12th Feb 2025 Intraday Trades & Concept

Market Opens

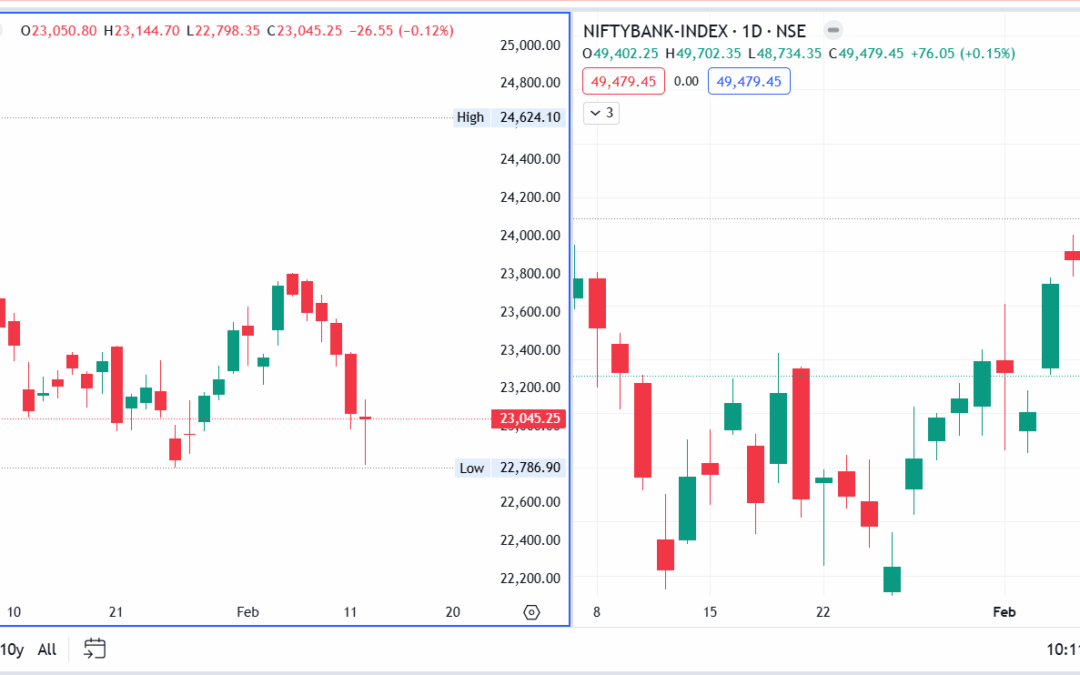

Today, both Banknifty and Nifty opened with minimal changes, suggesting a quiet start on the surface. Banknifty began virtually flat at 49,402.25 (–1.15 points), while Nifty started –21 points lower at 23,050.80.

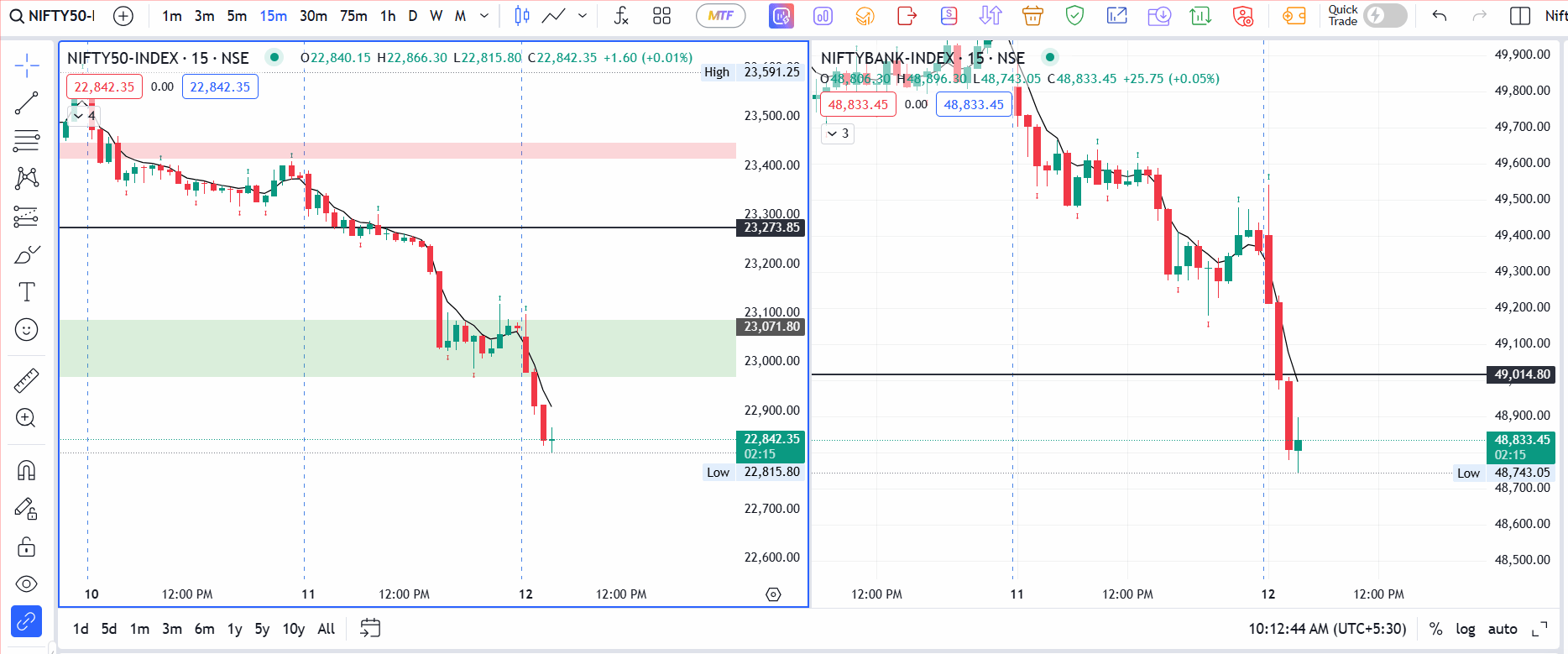

Over the past five trading sessions, these indices have consistently printed bearish daily candles, so I was watching closely to see if today would finally break that pattern and offer a green close.

Early Moves and Trades

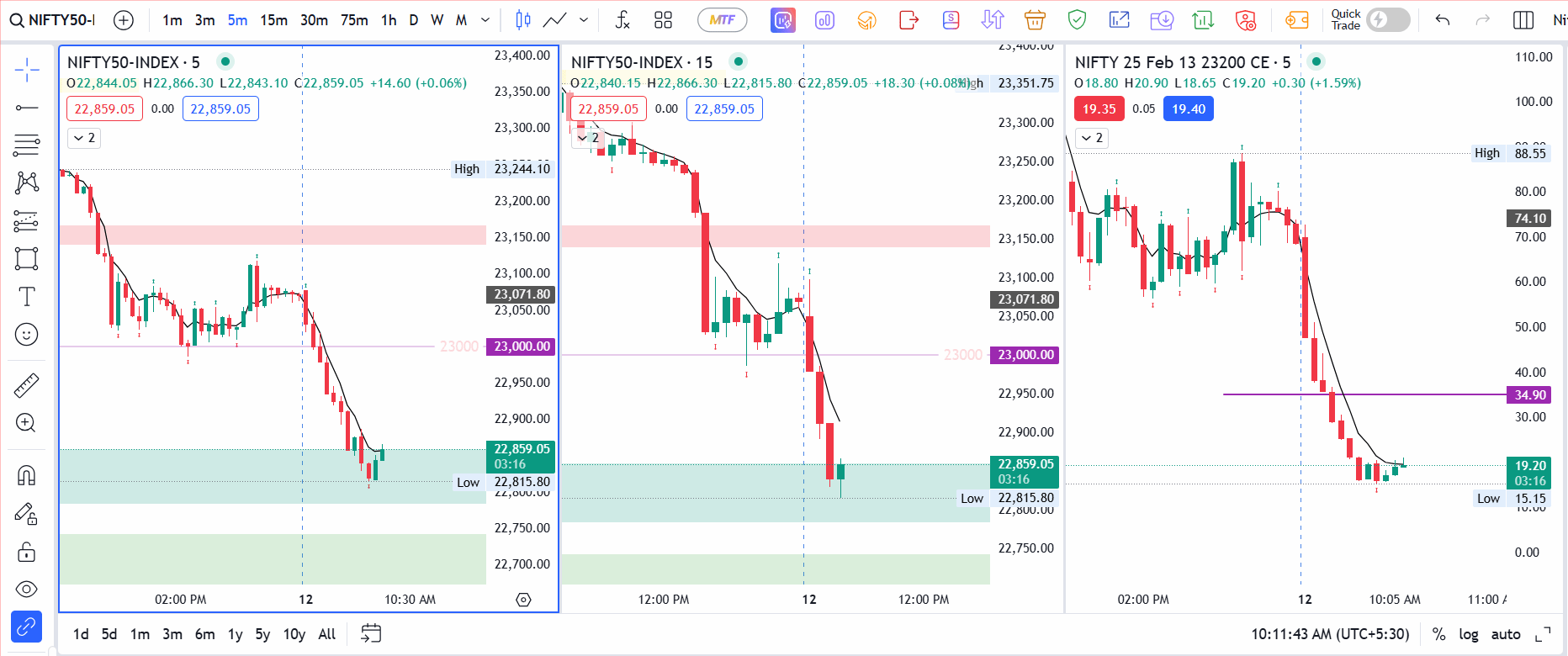

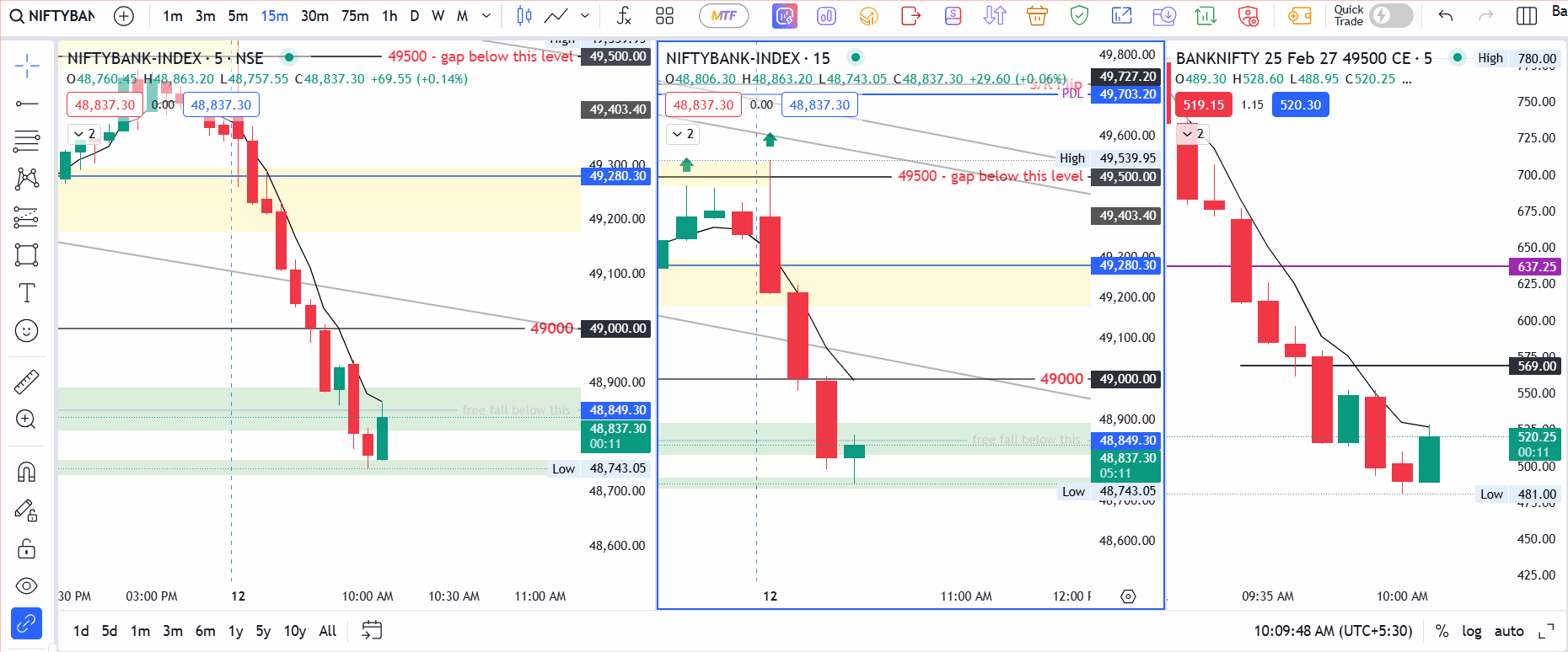

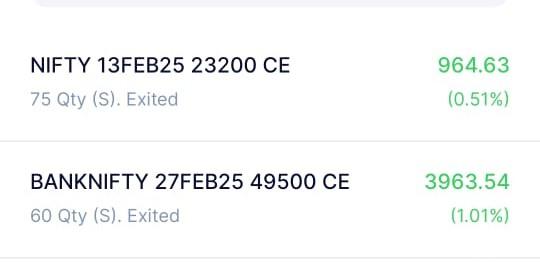

The market showed continuous selling after the opening bell. Aligning with a 15-minute setup and a confirmed day-low breakdown that also breached the previous day’s low, I initiated two trades:

- Nifty: Sold 23,200 CE at ₹34.90

- Banknifty: Sold 49,500 CE at ₹637.25

In hindsight, I was slightly late on my Banknifty entry. My plan had been to sell the Call Option at around ₹660, but by the time I managed my charts and confirmed the price action, it had already dropped to ₹637.25. Even so, the trade still aligned with my bearish read.

Exiting Near Round Numbers

Both indices continued downward, and I exited around a logical support:

- Banknifty Exit: ₹569.25 when the index approached 49,000—a round-level support it has tested three times today.

- Nifty Exit: ₹21.35 (the premium dropped near ₹20).

With that third test of 49,000 in Banknifty, I grew skeptical about its strength as support. A gap remains unfilled below, suggesting the market might continue drifting down to close that gap.

Pausing at Key Zones

By around 10:14 AM, both indices paused at marked zones I had identified on my charts. Even though the selling persisted, I hesitated to jump back in for a re-entry. Typically, I would consider using either the 5-minute or 15-minute chart for new signals, but the market didn’t present a strong follow-up move at that moment—and I also had a doctor’s appointment, forcing me to end my session early.

Closing Figures

By the close:

- Sensex fell 122.52 points (–0.16%) to 76,293.60.

- Nifty shed 26.55 points (–0.12%) to 23,071.80.

- Banknifty was up 76 points at 49,479

Despite the early promise that today might break the cycle of red candles, the market maintained its recent bearish tone. Both indices ended near their lows, supporting the notion that once again, sellers had the upper hand.

Lessons from a Day of Divergence

- Timeliness Matters: Being even slightly late (like my Banknifty entry at ₹637.25 instead of ₹660) can trim potential profits, but it’s still better than missing a valid setup entirely.

- Support Fatigue: Banknifty tested 49,000 repeatedly; each test erodes its reliability as a support level. When a key level keeps getting hit, the risk of a breakout (or breakdown) beyond it increases.

- Gap Awareness: An unfilled gap below can act like a magnet for price. Even if there’s a short-term bounce, the market often returns to complete such gaps.

- Chart Time Frames: Choosing between 5-minute and 15-minute charts for entry signals can be confusing mid-session. Sticking to one’s primary timeframe (the one used for initial confirmation) often helps maintain consistency.

- Trade Within Your Constraints: With limited time to monitor the market due to outside commitments, it’s better to lock in gains and step aside, rather than rush into uncertain trades.

Ultimately, today reinforced the recent bearish sentiment in the market, cutting short any hopes of a green close I initially entertained. While I wrapped up earlier than usual, the market’s momentum signaled that the selling pressure might persist—especially if another retest or gap-fill scenario unfolds. As always, staying disciplined, taking partial or full exits when objectives are reached, and planning around your schedule remain crucial to managing risk in a choppy market environment.