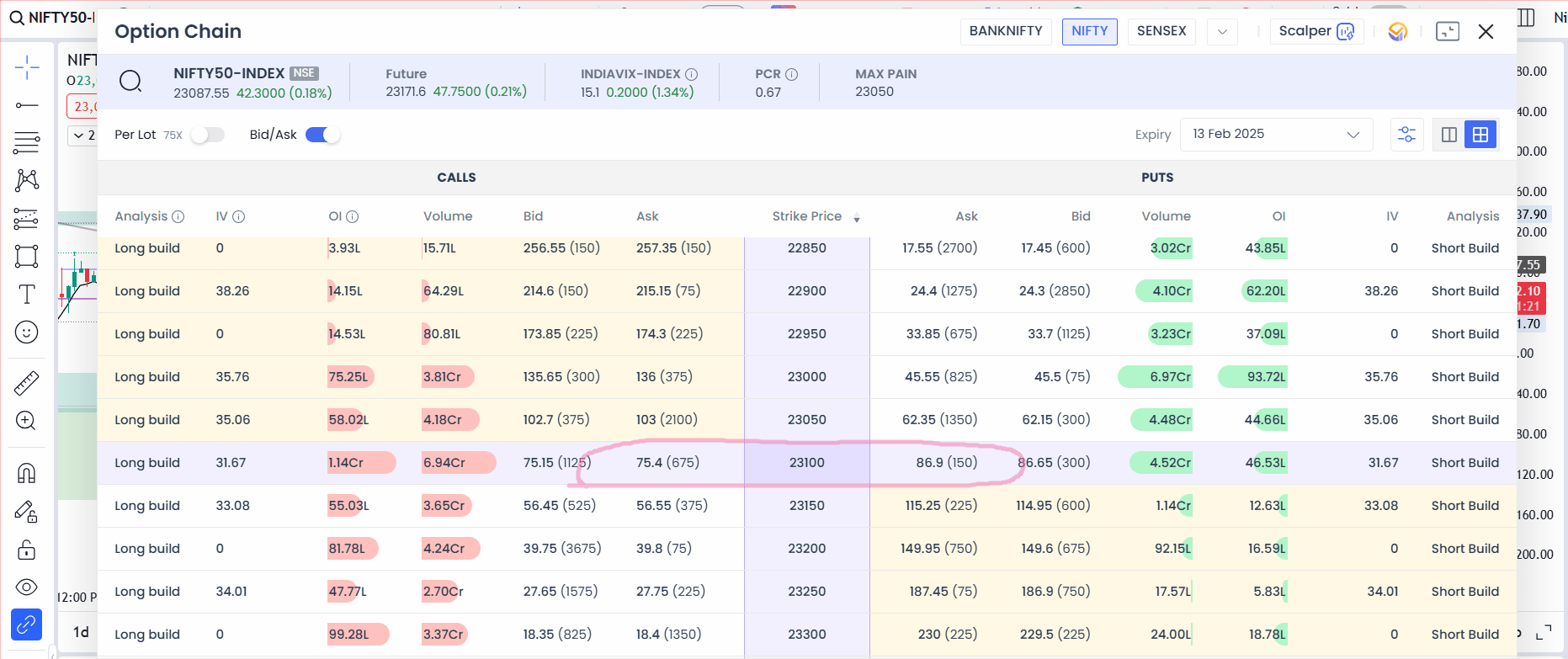

Coming into today’s session, I noticed that Put Option premiums were higher than Call premiums in Nifty, often indicating a bullish tilt. Below is how I navigated the day’s choppy moves, enduring multiple Stop Loss hits and trying to leverage time decay through option selling.

Early Trade Plans and Stop Loss Hits

Waiting for a Double Break

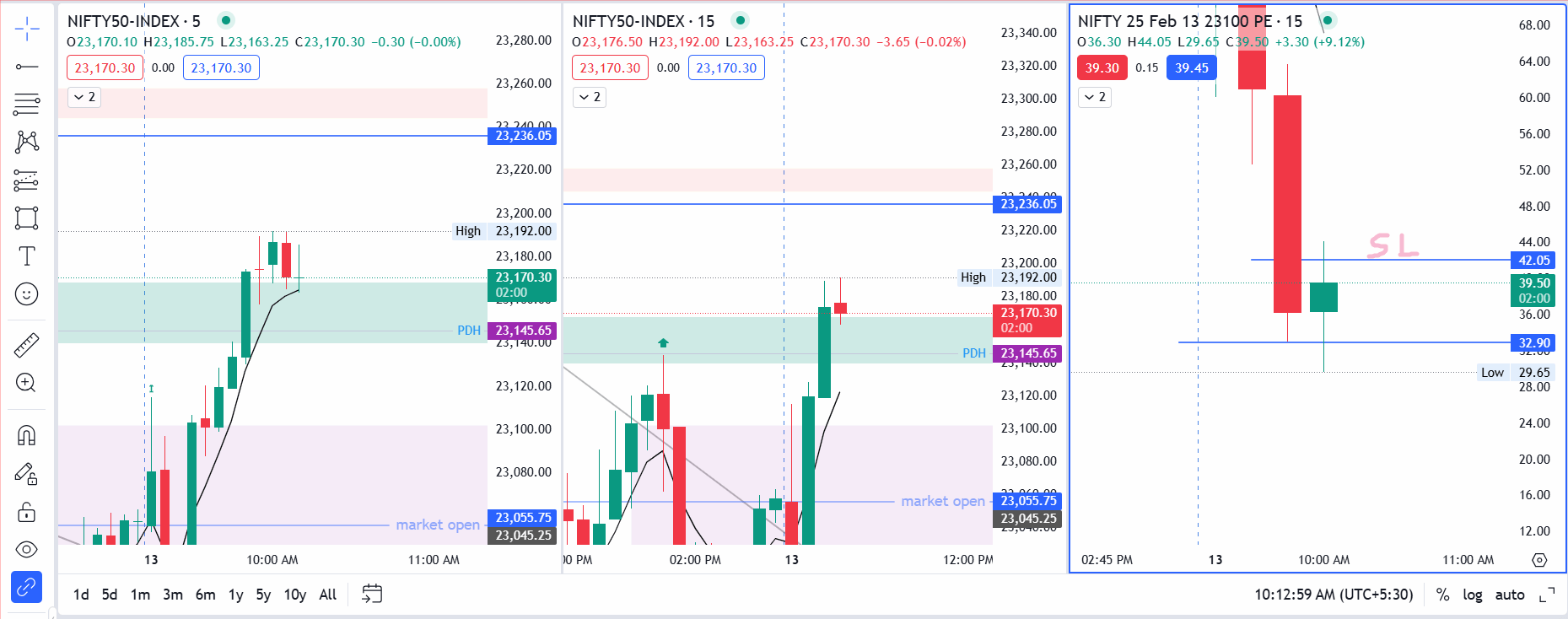

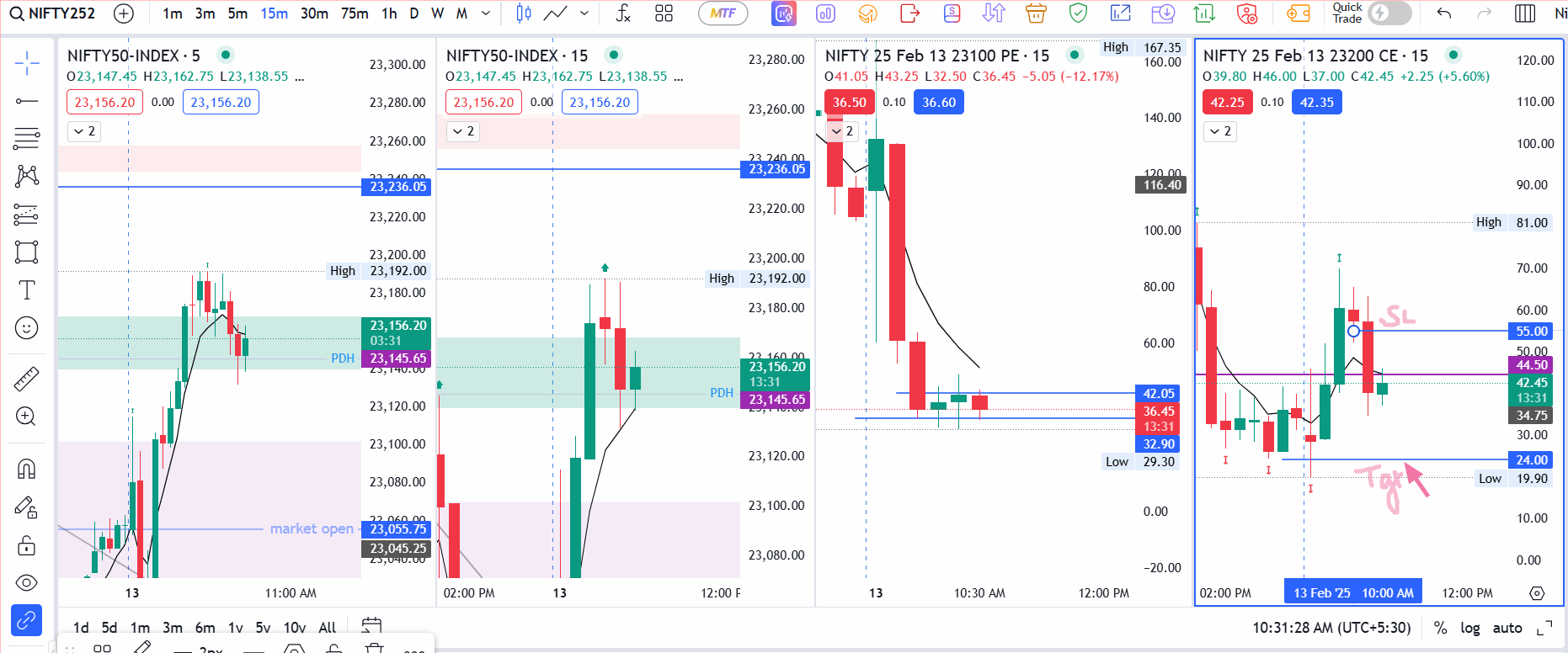

I intended to enter trades only after the current day high and then the previous day high were decisively taken out by a strong bullish candle, followed by a retracement. This was my standard approach for both Nifty and Banknifty. Once I saw enough momentum, I entered:

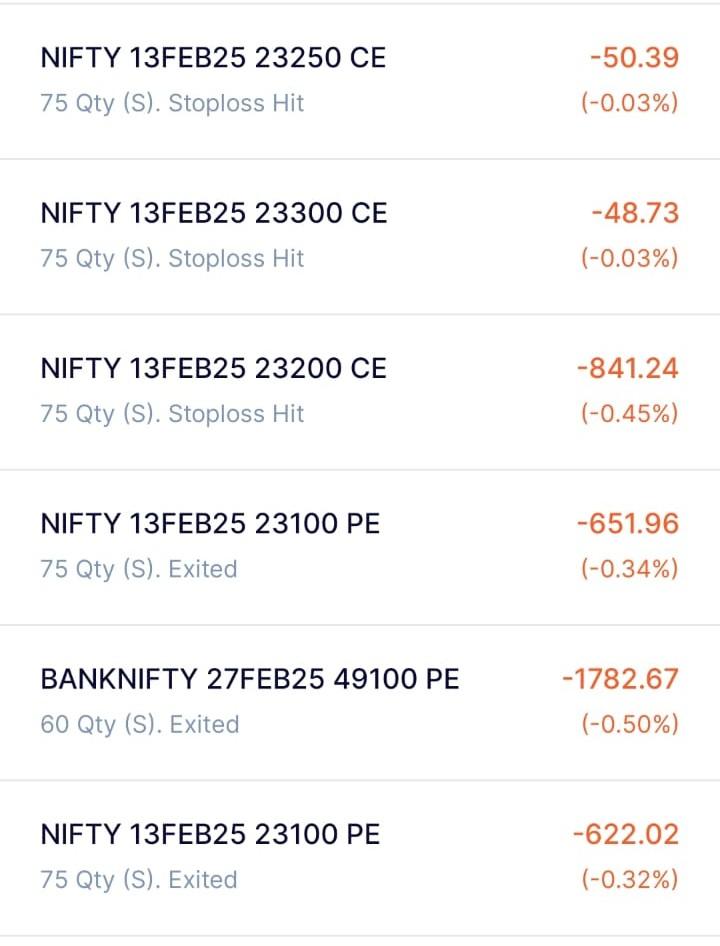

- Nifty: Sold 23,100 PE at ₹32.90, Stop Loss around ₹42.05

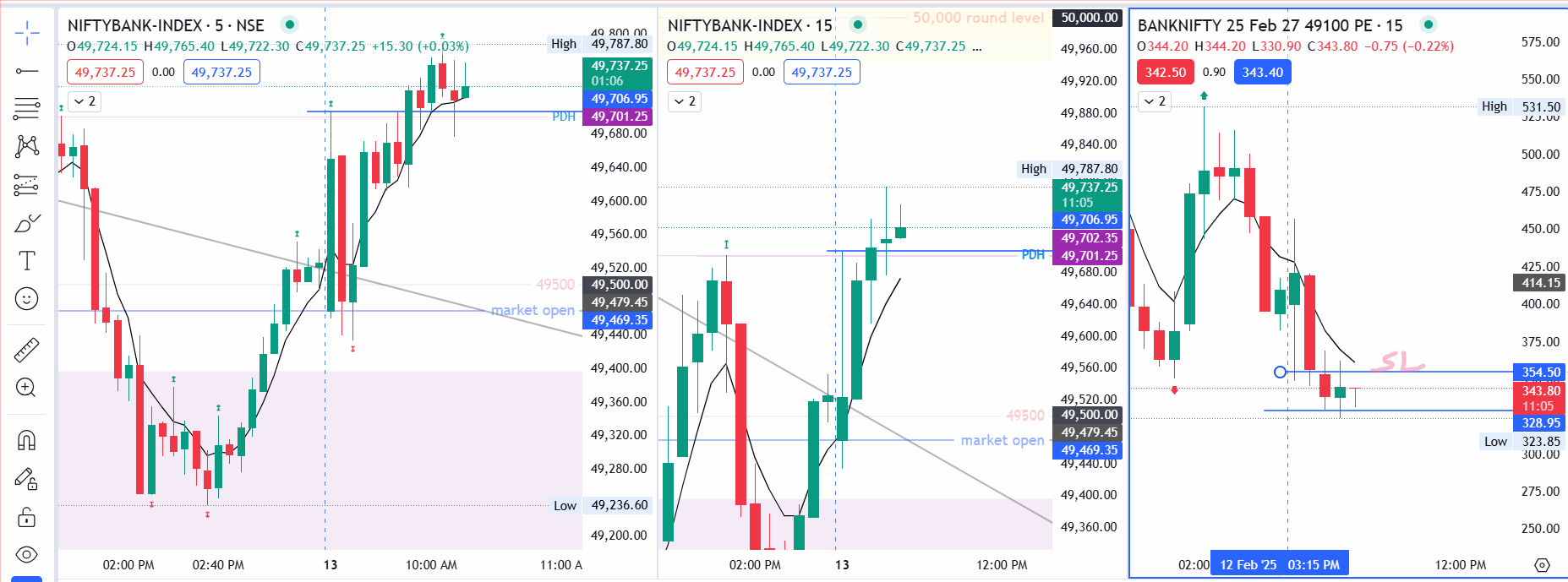

- Banknifty: Sold 49,100 PE at ₹329.15, Stop Loss roughly ₹354

Both of these trades went against me, hitting my SL. I attempted a re-entry in Nifty at 23,100 PE at ₹32.30, but again my SL was triggered. Around the same time, I also took another position, 23,200 CE at ₹44.50, but ended up with a Stop Loss as well.

A “m pattern” seemed to be forming near the top, but a crucial concern was whether the price would hold above the previous day’s high (PDH). Since there wasn’t a clear close below PDH, uncertainty remained, and every trade I attempted was stopped out.

Spot vs. Options Chart Discrepancies

In hindsight, some entries made sense on the options chart, but the spot chart never confirmed the same bullishness. The price in Nifty never closed above the previous candle high, further weakening those setups. In Banknifty, I simply chose not to re-enter after my first SL was hit. Meanwhile, Stop Losses in Nifty got triggered through sudden spikes, even though the price never definitively closed above those levels on the options chart. Naturally, as soon as I exited, the market moved in what would have been my favor.

Shifting to Aggressive Option Selling

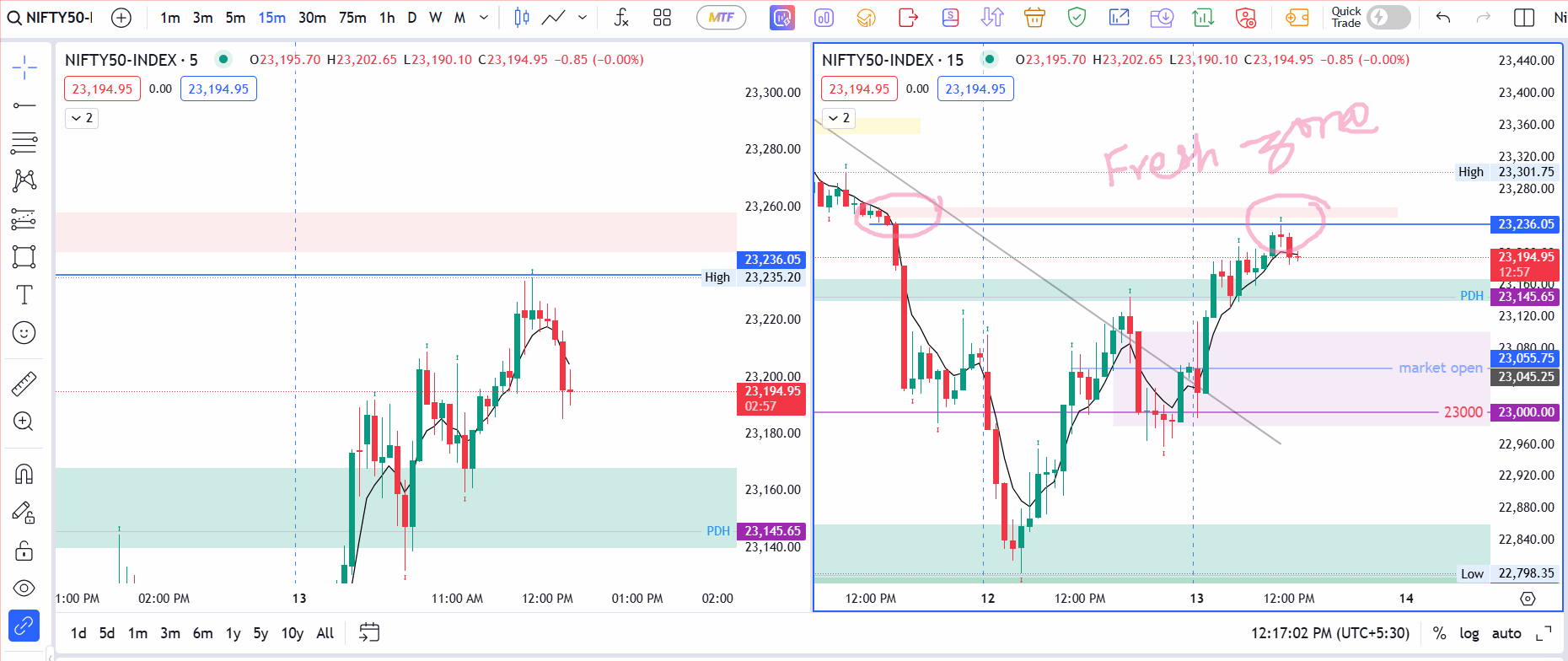

Selling OTM Calls

Undeterred by the earlier losses, I shifted focus to harnessing time decay. I sold OTM Calls—23,250 CE at ₹22.90 and 23,300 CE at ₹11.10—after spotting a bearish candle. The logic: if price stayed below these strikes, the premiums would decay and deliver profit.

Should the market have turned bullish and broken the day high, I planned to add 23,000 PE, 23,100 PE, and maybe 23,150 PE. Essentially, I wanted to create a range trade, hoping the price would close between 23,300 and 23,000 by day’s end.

This was not my usual approach. It was more of an on-the-fly strategy, relying on a “hopeful” reading of the charts and the knowledge that time decay can erode premiums quickly if the market remains within a range.

More Strikes, More Complexity

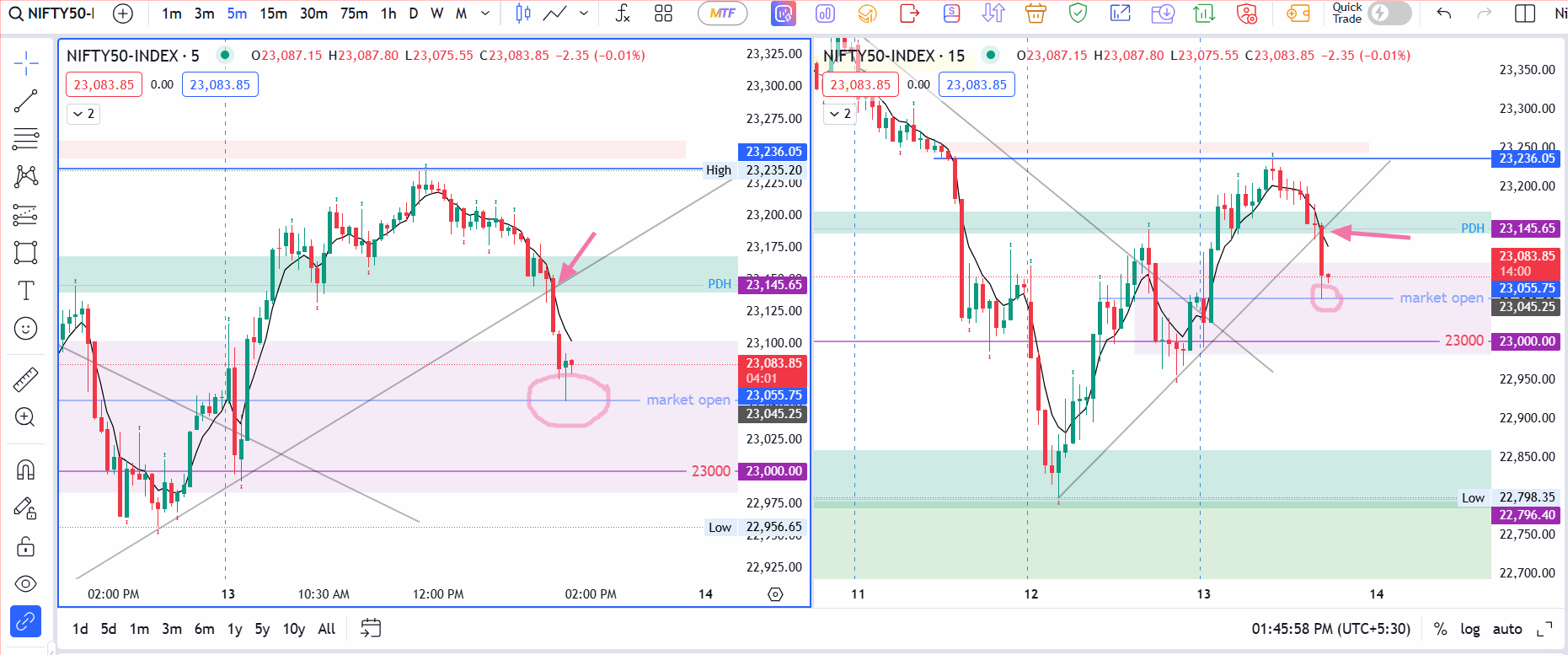

I took a break around 11:20 AM to 11:50 AM, leaving Stop Loss (SL) orders at my entry prices for the sold Calls. Some of those SLs were hit within minutes. Then, as soon as I noticed price crossing a certain trendline, I sold multiple Put strikes—23,000 PE at ₹5.85, 23,150 PE at ₹19.55, and 23,100 PE at ₹11.70—anticipating a continued downturn. Ironically, the index reversed again, prompting me to add 23,300 CE at ₹13.80. Shortly after, a strong bearish candle around 12:12 PM led me to sell 23,250 CE at ₹19.75, targeting the 23,235–23,260 zone as strong resistance.

In essence, I was setting up a tight range in which I believed the market would stay, hoping to capture premium from all sides. This approach demanded constant vigilance because any decisive breakout or breakdown could trigger multiple SLs and potentially magnify losses.

A Late-Day Decline and Partial Recovery

Around 1:30 PM, I observed a significant bearish candle that took support around the day’s open level near 23,055.75 in Nifty. The market had been moving down steadily, so I decided to close all open positions in small profits, partially recouping my earlier losses. A portion of me realized that my very first trade in Nifty could have hit its target with 1:2 R:R had I not exited prematurely when the spot chart never truly invalidated my Stop Loss. But such is trading: perfect knowledge often arrives only in retrospect.

Closing Figures

By the closing bell:

- Sensex was down 32.11 points or 0.04 percent at 76,138.97

- Nifty was down 13.85 points to 23,031.40

- Banknifty fell 119.60 points to 49,359.85

In the end, every trade I attempted in the morning was stopped out, but the subsequent flurry of option sells allowed me to reclaim some of those losses. The price remained quite volatile, forming strong candles in both directions, and only stabilized later. While I deviated significantly from my normal strategy, my knowledge of time decay and the day’s price action helped limit the downside.

Still, the day serves as a reminder of how crucial it is to coordinate spot and options charts, maintain discipline with each setup, and accept that not every potential profit can be captured—especially when the market’s patterns don’t align neatly with one’s game plan.

Key Lessons Learned

- Align Spot and Options Charts: An entry that looks valid on the options chart can fail if the spot chart doesn’t confirm. Spot levels remain the anchor especially on the expiry day.

- Exiting Too Early vs. Holding On: My initial trades got spiked out, but later the market moved in my direction. Stop Loss placements in volatile conditions often require a bit more room or a more flexible strategy.

- Complex Ranges Can Be Risky: Selling many strikes—calls and puts at different levels—can be profitable if the market stays range-bound. But if a breakout occurs, multiple SL hits can inflate losses quickly.

- Timing and Trendline Breaks: Entering new trades on mid-day trendline breaks or sudden moves requires caution. Volatility can spike, and direction can shift on a dime.

- Stick to Familiar Strategies: While experimenting with new methods can broaden skills, doing so should be measured and shouldn’t rely solely on “hope.”