15th Jan 2025 Intraday Trades & Concept

The Market Opens

Sometimes the market has a way of humbling us when we least expect it. Today was one of those days.

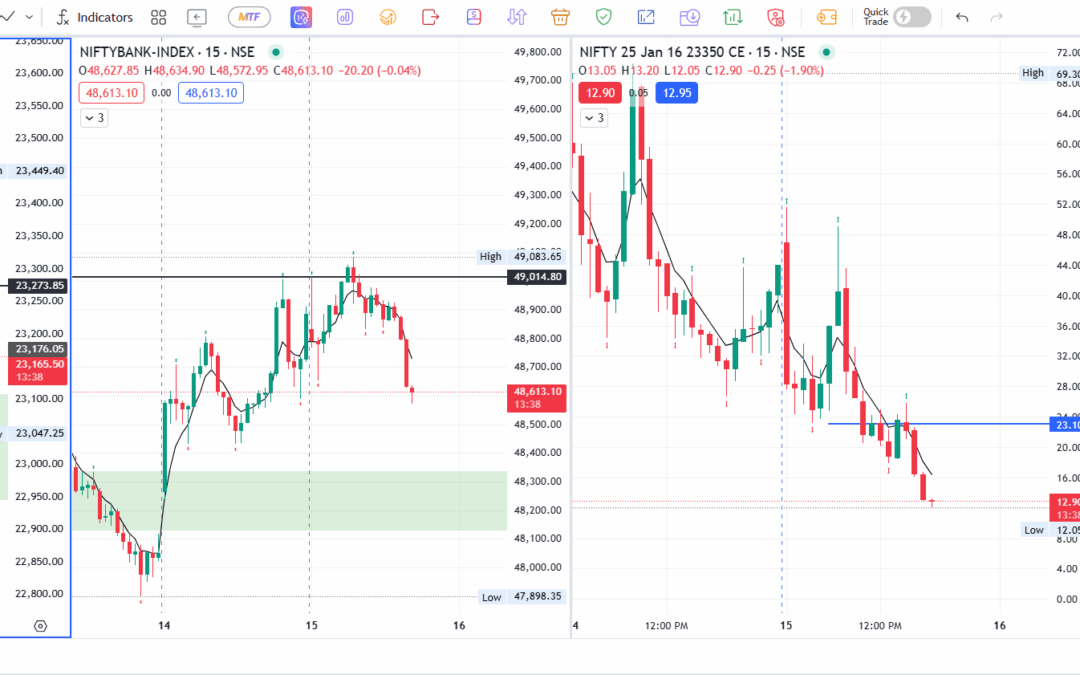

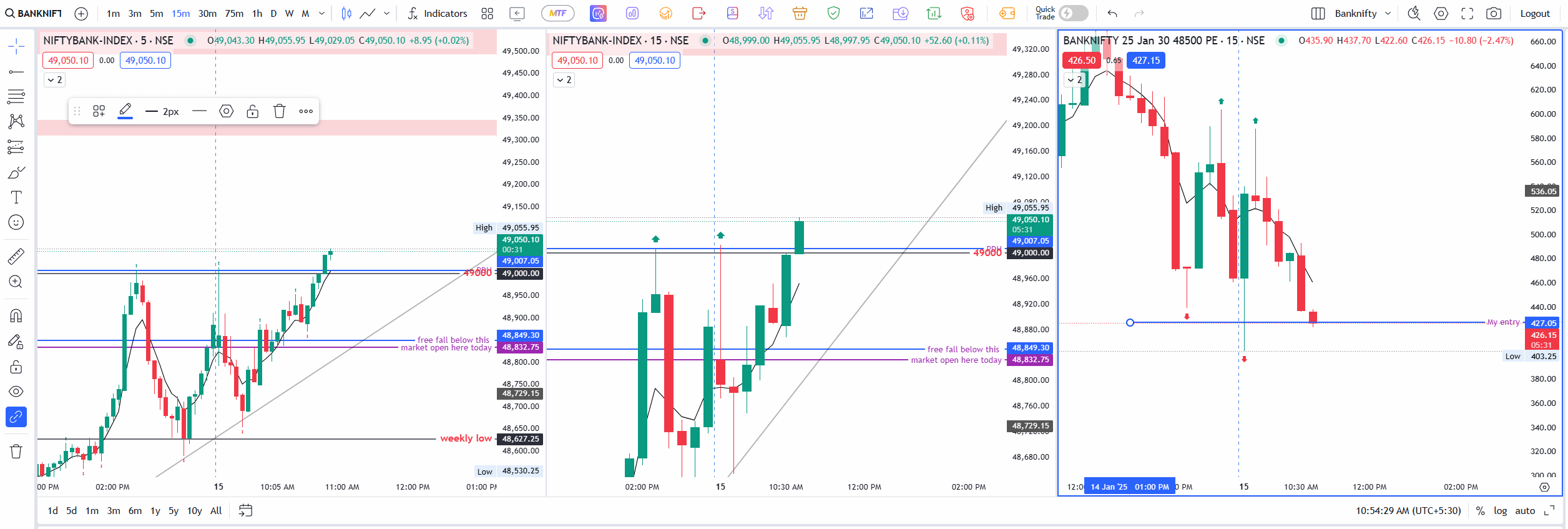

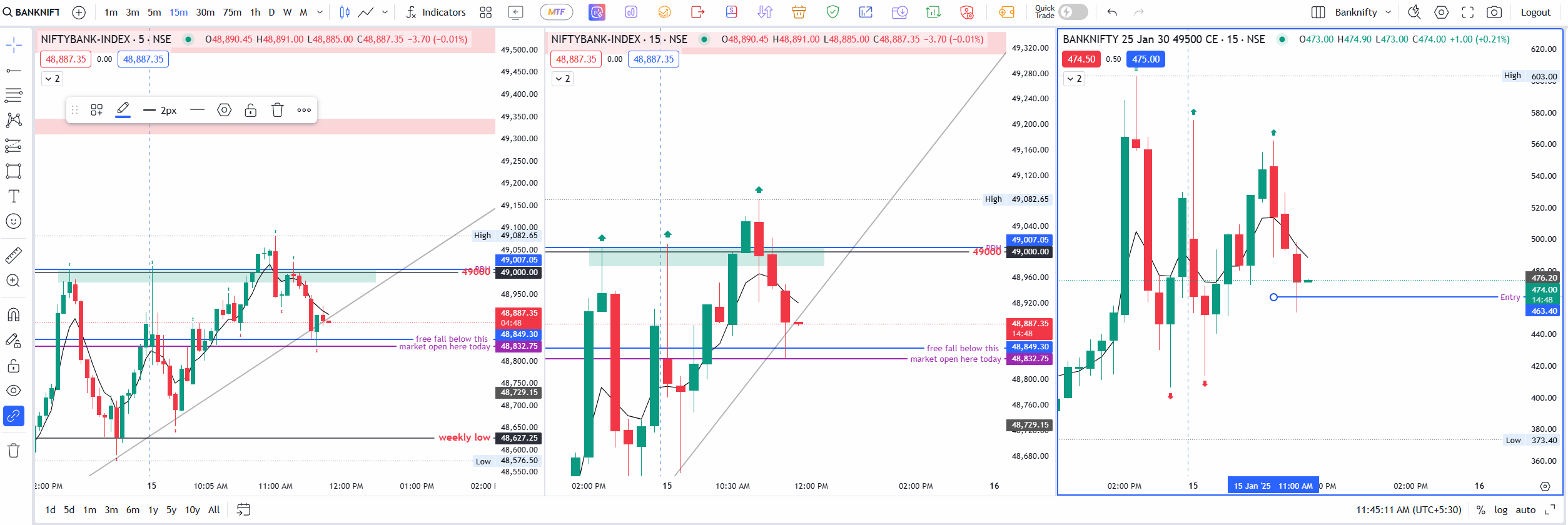

Banknifty

Banknifty opened +130.60 points gap-up today.

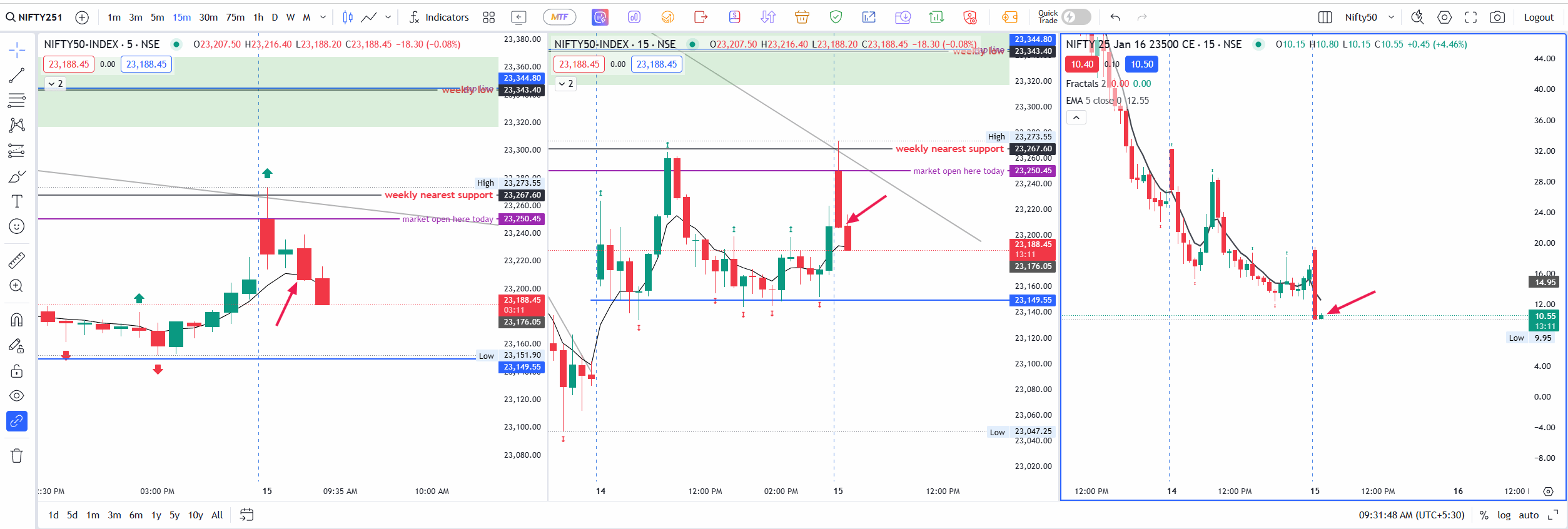

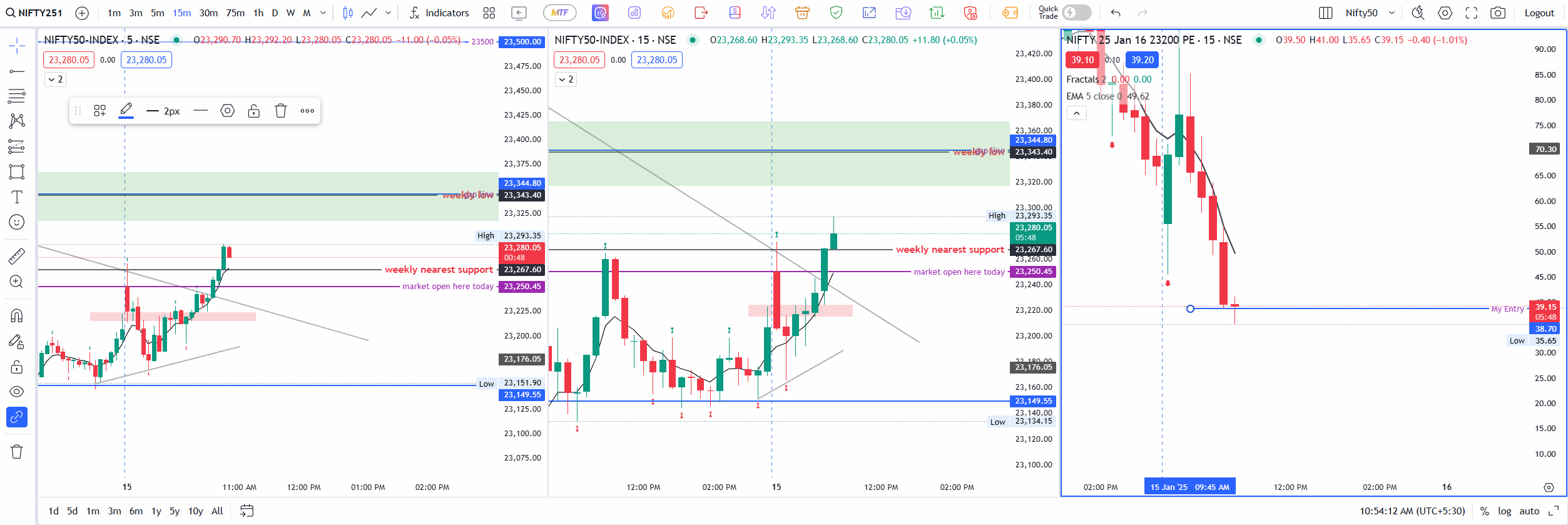

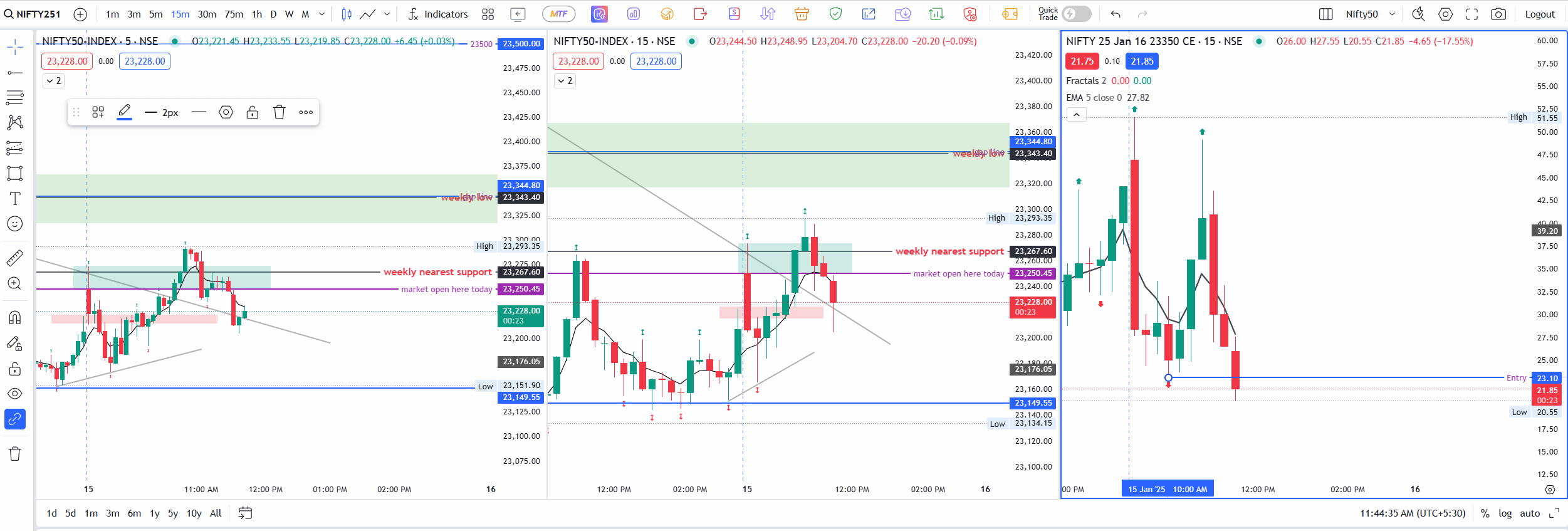

Nifty

Nifty opened +74.40 points gap up.

Today I ended up surrendering almost 90% of this month’s profits by the time I exited my trades. Below is a breakdown of what happened, how I ended up taking trades against my own rules, and why I plan to avoid these mistakes going forward.

A Promising Start Turns Sour

I began the day by noting that both indices had opened higher after a series of down days. Yet, the 5-minute time frame quickly showed a day-low breakdown in both Nifty and Banknifty. That lined up with a 15-minute setup I often use, giving me confidence that a bearish move could play out. I decided to sell 23,500 CE in Nifty because spot prices were drifting downward. However, I noticed something odd: although prices were falling, option premiums (especially Calls) were not dropping as expected. The same thing was happening in Banknifty.

Since the 23,500 CE premium had fallen to only around ₹10, I exited and switched to 23,300 CE at ₹39.95. At the same time, I also sold 49,000 CE in Banknifty at ₹659.85, hoping both indices would continue to slide. But things didn’t go as planned: my Stop Loss (SL) got hit in Banknifty, and I exited the Nifty trade voluntarily when the price failed to hold below the day’s low. Banknifty had already ignored its day-low resistance, and Nifty followed soon after with a breakout in the next candle.

In hindsight, I realize I jumped into these positions too soon, partly because I wanted material to write about. That’s a recipe for disaster in trading.

Breaking My Own Rules

By 10:30–11:00 AM, the market broke through key levels, but Banknifty near 49,000 and Nifty near 23,250 didn’t consolidate as I would have liked. A proper consolidation often indicates a healthier breakout, but I still went against my better judgment and took more trades:

- Sold 48,500 PE at ₹427.05 in Banknifty

- Sold 23,200 PE at ₹38.70 in Nifty

My thinking was that if there was a retracement, and then another move up, I could add more quantity for a possible continuation. Unfortunately, the breakout itself wasn’t convincing, and both Stop Losses got hit. Even as I typed my own warning that this type of breakout was not “clean,” I still took the trades. This is precisely what I need to stop doing—trading against my own rules usually ends badly.

The Trap of Over-Trading

After these losses, I entered two more trades:

- Sold 23,350 CE at ₹23.10 in Nifty

- Sold 49,500 CE at ₹463.40 in Banknifty

I justified these entries by convincing myself it was a “fake breakout” earlier, and these new positions might catch a downside move. But in reality, I was just chasing the market. That’s another big mistake: entering again and again without a proper setup. Soon enough, a sudden up-move in Banknifty clashed with a slight downward drift in Nifty, creating confusion. The market started “dancing,” and I exited these trades intentionally before my SL got hit—though I had already taken a total of three Stop Losses in the day.

Missed Opportunity After 12 PM

Ironically, after 12 PM, the market did start falling. Had I avoided those rule-breaking trades in the morning and waited patiently, I might have entered fresh positions aligned with the new price action. By that time, however, I was out of the market and had booked my biggest loss this month. Watching the indices drop without me only added salt to the wound.

I also reflected on how expiry days can be tricky. A lot of time decay on Options happens quickly, and moves between 10:30 AM and 11:30 AM can be decent if planned properly. But I didn’t plan properly; I forced trades instead of waiting for clear confirmations.

Emotional Toll and Self-Questioning

Losing 90% of my monthly gains in a single day hit me hard. At one point, I even considered quitting trading altogether. I questioned my strategies, my discipline, and whether I was cut out for this. These moments of self-doubt are common in trading, especially when rules are broken and losses stack up.

Yet, this blog isn’t just a dry list of my trades; it’s also a reflection of how traders feel during the early stages of their journey. Mistakes like mine are common—overtrading, ignoring one’s own rules, and chasing trades in search of immediate results. The key is to learn from these mistakes and not repeat them.

Committing to Better Discipline

I’ve come to the conclusion that today’s fiasco was primarily due to my own impatience. Rather than waiting for the market to come to my levels, I jumped in early, hoping to generate more content or get some quick gains. Moving forward, I’ve decided on a few critical changes:

- No More Trades Against My Rules: If my setup says “wait for consolidation,” I will do exactly that.

- Clear Conditions, Pre-Planned Trades: I’ll define specific entry and exit rules, and only take trades if those conditions are met.

- Take Small Steps: I want to capture points, not chase every move. Building consistency is more important than big wins.

I’ve already spent over two years studying the market, but I need to become more organized. It’s time to focus on taking one good trade rather than multiple mediocre ones.

The Day’s Finale

By the end of the session, Nifty closed at +37.15 points approx to 23213.20.

Banknifty on the other hand closed approx +19.75 points today.

Today was a brutal reminder that trading isn’t about trying to create action. It’s about responding to the market’s signals under a well-defined system. Breaking my rules led to multiple losses, wiping out most of my monthly gains. However, I’m not giving up. I’ll take these lessons to heart, slow down, and make sure I only trade when my strategy aligns with the price action.

The market will always be there tomorrow—so I’d rather preserve my capital and confidence than gamble on setups I know aren’t right. Small steps come first, then bigger moves once the foundation is steady.